Jeff Guinn, Son of Former Nevada Governor, Accused of Defrauding Late Boyd Gaming President

Posted on: September 28, 2016, 03:00h.

Last updated on: October 3, 2016, 12:19h.

Jeff Guinn, son of the late Nevada governor Kenny Guinn, is accused of running a Ponzi scheme that allegedly defrauded investors out of millions.

Among those who fell victim to the alleged scam include Donna Ruthe, the wife of the former president of casino operator Boyd Gaming Corp and Chuck Ruthe, who died in 2013, was a longtime business associate of Kenny Guinn.

Donna Ruthe claims that Jeff Guinn used his father’s name to attract investors to the now-bankrupt Aspen Financial Services.

The Ruthe family lost $6.9 million, and Donna Ruthe is pursuing the claim through the bankruptcy courts.

Aspen was once a successful real estate company riding the wave of the Las Vegas construction boom, and with Guinn’s connections in high places, there was no shortage of financing. But as the economy crashed the cracks began to show, while Guinn carried on regardless, according to the lawsuit.

Pattern of Refinancing Debt

“Guinn engaged in a constant pattern of financing and refinancing first and second trust deeds at an ever increasing debt level,” it states. “The primary purpose of virtually all of the Loans was to repay prior deeds of trust to carry out Guinn’s scheme, fund unpaid accrued interest on other loans, fund additional ‘capitalized’ interest reserve, pay fees and closing costs.

“Guinn often authorized cash out to borrowers, all of which was never disclosed to Plaintiffs before investing in the subject loans and in violation of the loan agreements. Plaintiffs were never informed of the real purpose of the loans.”

Dennis Prince, Ruthe’s lawyer, in an opening statement that lasted two hours, argued that Aspen was a “complex scheme to defraud” and that Guinn “failed to exercise safe and sound business judgment,” according to the Las Vegas Review-Journal, which attended the opening hearing this week.

Guinn “exploited” investors’ trust and confidence,” Prince continued, while living an extravagant lifestyle, constantly refinancing loans as part of “a Ponzi scheme.”

Catastrophic Decline

According to his defense counsel Joseph Liebman, Jeff Guinn had “believed in the loans, and he had no idea that they, or the economy in general, would eventually falter.” He also denied that Aspen had been a Ponzi scheme at all; the loans’ collateral had a “catastrophic decline” in value during the Vegas property crash.

Chuck Ruthe, meanwhile, was “obviously aware he was getting into a potentially risky venture,” claimed Leibman.

Ruthe died in 2014 after a long battle with Parkinson’s disease. As an original stakeholder in Boyd Gaming, he helped build the company from the ground up with his friend and business partner, Bill Boyd. He retired as president in 1997.

Related News Articles

Most Popular

LOST VEGAS: ‘Tony The Ant’ Spilotro’s Circus Circus Gift Shop

Las Vegas Overstated F1 Race’s Vegas Impact — Report

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

Las Vegas Strip Stabbing Near The Strat Leaves One Man Dead

NoMad Hotel to Check Out of Park MGM on Las Vegas Strip

Most Commented

-

End of the Line for Las Vegas Monorail

— April 5, 2024 — 90 Comments -

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

— April 16, 2024 — 8 Comments -

Long Island Casino Opponents Love New York Licensing Delays

— March 27, 2024 — 5 Comments

Last Comments ( 4 )

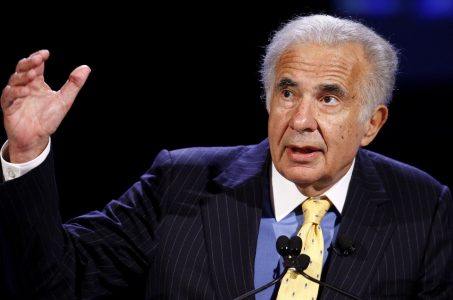

The photo is most definitely Jeff Guinn.

Dana Resnick Gentry, thank you for your feedback. Both errors have now been corrected.

And Liebman is Guinn's attorney, not witness.

That's David Goldwater, not Jeff Guinn.