James Packer Vote Saves Directors’ Skins at Crown Resorts AGM, Executive Pay Voted Down

Posted on: October 22, 2020, 06:42h.

Last updated on: October 22, 2020, 10:54h.

Australian billionaire James Packer used his ownership clout Thursday to save three Crown Resorts directors up for reelection at the company’s annual general meeting.

An influential organization told Crown Resorts’ shareholders that poor governance would not be tolerated, leaving the fate of the three directors hanging in the balance. The organization advises Australia’s biggest pension funds.

The company is currently the subject of a public inquiry into allegations of anti-money laundering failures and involvement with junket operators with links to organized crime.

Shareholders Revolt

Minor shareholders heeded the call and largely voted to boot out the directors, prompting Packer, who owns around 36 percent of the company, to come to the rescue. Nevertheless, one board member, John Horvath, promptly resigned, acknowledging he had been spared only by Packer’s vote.

Horvath received a vote of 58.4 percent. That’s more than the 50 percent needed to stay. but without Packer, it represents the approval of just 22 percent of shareholders.

The other two, Jane Halton and Guy Jalland, have vowed to remain. Jalland is a Packer appointee and the boss of the billionaire’s private investment firm, Consolidated Press Holdings. He’s digging in his heels despite 41 percent of shareholders wanting him out.

Bye-Bye Bonuses

But shareholders also made their dissatisfaction heard by voting down a resolution to adopt the remuneration report. Under Australian corporate rules, if shareholders reject a remuneration report for two years in a row, they can then call for a resolution to remove the whole board.

Crown chair Helen Coonan on Tuesday admitted while giving testimony to the public inquiry that the company had facilitated money laundering, but had done so through “ineptitude” rather than any criminal intent. On Thursday, she apologized unreservedly to shareholders for the board’s failures.

In all of its history, Crown has never faced adversity like we are now – but I’d like to reassure all our investors, stakeholders, and staff that the board is determined and willing to learn from the past,” Coonan told the AGM.

“The board accepts that there needs to be an injection of new perspectives and expertise on our board. These changes need to be undertaken in a considered and thoughtful manner to ensure an orderly transition,” she added.

Packer Could Divest

The inquiry will ultimately determine whether the Crown should retain its gambling license in New South Wales. The company hopes to open a $2 billion casino in state capital Sydney at the end of the year.

Testifying before the inquiry, Packer acknowledged that he may have to sell some or all of his equity in the business for the company to keep its license.

At the AGM, Coonan refused to answer questions about what Crown would do if it were to lose its Sydney license.

Related News Articles

Star Entertainment Shares Plunge on Money Laundering Allegations

Landing International Chairman Suspended Amid Securities Regulator Probe

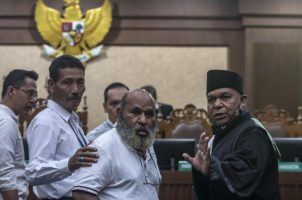

Former Indonesian Governor With Gambling Habit Goes to Prison

Most Popular

Las Vegas Overstated F1 Race’s Vegas Impact — Report

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

NoMad Hotel to Check Out of Park MGM on Las Vegas Strip

Most Commented

-

End of the Line for Las Vegas Monorail

— April 5, 2024 — 90 Comments -

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

— April 16, 2024 — 8 Comments -

Long Island Casino Opponents Love New York Licensing Delays

— March 27, 2024 — 5 Comments

No comments yet