NFL Forecasts $270M in 2021 Revenue from Casino, Sportsbook Agreements

Posted on: August 28, 2021, 12:27h.

Last updated on: August 30, 2021, 11:40h.

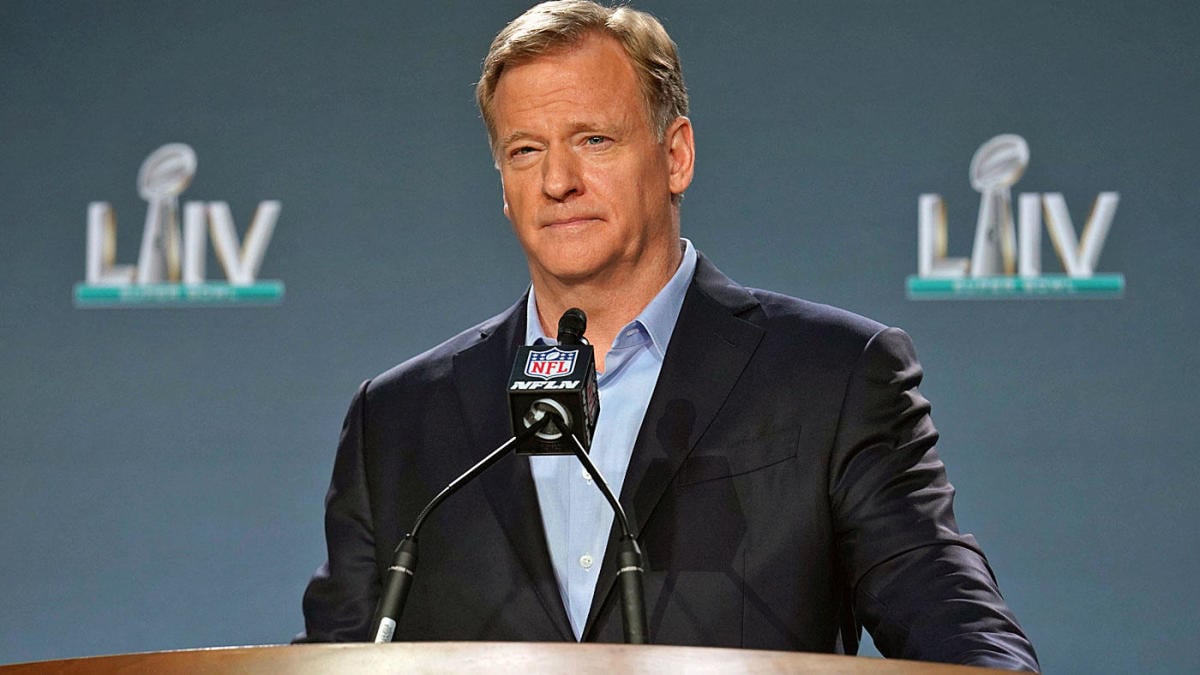

The NFL, a league once stridently opposed to gambling, estimates it will generate $270 million in revenue this year through agreements with casino companies and sportsbook operators. That figure potentially surges to $1 billion during the current decade.

Since the the 2018 Supreme Court ruling on the Professional and Amateur Sports Protection Act (PASPA), the most popular US sports league has increasingly warmed to betting. That represents a dramatic turnabout from the days when former Commissioner Pete Rozelle suspended Green Bay Packers legend Paul Hornung and Detroit Lions All-Pro defensive tackle Alex Karras for betting on games.

You can definitely see the market growing to $1 billion-plus of league opportunity over this decade,” said Christopher Halpin, an executive vice president for the NFL, in an interview with the Washington Post.

As the Post article points out, the NFL didn’t simply run blindly into its embrace of sports wagering. The league researched fans’ attitudes toward betting, discovering that half are either active or aspiring/casual betters, while another 30 percent are ambivalent towards betting. Conversely, the percentage of “active rejecters” — fans strongly opposed to betting — was 20 percent when the league initially researched the matter. But that figure has since tumbled to 12 percent, according to the Post.

NFL Sees Green in Betting

Experts and league observers say the NFL’s embrace of regulated sports wagering boils down to simple economics. Through advertising, naming rights deals, marketing partnerships, and other agreements, the NFL is realizing new revenue streams for the league and its 32 franchises.

Recent activity highlights the league’s sharp change of view on sports betting. Just this month, it was revealed the league will permit a limited number of sportsbook advertisements during broadcasts this season, while State Farm Stadium, home to the Arizona Cardinals, will be the first in the league to have an onsite retail sportsbook.

In April, the NFL announced that Caesars Entertainment (NASDAQ:CZR) is the league’s first casino sponsor. The league also brought DraftKings (NASDAQ:DKNG) aboard as its official sportsbook partner.

Last month, Louisiana lawmakers approved a 20-year, $138 million deal whereby Caesars gains naming to the New Orleans Superdome, home of the Saints. Caesars also has a marketing deal with the Houston Texans, although neither casinos nor sports wagering are allowed in Texas.

Expanding Opportunity

The NFL’s softer stance arrives as experts estimate north of $20 billion will be wagered on college and pro football this year in regulated sportsbooks.

Heading into the start of the 2021 NFL season on Sept. 9, sports wagering is live and legal in a dozen states and Washington, DC that are homes to NFL franchises. That figure includes Arizona, which is likely to be ready on or before Sept. 9. It also includes New Jersey and Virginia, which aren’t official homes to NFL franchises, but are close to the named markets of the New York Jets, New York Giants and the Washington Football Team. Fourteen of the league’s 32 clubs are based in markets where sports betting is live and legal.

As for other sports wagering revenue-generating opportunities, the NFL has those as well. For example, the league has a 4.5 percent equity stake in sports betting data provider Genius Sports (NYSE:GENI). Earlier this year, Genius won a data agreement with the league, rumored to be worth $1 billion over six years.

In addition to the stake in Genius, the NFL owns equity in Sportradar, Skillz Inc. (NYSE:SKLZ), Fanatics, and On Location Experiences.

Related News Articles

Maryland Casinos Tell Lawmakers to Back Sports Betting

Outlook Rosy for Sports Betting if Supreme Court Approves Legalization

Most Popular

Las Vegas Overstated F1 Race’s Vegas Impact — Report

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

NoMad Hotel to Check Out of Park MGM on Las Vegas Strip

Most Commented

-

End of the Line for Las Vegas Monorail

— April 5, 2024 — 90 Comments -

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

— April 16, 2024 — 8 Comments -

Long Island Casino Opponents Love New York Licensing Delays

— March 27, 2024 — 5 Comments

No comments yet