Deloitte: Sports Struggling to Blend Betting Into Overall Fan Experience

Posted on: July 4, 2023, 08:06h.

Last updated on: July 4, 2023, 10:52h.

Researchers at Deloitte, one of the “Big Four” accounting firms, has issued a new report titled “2023 Sports Fan Insights: The Beginning of the Immersive Sports Era.” The report contends that professional and college sports leagues, organizations, teams, and media companies still haven’t figured out how to best implement the emergence of legal sports betting in the US.

The US Supreme Court’s May 2018 landmark decision returning the legality of sports betting to the states has birthed a new industry. It resulted in more than 30 states today having legal sports wagering laws on their books.

The historic ruling greatly changed the sports landscape in the US. Fans who bet on sports are significantly more engaged, research has found, and watch more, spend more, and discuss more on social media about the sports, teams, and players they watch.

Sports have seen a considerable uptick in television ratings since the emergence of regulated sports betting. But researchers at Deloitte found that the sports industry still has a ways to go in perfecting the integration of gambling.

Key Demo

Deloitte’s “2023 Sports Fan Insights” found that sports betting is wildly popular with younger people, including the all-important millennial and Generation Z demographics.

The Gen Z group is especially craving an integrated sports viewing and social experience, the study found. Gen Z is likelier to use social media and comment live on the sports they’re watching.

About 80% of Gen Z fans follow at least one professional athlete online, and that often leads to them betting on that player or that sport. And nearly 20% of Gen Z sports fans said they used a sports betting app as a result of following a professional athlete online.

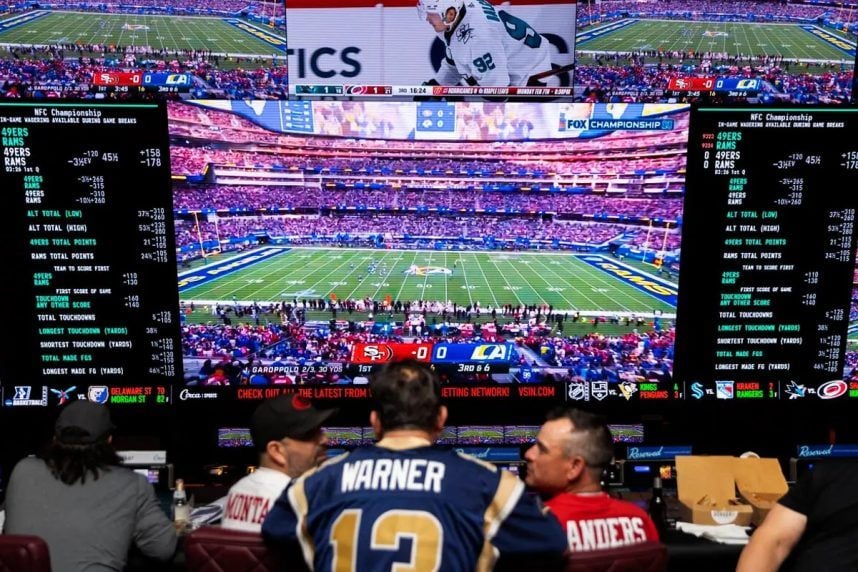

Sports leagues and franchises have tried to capture the younger market by partnering with sportsbooks and allowing sports betting companies to advertise during their television and streaming broadcasts. The leagues are also allowing some in-stadium sportsbooks, something unimaginable less than a decade ago.

But other fans have expressed frustration with what they consider to be excessive advertising from sports betting interests. That’s caused some divide among bettors and non-bettors or casual bettors.

When looking to integrate betting into the fan experience, it’s important to address the sentiments of non-bettors as well,” the Deloitte study read.

The review found that two in three non-betting fans say they see too many sports betting advertisements (compared to 48% of bettors). And 59% of non-bettors to just 42% of bettors voiced concerns about the long-term impacts of the redundant sports gambling adverts.

“This reflects the feeling that the more prevalent sports betting becomes in the United States, the chances for mistakes and abuse could grow,” Deloitte said.

Challenges Remain

The legal sports betting industry is flourishing in the US. Bettors have lawfully wagered more than $236.5 billion and lost more than $19 billion to the oddsmakers since the SCOTUS May 2018 ruling.

Sports gambling has fueled interest in college and pro sports stateside. But Deloitte cautions the leagues that they must also take into account their legacy fans who aren’t regularly betting.

“In the pursuit of new revenue and deeper personal connection, many teams, leagues, organizations, and media companies have started to explore integrating sports betting into the fan experience. There are increasing numbers of sportsbooks located in venues and there have been some early experiments by streamers to incorporate betting functionality into their services.

To capture and grow this market, sports betting operators have pushed hard over the last few years with aggressive advertising and incentives. Despite the opportunity, there are questions around how to blend sports betting into the overall fan experience, and how to cater to bettors without alienating other fans,” the Deloitte market study concluded.

Deloitte researchers asked more than 3,000 US sports fans aged 14 and older to reach their conclusions.

Related News Articles

Deutsche Bank Bullish on US Sports Wagering Growth

Former Texas Governor’s Sports Betting Estimates Contain Hyperbole, Say Experts

US Sports Betting Growth Propelled by Young, High-Income White Males – Poll

Twitter Sports Betting Data Revealed, Insights Claim Social Media Spurs Gambling

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet