Las Vegas Sands Japan Door Closed, But It’s Ajar for Melco, MGM, Analyst Speculates

Posted on: May 14, 2020, 11:55h.

Last updated on: May 14, 2020, 12:46h.

Las Vegas Sands (NYSE:LVS) sent shockwaves through the gaming industry Tuesday, saying it has ended its pursuit of a Japanese gaming license. Chairman and CEO Sheldon Adelson cited issues with the policy framework set forth by the government there.

The Sands boss said his company’s goals in the Land of the Rising Sun became “unreachable,” stoking speculation among analysts that although gaming licenses there were prized, operators may not be able to generate adequate return on investment in Japan.

With the departure of LVS – widely seen as the lead horse in the pack – some analysts see opportunity for other companies looking to enter the world’s third-largest economy.

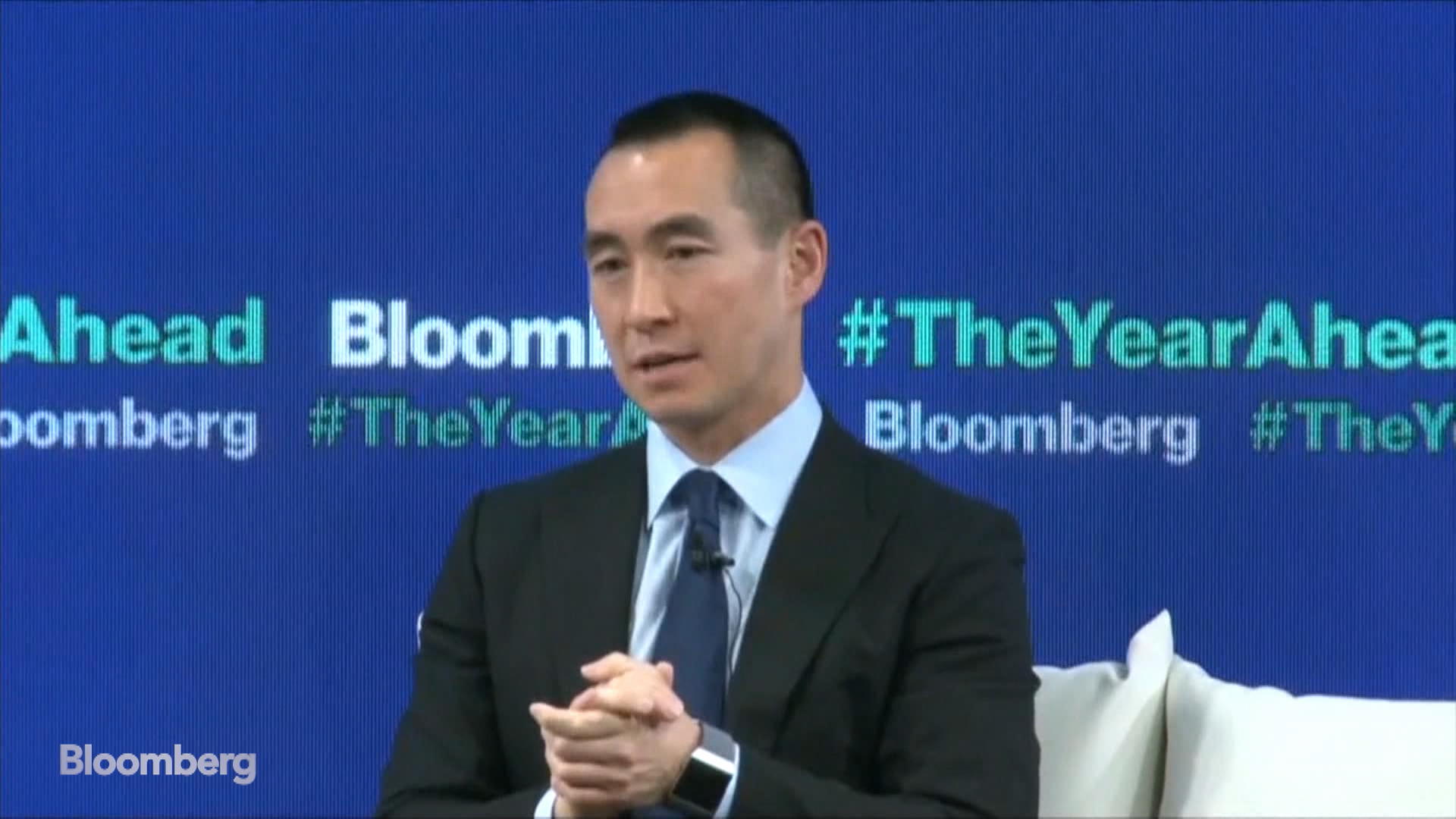

By discontinuing its pursuit of an IR in Japan, LVS has made it official that it intends to target its growth plans elsewhere in Asia,” said Nomura Instinet analyst Harry Curtis in a note to clients today.

Curtis highlights Melco Resorts & Entertainment (NASDAQ:MLCO) and MGM Resorts International (NYSE:MGM) as possible beneficiaries of LVS’s decision to abandon its Japan efforts.

Opportunity for MGM

Like LVS, MGM remains one of the leading contenders for one of the first three Japanese gaming permits. But the Bellagio operator’s focus is on Osaka, where it is now the only company in that city. Sands was intent on building an integrated resort (IR) in Yokohama.

Curtis’s analysis underlines the key for MGM to convince investors that it can make Japan not only work, but that the project will generate strong returns after what’s likely to be an 11-figure investment.

“We doubt that the withdrawal of LVS changes their appetite. But we hope that, at a minimum, MGM can use the negative headline to make terms in Osaka more appealing for its shareholders,” said the analyst. “If not well-received, then perhaps refocusing on Macau, where returns should be stronger, makes sense.”

MGM China operates MGM Cotai and MGM Macau in the world’s largest gaming center.

Maybe Melco?

Melco makes for an obvious potential winner under the LVS-leaving-Japan scenario, because like the Venetian operator, Lawrence Ho’s company is eyeing Yokohama.

Melco is already a major player in Asian gaming with a significant Macau footprint and the City of Dreams in Manila – traits analysts view as favorable when it comes to procuring a Japanese IR permit.

Even with Sands out of the running, Melco faces intense competition in Japan’s second-largest city from the likes of Galaxy Entertainment, Genting Singapore, and Wynn Resorts, among others. In an effort to bolster its case, Melco said last year it will build two non-gaming hotels in Japan for a total of $250 million.

Previously, Ho affirmed his company’s commitment to Yokohama, saying he expects a high-end IR project there will cost at least $10 billion. The company reported first-quarter results earlier today, but executives didn’t directly comment on Japan.

Related News Articles

Wynn Resorts Stock Favored as Analysts See Macau Headwinds Abating

Las Vegas Sands, Wynn Surge as Macau Ends China Travel Quarantine Policy

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments -

Chicago Pension Mess Highlights Need for Bally’s Casino

— July 2, 2024 — 5 Comments

No comments yet