Star Entertainment Shares Plunge on Money Laundering Allegations

Posted on: October 11, 2021, 07:50h.

Last updated on: October 11, 2021, 09:59h.

Allegations that Star Entertainment enabled money laundering at its Sydney and Gold Coast properties have sent the Australian casino operator’s shares spiraling. By the end of trading Monday, the company’s stock plummeted by almost 23 percent on the ASX, wiping nearly $A1 billion ($740 million) off its market value.

A joint investigation by The Age, The Sydney Morning Herald, and 60 Minutes accused Star of facilitating “suspected money laundering, organized crime, large-scale fraud, and foreign interference within its Australian casinos for years.”

Among the allegations are that the company wooed suspected criminals, foreign agents, and fraudsters to gamble in its casinos from 2014 to 2021. That’s while ignoring an internal KPMG report that criticized its anti-money laundering controls.

‘National Security Risk’

The media investigation found Star allowed Chinese high rollers to use special debit and credit cards to withdraw hundreds of millions of dollars for gambling that could be disguised as hotel expenses.

It also accuses the company of failing to vet high rollers brought to its casinos by junket operators who had links to organized crime. Among gamblers alleged to have been regulars at Star properties is Chinese crime boss Tom Zhou, known as “Mr. Chinatown,” who is wanted by Interpol for serious criminal conduct.

Zhou worked with both Crown and Star to organize junkets for high rollers, as did the brothel owner, suspected sex trafficker, and alleged money launderer, Simon Pan.

The reports also allege links to Chinese property billionaire Huang Xiangmo, who was accused by the Australian government of being a “foreign influence agent” and banned from the country as a national security risk.

Homegrown criminals include Mende Rajkoski, who was the biggest slots player at the Star Sydney. He once plowed US$77 million into the machines in one week. That’s until his arrest in June for conspiracy to import US$700 million of cocaine into the country.

Falling Star

The accusations echo those leveled in 2019 at Crown Resorts by the same media organizations. That set off a chain of investigations that ultimately led to the revocation of Crown’s New South Wales gaming permit, and continues to threaten its licenses in the states of Victoria and Western Australia.

So far, Star has escaped the regulatory pressure heaped on its biggest rival. But the new allegations will add greater urgency to a planned routine review into its business practices by the NSW regulator, announced last month.

The state’s chief regulator told the media organizations he was unaware of the Star’s alleged transgressions.

In a statement to the ASX Monday, Star said it was “concerned” by “misleading” reports in the media.

“We are subject to thorough and ongoing regulatory oversight, including compliance checks and reviews across our operations in NSW and Queensland,” it added. “The Star works closely with authorities, including law-enforcement agencies, and is committed to transparent engagement with regulators.”

Related News Articles

Landing International Chairman Suspended Amid Securities Regulator Probe

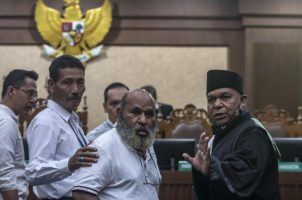

Former Indonesian Governor With Gambling Habit Goes to Prison

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet