MGM Resorts Takeover Offer of Wynn Resorts Rumored, Wynn CEO Matt Maddox Reported to Be Open to Possibility

Posted on: April 6, 2018, 10:20h.

Last updated on: April 6, 2018, 10:24h.

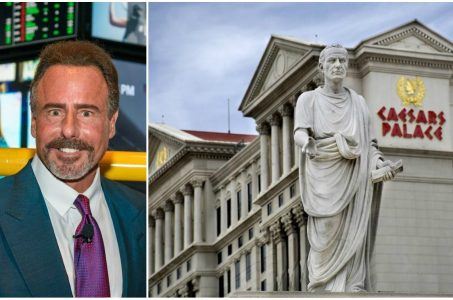

Could MGM Resorts be considering an offer for rival gaming operator Wynn Resorts? That’s the buzz now circulating in the wake of Steve Wynn’s fall from grace and subsequent departure from the company in February, which left Matt Maddox in the top spot.

According to the New York Post, rumors have emerged that new Wynn CEO Maddox is open to offers.

“I think if the Wynn CEO gets his deal, he’ll sell,” a source close to the gaming company told the news site. The unnamed insider also set strong odds that an acquisition is imminent, opining that there’s a 50 percent chance MGM will buy the company in the “next several months.”

Wynn Resorts, which is traded on the New York Stock Exchange (NYSE), currently has a market cap of nearly $20 billion. “Market cap” indicates the value of a company’s outstanding shares.

Wynn Resorts owns two casinos on the Las Vegas Strip, two in the Chinese gaming enclave of Macau, and is also constructing a $2.4 billion property near Boston.

MGM Exploring Opportunities

MGM Resorts contemplating a Wynn takeover comes as a surprise.

In February, MGM CEO Jim Murren said due to the size and value of Wynn Resorts, “It would be difficult to believe anyone is going to have the financial wherewithal to make a serious bid.”

But those comments came as Steve Wynn continued to deny decades of sexual harassment and misconduct made against him. The billionaire has since not only resigned from the company he founded, but also sold his entire stake, worth roughly $2.2 billion.

An also unidentified “gaming banker,” as described by the New York Post, added that MGM is certainly interested. The banker reportedly stated that the ongoing investigations by regulators in Nevada, Massachusetts, and Macau make a sale even more likely.

However, the source says time is of the essence, because should those jurisdictions settle with Wynn and allow the company to maintain its casino permits, an acquisition might be costlier, and therefore, unlikelier.

The Post acknowledges that no formal negotiations have occurred. MGM and Wynn Resorts both declined to comment.

MGM buying Wynn would give the company an even greater presence on the Las Vegas Strip, where it already has 13 casinos, with a 14th — the Park MGM — slated to open this spring, and its sister property, NoMad Las Vegas, scheduled to open in the fall.

Other Potential Suitors

MGM Resorts may not be the only company looking at Wynn, of course. Malaysian conglomerate Genting Group — which owns Resorts World casinos in Malaysia, Singapore, the Philippines, New York, and soon Las Vegas — could also be a strong contender for a Wynn takeover.

Wynn Resorts is best-known in the US for its two Strip properties, but the company makes the bulk of its cash in Macau. Recent financial disclosures show that more than 75 percent of its revenue comes from China.

One of six casino permit holders, Wynn Macau’s operations are what make the company highly valuable. It’s also why Genting — which isn’t licensed in Macau, while MGM is — might be more willing to pay a premium to buy Wynn Resorts.

Galaxy Entertainment, another Macau licensee, recently took a 4.9 percent stake in Wynn Resorts, but company Chairman Francis Lui Yiu-tung said it would be a “passive investor.”

Then there’s Las Vegas Sands CEO Sheldon Adelson. The billionaire who built The Venetian and Palazzo has long been at odds with Steve Wynn, and his company certainly has the financial means to make a serious offer. Sands has a market cap of more than $55 billion.

Related News Articles

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet