Sands Misses Q2 Estimates as Macau Revenue Tumbles 98 Percent, Has Cash to Survive 18 Months or More

Posted on: July 22, 2020, 03:57h.

Last updated on: July 23, 2020, 11:05h.

Las Vegas Sands (NYSE:LVS) reported second-quarter results below an already low bar, with the Venetian operator saying revenue plunged 97.1 percent to $98 million in the April through June period.

On a net basis, the company lost $985 million in the quarter, compared with income of $1.11 billion in the year-earlier period. Adjusted property earnings before interest, taxes, depreciation and amortization (EBITDA) slid to loss of $547 million from a profit of $1.27 billion in the same period last year.

On an adjusted per-share basis, LVS lost $1.05. Analysts expected a loss of 72 cents a share on revenue of $738.9 million, indicating that the Parisian Macau operator wasn’t anywhere close to meeting Wall Street forecasts, underscoring concerns that this earnings season will be a rocky one for gaming companies with Asia-Pacific exposure.

Despite the glum results, Sands Chairman and CEO Sheldon Adelson sees inklings of recovery in Las Vegas, Macau, and Singapore — the company’s three markets.

I am pleased to say that the early stages of the recovery process from the COVID-19 pandemic in each of our markets is now underway, he said in a statement. “We remain optimistic about an eventual recovery of travel and tourism spending across our markets, as well as our future growth prospects.”

LVS is the first of the major US-based gaming companies to deliver results for the June quarter.

Waiting on Asia to Recover

LVS runs five Macau integrated resorts, making it the largest operator in the special administrative region (SAR). The company also owns the Marina Bay Sands (MBS) in Singapore, one of the most profitable casinos in the world.

All Macau casinos were open in the second quarter, but visits remained scant due to travel restrictions resulting from the coronavirus pandemic. As a result, some analysts are saying the second quarter of 2020 will go down as the worst three-month stretch on record for Macau’s six concessionaires. Specific to Sands, results were further pressured by MBS being closed for all but a few days in the quarter.

MBS reopened on a limited basis on July 1 and last week, Macau operators got a much need jolt when Guangdong province did away with its quarantine policy pertaining to travelers arriving from Macau. However, Sands acknowledged in an investor presentation it would be helpful if Beijing resumes issuing individual visit scheme (IVS) permits, something analysts and operators have no visibility on when that’s going to happen.

Sands China accounted for $40 million of the $98 million in total revenue the company generated in the quarter.

Down, But not Out

While the gaming industry is still in the early stages of what could be a lengthy recovery from the effects of the pandemic, LVS remains one of the financially sturdier names in the group.

The company said it has cash balances of $3.02 billion as of June 30, giving it enough capital to survive more than 18 months in a zero-revenue environment while continuing with Macau and Singapore expansion plans. LVS has no debt maturing until 2023.

“We are fortunate that our financial strength will enable us to continue to execute our previously announced capital expenditure programs in both Macao and Singapore,” said Adelson.

The Sands boss added that the operator’s financial strength affords its opportunities to “pursue growth opportunities in new markets.” South Korea was mentioned in an investor presentation as a “principal area of future development interest.”

Related News Articles

Hard Rock International Wins Right to Build Ottawa Casino

Ethics Commission to Seize Maine Casino Backer’s Financial Records

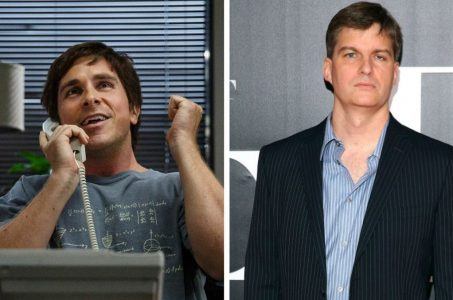

Burry, Inspiration for ‘Big Short’, Adds to Wynn Resorts Investment

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet