Nevada Supreme Court to Rule if Booking Sites Paid Adequate Room Taxes

Posted on: October 2, 2023, 12:18h.

Last updated on: October 2, 2023, 02:19h.

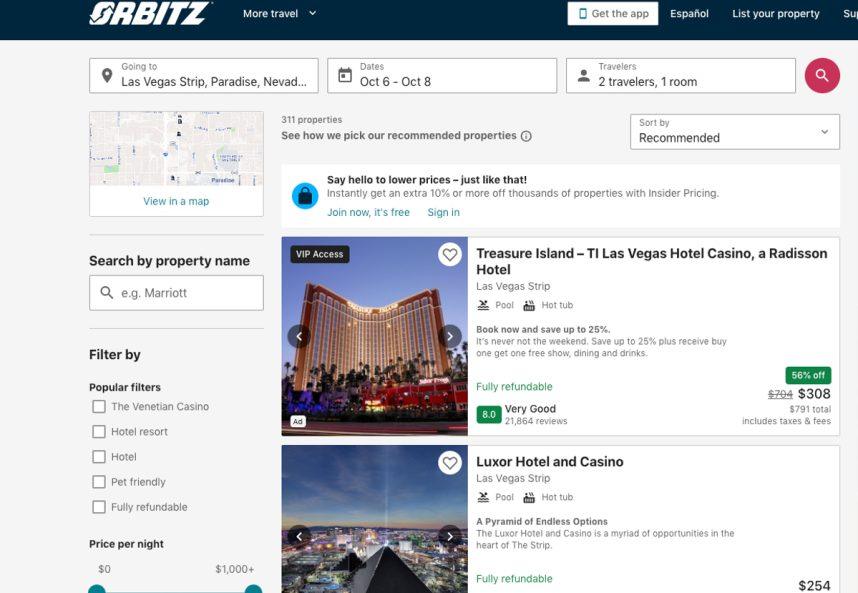

The Nevada Supreme Court last Thursday moved forward with a case that alleges third-party internet travel sites like Orbitz and Expedia have not properly paid the state its share of room taxes.

A lawsuit was brought last year through private action filed by Sig Rogich and Mark Fierro. Rogich founded R&R Partners in 1974, the ad agency that remains the go-to marketing house for the Las Vegas Convention and Visitors Authority (LVCVA). Fierro is a litigation expert whose company, Fierro Communications, supports attorneys involved in high-profile cases.

Though not attorneys, Rogich and Fierro hired lawyers to file the lawsuit. The complaint alleges third-party booking platforms designed a scheme to pay Clark County and Nevada fewer room taxes on the hotel rooms they sold to consumers on behalf of casino resorts and other lodging establishments. Nevada Attorney General Aaron Ford has expressed his support for the plaintiffs in the litigation but declined to intervene.

Attorneys representing Rogich and Fierro allege that booking sites negotiated discounted room rates with casinos and hotels and then sold them at higher retail rates to consumers. The lawsuit claims the travel sites remunerated the hotel occupancy taxes based on the negotiated, discounted rate, not the cost the guest paid the booking site.

Rogich and Fierro believe the long-running scheme has resulted in Nevada missing out on at least $1 billion in hotel occupancy tax revenue, money that would have gone to the LVCVA, public schools, and the Nevada Department of Tourism. Hotel occupancy taxes also benefit state and local general funds.

‘Qui Tam Case’

Though relatively rare, the Nevada Supreme Court explains that Rogich and Fierro’s lawsuit on behalf of Nevada and impacted counties “is sometimes referred to as a qui tam case.” Such a legal challenge is permitted under the federal False Claims Act, which provides a legal path for whistleblowers to bring litigation against parties that have allegedly defrauded governments.

The named defendants include Orbitz, Travelscape, Travelocity, Expedia, Hotels.com, Hotwire, Priceline, Agoda, and Hotel Tonight.

The legal teams representing the online travel sites had asked the Nevada Supreme Court to dismiss the litigation on claims that Clark County dismissed a similar lawsuit in federal court against the defendants. The county is appealing the matter, but because the state was not involved in the federal lawsuit, an en banc ruling from the Nevada Supreme Court concluded that it could consider Rogich and Fierro’s litigation on behalf of the state.

Oral arguments were heard before the Nevada Supreme Court in April. The court issued its opinion and agreement to fully consider the appeal in a ruling issued last week on Sept. 28.

Hotel Taxes Add Up

The transient lodging tax for hotel stays on the Las Vegas Strip, within the county’s defined “Primary Gaming Corridor,” is an effective rate of 13.38%. Of the nightly tariff, 12% goes to Clark County, 0.5% is set aside for the Las Vegas Convention Center’s expansion, and 0.88% goes to the Las Vegas Stadium Authority to pay off the $1.9 billion Allegiant Stadium.

Room rates on the Strip are pricey for a two-night stay from Friday to Sunday because of the Sphere and U2’s residency opening, a busy convention calendar including the upcoming Global Gaming Expo, and the Raiders playing at home on Monday Night Football.

The cheapest room at The Venetian Resort is running $322 before the property’s $45 nightly resort fee. Hotel taxes come to nearly $200 for the stay.

Related News Articles

Nevada’s Strict Cannabis Classification Ruled Unconstitutional

Nevada Cannabis Sales Slightly Off High, But Still About $1B Yearly

Wynn Resorts Concludes Steve Wynn 2019 Sexual Harassment Lawsuit

Most Popular

LOST VEGAS: ‘Tony The Ant’ Spilotro’s Circus Circus Gift Shop

Casinos That Were Never Casinos

Texas Lottery Player Won $95M Jackpot by Buying 26M Tickets

Most Commented

-

End of the Line for Las Vegas Monorail

— April 5, 2024 — 90 Comments -

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

— April 16, 2024 — 9 Comments -

Long Island Casino Opponents Love New York Licensing Delays

— March 27, 2024 — 5 Comments

Last Comment ( 1 )

Great article! Hopefully this taxation decision works out perfectly!