Crown Resorts Credit Rating Trimmed by Moody’s Amid Sydney Project Delays

Posted on: November 23, 2020, 08:48h.

Last updated on: November 23, 2020, 12:47h.

Crown Resorts Ltd.’s credit rating was pared one notch to Baa3 from Baa2 by Moody’s Investors Service. That’s after Australian regulators postponed the opening of the operator’s Crown Sydney integrated resorts pending the outcome of a licensing suitability inquiry.

Originally, the Aussie gaming giant planned to open its $1.6 billion casino-resort in the country’s capital city in December. But that effort is in jeopardy because of an investigation started earlier this year into the operator’s alleged anti-money laundering failings and ties to dubious Chinese junket firms. That could ultimately result in Crown losing gaming licenses.

The New South Wales Independent Liquor and Gaming Authority (ILGA) is delaying decisions on various Crown licensing requests until February, preventing the company from progressively opening the Sydney venue in December, as was initially planned.

The downgrade reflects our opinion that there is an increasing likelihood of material downside implications from the escalating regulatory investigations Crown is facing. In particular, the review will focus on the potential for further material negative outcomes that could not only affect the license for Crown Sydney, but could also bring forth regulatory challenges to Crown’s other licenses,” said Moody’s analyst Maadhavi Barber.

Bonds with any of the three Baa ratings from Moody’s are considered to have moderate credit risk. But Crown’s new Baa3 rating is the lowest on the research firm’s investment-grade spectrum, just one notch above junk territory.

The credit grader said the gaming company’s mark is on review for further downgrade.

Ongoing Saga

Hearings into Crown’s suitability to hold gaming licenses in its home country are ongoing for nearly two months. They stem from allegations that the company may have flouted Chinese law in an effort to lure wealthy gamblers from that country to its Australian properties.

In 2005, China’s Supreme Court and the People’s Procuratorate (Prosecutor General), issued a decree clarifying the illegality of online gambling. It also said it’s illegal for companies to attempt to organize groups of 10 or more Chinese citizens to gamble overseas and charge fees or commissions for that endeavor.

Crown thought it was on the right side of the law because it was marketing directly to potential patrons, not working with middlemen. Counsel for the gaming operator claims the mistake was “honest” and the company shouldn’t be subject to harsh punishment. Still, the firm could face steep penalties in its home country. But the loss of license doesn’t appear probable at this juncture.

“Specifically, Moody’s considers that adverse outcomes from these investigations could potentially result in large fines and/or changes to Crown’s licensing conditions in Sydney, with license loss being the most severe, although still unlikely, outcome,” said the research firm. “Furthermore, the review will assess the potential for adverse regulatory actions in respect of Crown’s operations in Victoria and Western Australia from December 2020.”

Strong Cash Position

Despite the coronavirus pandemic weighing on earnings and the money-laundering imbroglio pressuring investor sentiment, Crown is remaining steady from a cash perspective.

As of June 30, the operator has nearly $210 million in cash on hand, access to $293.05 million in undrawn credit revolvers, and its debt ratios are tolerable.

“Nevertheless, despite these challenges, the company’s leverage has remained low, registering at 1.6x as of 30 June 2020, well below the rating tolerance threshold of 3.0x, while its EBIT/interest was 4.9x, above the rating tolerance threshold of 4.0x,” according to Moody’s.

The ratings agency is at least the second in less than a month to lower grades or outlooks on Crown.

Related News Articles

Star Entertainment Shares Plunge on Money Laundering Allegations

Landing International Chairman Suspended Amid Securities Regulator Probe

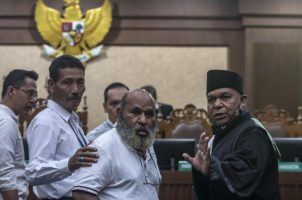

Former Indonesian Governor With Gambling Habit Goes to Prison

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet