Macau, US Regionals Leaving Vegas Behind in Gaming Recovery

Posted on: September 18, 2020, 12:04h.

Last updated on: September 18, 2020, 12:46h.

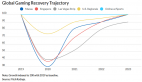

Gaming companies’ coronavirus recovery efforts hinge largely on geographic exposure. Those relying on the Las Vegas Strip are likely to lag rivals with significant Asia-Pacific or domestic regional footprints, according to Fitch Ratings.

With a COVID-19 vaccine likely still months away, Sin City continues struggling, as convention traffic remains non-existent, leading to rock bottom weekday occupancy rates. Weekends in the largest US gaming center are only slightly better, with a major runway for improvement, because many leisure travelers are wary of boarding passenger jets in the wake of the pandemic.

Global gaming company recovery trajectories following the aftermath of the coronavirus pandemic will differ with exposure to local markets and online channels differentiating winners from losers over the near term,” said Fitch in a recent note.

The research firm acknowledges that the major global destination gaming markets of Las Vegas, Macau, and Singapore are currently faring poorly. But their timelines to recovery aren’t comparable.

Macau Not Great, But Better Than Vegas

Over the course of the pandemic, it’s been common for analysts to opine that Macau and perhaps Singapore will rebound faster than Las Vegas.

While both Asia-Pacific markets were hindered by travel restrictions and temporary gaming property closures earlier this year. Those travel controls are easing and there are some near future imminent catalysts, mainly for Macau, in terms of marquee festivals.

Likewise, Asia’s history of dealing with pandemics is a positive for operators there, with executives noting the region has been through experiences like COVID-19 in the past, and when things return to normal, there’s a voracious appetite for gambling.

“Destination gaming markets outside of the US are also faring poorly, albeit with different near-term prospects than the Las Vegas Strip,” said the research firm. “Fitch expects Macau, China to recover faster than Las Vegas, due to closer proximity of Macau’s feeder markets.”

“The recovery trajectory for Macau is still opaque,” the ratings agency adds, because there’s still a travel ban in place with Hong Kong. But with the issuance of tourist visas across mainland China resuming next week, there is an avenue for augmenting some of the lost traffic from Hong Kong.

Online, Regional Where it’s at in US

Investors considering exposure to domestic gaming equities should consider those with online or regional exposure. Some operators, including Boyd Gaming (NYSE: BYD) and Penn National Gaming (NASDAQ:PENN), check both boxes.

Revenue growth from iGaming and sports wagering, coupled with regional markets rebounding more rapidly than Sin City, bolsters the case for gaming assets that aren’t intimately correlated to Strip occupancy and traffic trends.

“We expect the revenue generation of companies exposed to local markets and online channels to hit 2019 baseline levels faster than those with high exposure to destination markets, or markets with a more cautious approach to re-opening and travel. US regional operators, such as Penn National Gaming and Boyd Gaming, are already showing promising results,” said Fitch.

The research firm adds companies that are highly focused on the destination/experiential element of Las Vegas are “at the mercy of long-distance travel trends normalizing.”

Related News Articles

David Baazov’s Lawyer Grills AMF, Claims Regulator’s Case Is Full of Holes

Gaming, Leisure Industry Epicenter of COVID-19 Credit Downgrades

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet