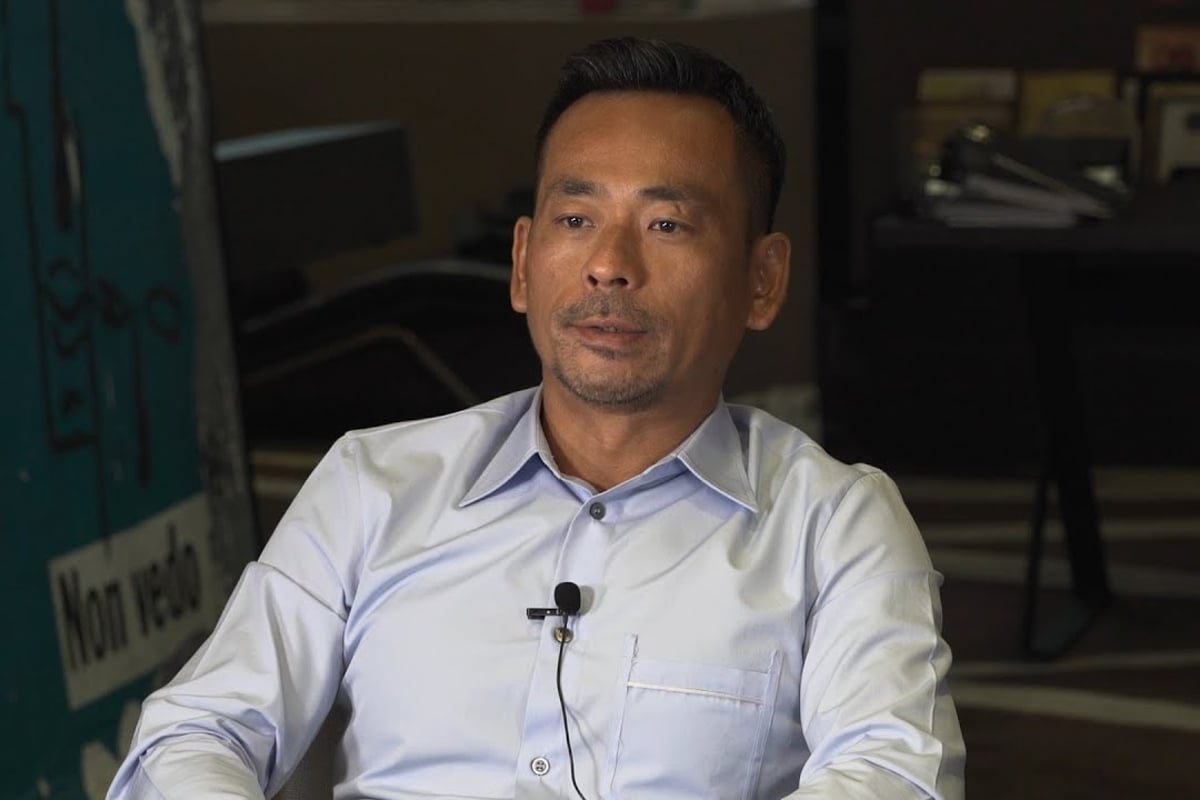

Suncity Boss Alvin Chau Says Macau Not Ridding Itself of VIP Junket Groups

Posted on: September 20, 2021, 01:01h.

Last updated on: September 20, 2021, 03:47h.

Suncity Group founder and CEO Alvin Chau says the current chaos surrounding the future of Macau’s gaming industry will not result in the elimination of VIP junkets.

Speaking with the Hong Kong Economic Journal, as first reported by GGRAsia, Chau says junket groups play a critical role in Macau’s gaming industry. He explained recently that local leaders pondering changes to their junket operations are not looking to force such businesses out of the area.

The Special Administrative Region (SAR) is presently considering a host of regulatory changes that would apply to casinos under the next licensing period. Macau’s six commercial gaming licenses are set to expire next June.

Junkets to Continue

VIP junket groups, officially called “promoters” under Macau gaming law, organize travel for high rollers throughout Asia to Macau. The SAR is the only area in China where gambling is legal.

Being a Special Administrative Region, Macau governs autonomously from China under the “one country, two systems” policy approach. When the enclave was returned from Portugal to China, the SAR’s 2001 legalization of expanded gambling called for the implementation of junkets.

VIP groups collect fees in China and elsewhere outside Macau from high rollers. The customers are then transported to the casino hub, put up in first-class accommodations at five-star casino resorts, and then typically issued a substantial line of gaming credit that often nears the total trip purchase price.

Since China limits how much money mainlanders can take out of the country, Macau’s VIP junket arrangement is one way to circumvent that condition. A recent regulatory suggestion from the Macau government is to ban junkets from accepting cash deposits from customers for anything other than casino gambling.

Chau says that shouldn’t be inferred as a direct assault on junkets.

The government is not aiming to trivialize or drive out the junket sector, but to regulate the sector so that it would not hurt Macau’s reputation,” Chau said. “It is not to completely bar the patrons’ capital from coming here.

“If the patrons don’t pay us, how are we to purchase gaming chips on their behalf?” he continued.

Chau, along with local legal scholars in Macau and gaming experts, say the proposed amendment has more to do with small- and mid-level junket groups from holding deposits from clients and keeping the money in interest-bearing bank accounts. There have been several cases in recent years involving theft by junket workers.

“The objective, which, to me, is legitimate in the light of past events, is to deter and punish the usage of casino deposits as financial investments. As much as this may impact the ability of gaming promoters to finance their activities, the protection of the general public and of the financial stability of the gaming concessionaires is clearly the policy priority,” declared attorney Rui Pinto Proença to GGRAsia.

Ongoing Review

Macau, in collaboration with its Gaming Inspection and Coordination Bureau, is amid a public consultation period that runs through October 29.

Potential regulatory changes have caused a massive sell-off of publicly traded casino companies that operate in Macau. The three US-based Macau casino concession holders have seen their shares plummet over the past week.

Las Vegas Sands has gone from $42.89 on September 13 to $37.66 as of midday trading today. That’s a decline of 12 percent.

MGM Resorts has tumbled from $43.10 to $41.24, a four percent decline. Wynn Resorts has been the biggest loser over the past week, its shares dropping from $103.48 to $81.94 — a 21 percent reduction.

Related News Articles

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments -

Chicago Pension Mess Highlights Need for Bally’s Casino

— July 2, 2024 — 5 Comments

No comments yet