The Highest And Lowest Gambling Taxes Around The World

In many countries, gamblers have to pay a small tax on their winnings. While giving some of your hard-earned profits to the government can feel unfair, try being the casino.

In most countries where gambling is legal, casinos pay a tax on their Gross Gaming Revenue (GGR), which is in part how economies and communities benefit from regulated gambling.

Every country collects GGR payments a little differently, but generally it’s a percentage of the net profit (player wagers minus wins) that a casino brings in.

Figuring out a good GGR or similar system is tricky for governments, who obviously want to benefit handsomely on their casino sin tax but not so much that they discourage new business. This delicate balance sees governments in different parts of the world tinker with their rates, sometimes every few years.

Here we’ll look at the top 10 countries with both the highest and lowest tax rates on gambling, as well as explore the impact that the coronavirus pandemic could have on casino taxes.

Top 10 Countries With The Highest Gambling Taxes

Whilst for many gambling is considered morally wrong, there’s no doubting that it can bring a lot of money into a country through taxes. Here’s a look at the most heavily taxed countries with regulated gaming markets:

At the top of the chart for 2020 is France, who have just changed their taxing system from overall gaming turnover to GGR. Arguably this leaves casinos in a better position than the old system as they won’t pay tax on money that’s paid back to players as winnings.

There are different rates across the industry, so land-based casinos will pay 83.5 percent GGR whilst horse racing is set at 37.7 percent. With more of the industry turning online, sportsbooks are liable for 52.2 percent and poker operators for 40.8 percent.

Denmark’s 75 percent GGR looks eye watering at first glance but look at the small print and you’ll see it says only if the GGR exceeds DKK 4 million ($612,000). Failing to hit that, land-based casinos pay instead 45 percent.

Australia’s rate varies in each state where in some places the tax is as high as 65 percent on the lottery. It drops significantly for gaming machines at 25 percent and continues to soften to less than 20 percent on racing and table games.

Similarly, in The US the variations are massive across the different states, however here it falls on the player to pay, not the casino. In land-based casinos that’s easier to regulate but if you play online it’s more of a grey area.

The highest rates are on Rhode Island at 51 percent, whereas in DC and Colorado it falls to 10 percent. In New Jersey and Illinois it’s in the mid to low teens and in Pennsylvania it’s expected to be 34 percent.

The UK has a tiered tax system where casinos pay a fixed percentage based on their revenue. Starting at 15 percent on anything up to £2,370,500, this increases accordingly to 20 percent, 30 percent, 40 percent and 50 percent.

Whilst they didn’t make it onto the chart, European countries like Portugal and the Netherlands ask for quite a bit in GGR.

In Portugal casinos pay 15-30 percent GGR on revenue and this applies to poker too. In the Netherlands there’s 29 percent GGR with a 2 percent fee thrown on top.

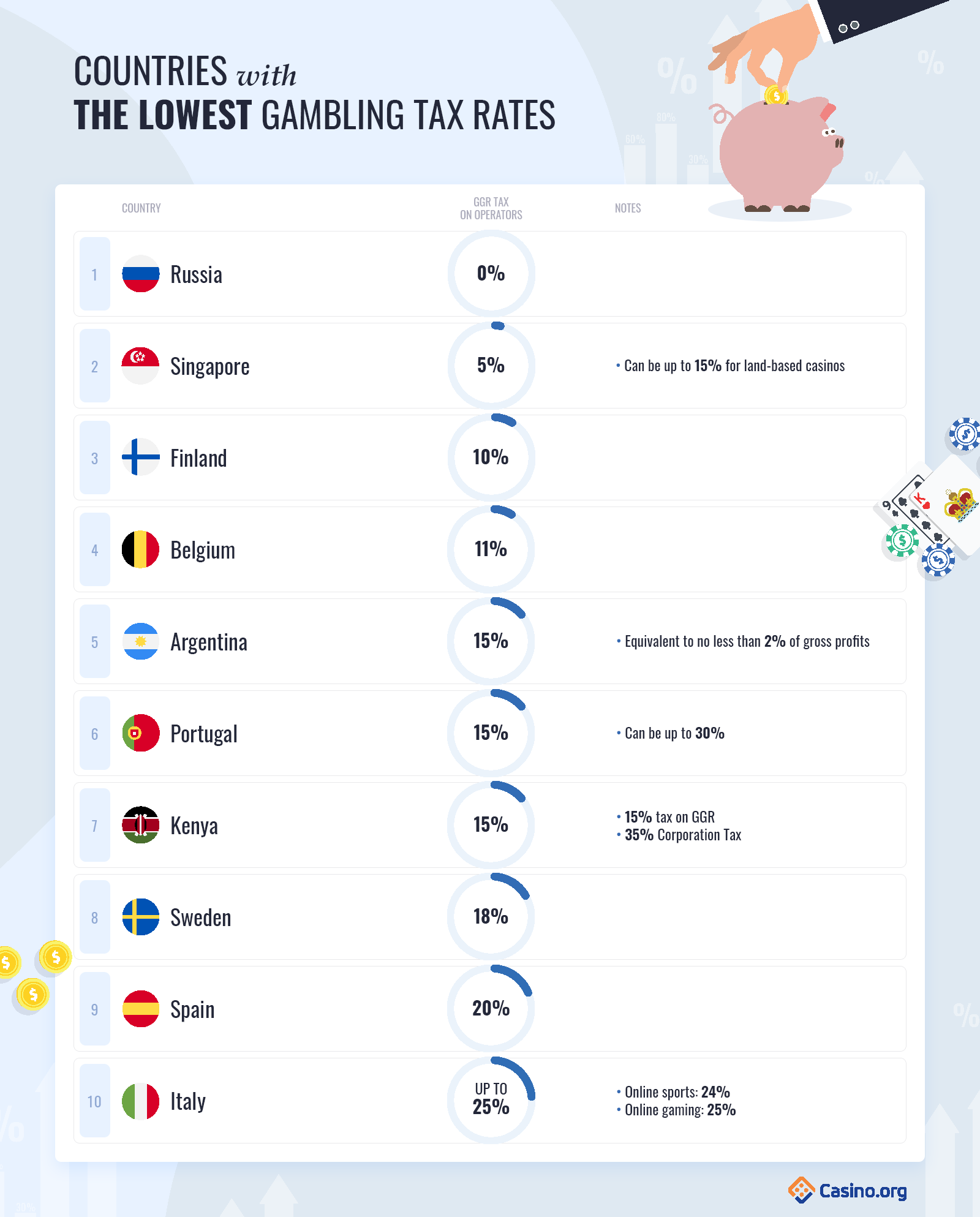

Top 10 Countries With The Lowest Gambling Taxes

And whilst there are some countries whose tax rates might make you cry, there are other that are so low you’ll be in disbelief. The casinos and sportsbooks in these countries barely pay any tax:

Russia must be one of the coldest places to live but if you own a casino it’s the hottest place to be. Currently, casino owners don’t have to pay any taxes on gaming revenue. At 0 percent, unsurprisingly, that’s the lowest in the world.

There is a flat fee for gaming tables or electronic gambling machines, and the same goes for bookmakers on each of their retail facilities.

Singapore sits high up on the list at a mere 5 percent with this stretching up to 15 percent on land-based casinos.

Although featured on the list of countries with the lowest taxes there has been some fallout. Following a disputed tax increase last year which saw it double to 20 percent on sports betting, Kenya’s SportPesa app pulled the plug on its HQ and operations in the country.

However, as of June 25, Kenya’s National Assembly has now agreed to remove this controversial 20 percent turnover tax.

Argentina had provided a haven for online gamblers up until very recently with its tax-free winnings legislation. That’s all set to change with a 15 percent gross income and 2 percent fee being considered.

Italy’s turned itself around in the last few years and targets the online operators with a healthy 25 percent.

Following the UK’s example Sweden decided in 2017 to make the market more player friendly and apply tax at 18 percent on GGR, putting the onus on casino owners. This applies to sports betting and online gaming too.

How Will The Coronavirus Impact The Tax Rates?

With the huge amounts of money generated by casinos it’s no surprise that each country’s economy gets a real boost from them. The tax rates applied to casinos vary greatly from country to country and are appreciated by each governing party.

With the on-going pandemic casinos have taken quite the hit, as has the global economy. Countries are looking for ways to maximise revenue return.

So what does that mean for casinos and their tax rates? Will there be an increase or decrease in taxes?

The USA

With GGR hitting a record breaking $43.6 billion in the States last year (2019), state and local governments raked in a total of $10.2 billion through tax on commercial casinos. This hefty sum surely gave the US economy a good boost.

The recent casino closures will impact each state differently. For Maryland, the closure of its six commercial casinos over the last three months has dealt a hard blow to their education fund. With a loss of $372.5 million in GGR for 2020, the education fund has lost out on almost $149 million.

In a bid to boost the tourism trade and get the city’s economy bouncing back, two bills have been passed in Atlantic City to support casinos. The new plans will reduce gaming taxes and fees through to the end of 2020. It means that casinos won’t have to pay hotel occupancy tax or fees for parking lots.

Macau

Macau took a massive swipe to gaming revenue with a drop of 97 percent in April. Although casinos in the region remained open for part of the month, there were severe travel restrictions which greatly reduced the number of visitors.

Although Macau has suffered severe losses the government is not planning to make any concessions or tax cuts. With the huge contributions from casinos taxes, Macau needs to hang onto its main source of revenue.

Singapore

Singapore, on the other hand, knows which side its bread is buttered. With 10 percent tax breaks for their two gaming sites and 30 percent for hotels, it’s been widely lauded by analysts. Just a shame the entry fees are still sky-high.

Japan

Plans are still very much going forward to get the proposed casino resorts built up. Japan’s determined to get its modern gaming industry launched and use the casinos as a way to restart its economy.

Like with anything in gambling, appearances can be deceiving and it can take some digging to figure out the real numbers.

Now you know all about the taxes casinos have to pay around the world, make sure you’re clued up on the taxes gamblers must pay on their winnings.

Sources

https://www.pc.gov.au/inquiries/completed/ageing/technicalpapers/technicalpaper10.pdf

https://www.finsmes.com/2019/10/the-gambling-industrys-effect-on-the-uk-economy.html

https://www.yogonet.com/international/noticias/2018/12/05/48455-buenos-aires-province-regulates-online-gambling-and-sets-new-tax-on-slots

https://iclg.com/practice-areas/gambling-laws-and-regulations/austria

https://uk.practicallaw.thomsonreuters.com/4-636-9099?contextData=(sc.Default)&transitionType=Default&firstPage=true&bhcp=1

https://www.edisongroup.com/wp-content/uploads/2019/07/GamingSectorReport2019.pdf

https://www.forbes.com/sites/muhammadcohen/2019/04/09/singapore-makes-casinos-an-offer-they-cant-refuse/