Burry, Inspiration for ‘Big Short’, Adds to Wynn Resorts Investment

Posted on: August 19, 2020, 08:03h.

Last updated on: August 20, 2020, 10:13h.

Scion Asset Management, the hedge fund run by Michael Burry, added to its investment in Wynn Resorts (NASDAQ:WYNN) during the second quarter.

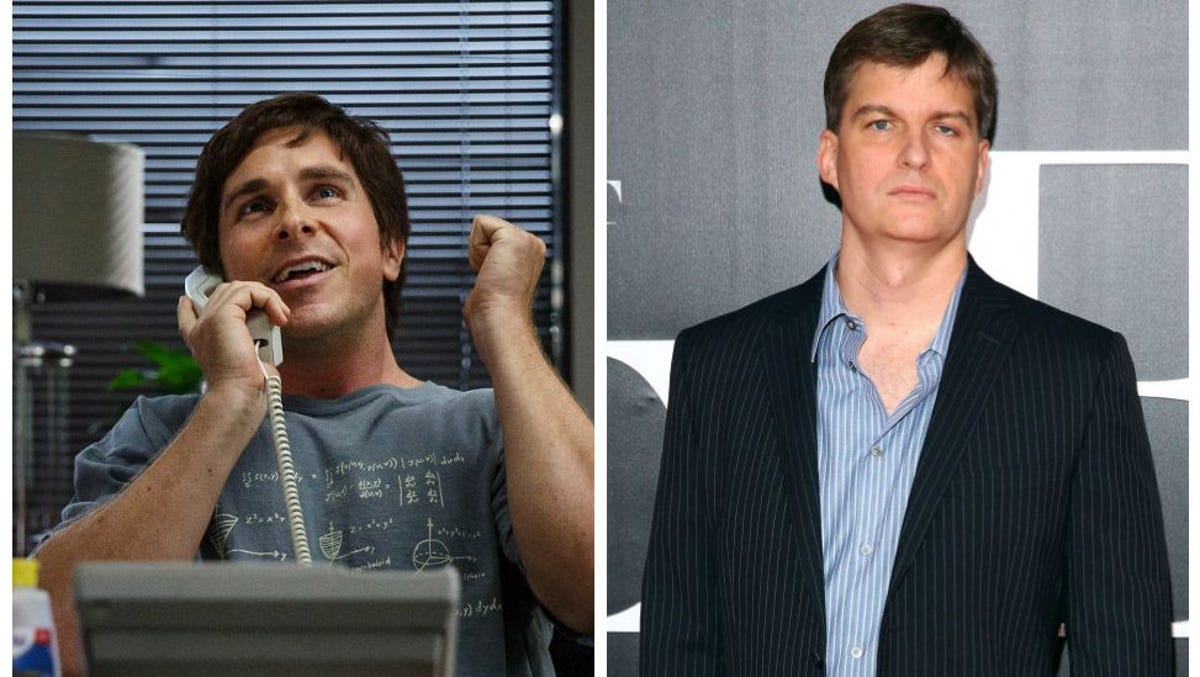

The investment vehicle, which had $315.2 million in assets under management as of June 30, revealed a significantly larger stake in the Encore operator in a recent 13-F filing with the Securities and Exchange (SEC). Burry was one of the investors profiled in the 2015 hit movie The Big Short. He was portrayed by Christian Bale.

Scion established positions in Wynn and Las Vegas Sands (NYSE:LVS) in the first quarter, as the stocks were drubbed first by a 15-day shutdown of gaming properties in Macau — the most vital market for each operator — and then a multi-month closure of their Las Vegas venues because of the coronavirus.

During the course of the pandemic, Burry hasn’t been shy about bashing Democratic governors, including Nevada’s Steve Sisolak, for what he saw as arcane shutdown policies that are harming the US economy. Nor has he been shy about putting his money where his mouth is in terms of betting on a recovery. Including LVS and Wynn, Scion owns 10 consumer discretionary stocks as of June 30.

Doubling Down

At the end of the second quarter, Scion’s LVS and Wynn stakes were worth $6.96 million and $5.21 million, respectively, according to the 13-F. Both positions are held in the form of call options – contracts designed to appreciate as the underlying security does the same.

The Venetian operator and Wynn aren’t the only bets Burry is making on COVID-19 being defeated and travel getting back to normal. Scion also has a stake in travel reservations site Booking Holdings (NASDAQ: BKNG).

Combine that with the positions in companies that own four properties on the Las Vegas Strip, and the hedge fund is, in a matter of speaking, saying it’s confident Sin City will eventually rebound, though the near-term outlook is clouded amid a lack of a coronavirus vaccine and still slack air travel capacity and demand.

Doubling Down Part II

By being long LVS and Wynn, Burry’s Scion is also wagering that Macau will bounce back. The lone Chinese territory where gambling is legal is home to five Sands and two Wynn integrated resorts. Both operators depend on the world’s largest gaming hub for significantly more of their earnings and revenue than are derived in Las Vegas.

Betting on a rebounding Chinese economy and Macau gross gaming revenue (GGR) appears to be another wager Scion is taking because the hedge fund also owns shares of Trip.com (NASDAQ:TCOM), the Chinese equivalent of Booking Holdings.

That was one of the investment vehicle’s new positions added during the June quarter. With China’s tourist visa policy for Macau set to loosen a bit at the end of this month, and with most of the restrictions coming off on Sept. 23, Trip.com could benefit as eager gamblers from the mainland book trips to Macau.

Another round of US/China geopolitical tensions could dent the near-term case for US-based Macau operators. Wynn Macau warned about that in a Tuesday regulatory filing, noting the Trump Administration’s ban on Chinese messaging app WeChat could have adverse effects on its business.

Related News Articles

Ethics Commission to Seize Maine Casino Backer’s Financial Records

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet