New Jersey Online Gambler Claims Identity Theft to Avoid Debt

Posted on: May 17, 2014, 05:30h.

Last updated on: May 16, 2014, 03:19h.

There’s nothing newsworthy about a gambler coming up with some excuse as to why they can’t – or shouldn’t have to – pay off their debts. It happens on a regular basis, so it’s usually only the stories where millions are on the line that attract attention. But one player at New Jersey’s online casinos made waves recently by employing a unique excuse that would never fly at a live venue: according to her, she wasn’t the one who spent the money.

A New Jersey woman named Diana Zolla has been charged with theft by deception after claiming that she was a victim of identity theft. She was using the story in an attempt to avoid paying off nearly $10,000 in debt and banking fees that she had accumulated while playing at the licensed online gambling sites in the state.

Investigation Reveals Deception by Zolla

However, detectives reviewed Zolla’s records. After taking a look at banking transactions, records from the online gaming sites, and ISP records, they came to the conclusion that Zolla created the account and was the one who spent the $9,565 in question.

Zolla, a 31-year-old woman from Jackson Township, was released, but faces a mandatory appearance in Atlantic County Superior Court.

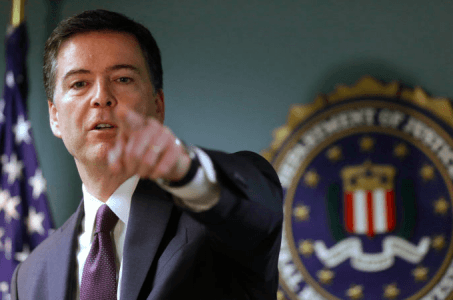

“People who gamble online may be tempted to fabricate an identity theft complaint in order to avoid paying their debt,” said New Jersey State Police superintendent Colonel Rick Fuentes. “This criminal activity can only make a bad situation worse.”

This is the kind of story that would be hard to imagine at a land-based casino. Perhaps an identity thief could withdraw money and then take it to a casino to play with, but any attempt to actually use credit in the venue would certainly result in the criminal being caught on tape, likely ending their crime spree soon thereafter.

State Says Case Shows Oversight Works

Groups such as Sheldon Adelson’s Coalition to Stop Internet Gambling have often argued that online casinos can’t realistically ensure that they know who is playing on a given account. But while opponents of online gambling might point to a case such as this one as an example of why the industry cannot be properly regulated, officials in New Jersey instead say it shows that their systems work.

“Suspicious transactions are thoroughly investigated, and as this case shows, attempts to defraud New Jersey casinos will not be tolerated,” said Division of Gaming Enforcement director David Rebuck.

So far, a total of 291,625 online accounts have been created at New Jersey’s Internet casino sites. The popularity of online casinos has continued to grow in the state, with the rate of creation rising 17 percent month-over-month in March, according to figures from the Division of Gaming Enforcement.

Confidence in the security of the gambling sites – and the ability for consumers to be protected – is critical for continued growth, and Rebuck says that the state is continuing to work hard to keep the public’s trust.

“The Division of Gaming Enforcement and the State Police are committed to working together to deter fraudulent activity and instill confidence in Internet gaming operations for all involved, including players, platform providers, and payment processors,” Rebuck said.

Related News Articles

Strict Punishments Proposed to Curb Turkish Online Gambling

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet