Mount Airy Casino Gets $50 Million Coronavirus Loan from Bank Chaired by Mob-Connected Former Owner

Posted on: September 1, 2020, 10:35h.

Last updated on: September 1, 2020, 12:55h.

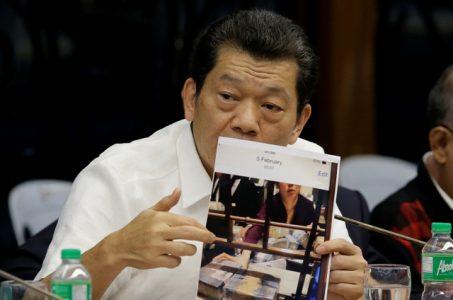

The Mount Airy Casino & Resort in Mount Pocono, Pennsylvania received $50 million in coronavirus relief loans from a local bank, FNCB, as part of the taxpayer-backed Main Street program. But the bank’s chairman and largest shareholder, Louis DeNaples, just happens to be the former owner of the Mount Airy Casino, The Philadelphia Inquirer reports.

DeNaples was forced to relinquish his interest in the property after he was indicted on perjury charges in 2008 for lying to licensing authorities about his ties to the Scranton Mafia. Casino ownership is divided equally among trusts in the names of DeNaples’ children and grandchildren.

DeNaples’ son, Louis DeNaples Jr., is the bank’s vice chairman and a minority owner, as well as being the beneficiary of one of the casino trusts.

Who is Louis DeNaples?

DeNaples initially made his fortune operating landfill and auto parts businesses. In 1978, he was charged with defrauding the government out of more than $500 million in recovery funds in the aftermath of Hurricane Agnes.

Several people, including James Osticco, the reputed underboss of the Bufalino crime family, were charged with witness tampering at the trial.

When DeNaples applied for a casino license in 2005, his previous conviction was overlooked because it was more than 15 years old. But his connections to the Bufalino family soon resurfaced.

Is Mount Airy Casino Loan Legal?

It is extremely unusual for a small bank like FNCB to issue a loan of that size because of the risk involved, analysts told the Inquirer. It’s one of two Main Street loans in the country that exceeded $5.5 million.

The Main Street program was designed to make lenders less nervous about issuing loans to struggling businesses. But it means it’s the taxpayer who loses out if the casino defaults, not the bank.

The loan appears to have been made possible by the Treasury Department’s decision to exempt the Main Street program from certain regulations. Those include prohibiting financial institutions from issuing taxpayer-backed loans to companies owned by their directors. The thinking was that since all coronavirus relief loans are offered on the same terms, there’s no room for favoritism.

But banking compliance lawyer Braden Perry told the Inquirer that the transaction could be in violation of “Regulation O,” which governs insider lending.

It does not look good from an outsider’s point of view, and is a disservice to the taxpayer if the proper underwriting and vetting procedures were not followed,” he said.

Representatives of the casino said in an official statement that the loan would be used to “improve the strength of our business, which was deeply impacted by the COVID-19 pandemic,” and to “secure the jobs of nearly 1,000 Pennsylvanians employed by Mount Airy.”

Related News Articles

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments -

Chicago Pension Mess Highlights Need for Bally’s Casino

— July 2, 2024 — 5 Comments

No comments yet