Crown Resorts Loses $191M, Oaktree Rescinds James Packer Offer

Posted on: August 30, 2021, 11:56h.

Last updated on: August 30, 2021, 12:22h.

Crown Resorts investors knew it would be bad. And today, those shareholders found out how devastating COVID-19 and ongoing regulatory issues facing the Australian casino giant have impacted business.

Crown revenue for its 2021 fiscal year (July 1, 2020, through June 30, 2021) fell more than 31 percent from 2020 to US$1.13 billion. After operating expenses, the firm reported a net loss of $191.2 million.

2021 has been a challenging year for Crown, with intense regulatory scrutiny and unprecedented impacts on business operations from the COVID-19 pandemic,” said Crown Interim Chair Jane Halton.

Crown Melbourne, the company’s flagship property, was closed for 160 days during the fiscal period because of COVID-19. Revenue there tumbled 64 percent to $420.9 million.

Crown Sydney, the group’s $1.6 billion integrated resort that opened in late December, has no casino space. That’s after the company was found unsuitable to conduct gaming by the New South Wales Independent Liquor and Gaming Authority. Revenue at the Barangaroo complex totaled just $50.2 million in its first six months.

Crown Perth, Crown’s other casino in Australia, was the company’s lone bright spot. Being closed for only 27 days, the Western Australia property increased operating revenue by 22 percent to $543.3 million.

The remaining Crown revenue was generated by its London boutique casinos and Crown Digital online social gaming unit.

Oaktree Exit

Crown Resorts remains prohibited from operating a casino in New South Wales. Its gaming privileges in Melbourne and Perth also are in jeopardy, as ongoing Royal Commissions continue their probes.

The Sydney review concluded that Crown didn’t do nearly enough to protect its casinos Down Under from being used as money laundering facilities. The casinos were targeted by criminal networks that operate predominantly throughout Asia. Officials in New South Wales also stated that troubled billionaire James Packer — who founded Crown and maintains a nearly 37 percent stake in the organization — has too much power and control, despite not being an official board member or executive.

Oaktree Capital Management, a private equity firm based in the US, sought to settle that concern among the Royal Commissions in Victoria and Western Australia by purchasing Packer’s stake. The global asset management company’s most recent offer was approximately $1.5 billion.

But in today’s fiscal year report, Crown Resorts revealed that Oaktree is no longer bidding.

“Crown is no longer in discussions with Oaktree regarding the Revised Proposal that was previously announced by Crown to the market on June 15, 2021,” the company briefly stated. No further explanation was reported.

Leadership Shuffling

Crown Resorts has taken drastic steps to improve its corporate reputation. Numerous high-up officials, from the board room to C-suites, have resigned or been replaced since the Royal Commission Inquiry in NSW was initiated.

The latest, and most significant, is the recent departure of Helen Coonan. Appointed to the Crown board in 2011 after departing the Australian parliament that same year, Coonan became chairperson of the organization in January of 2020.

Coonan, who previously said she was best-suited to help Crown navigate its complex regulatory reviews, announced early this month that she would depart the organization effective August 26. Her notice followed scathing remarks by Ray Finkelstein, who is heading Victoria’s Royal Commission reviewing Crown’s suitability, casting doubt on Crown’s current leadership resolving the most critical issues facing the casino operator.

Dr. Ziggy Switkowski has replaced Coonan as Crown chair. He comes to the gaming operator with an abundance of corporate boardroom experience at numerous publicly listed Australian companies.

Commissioner Finkelstein is set to deliver his suitability verdict by October 15.

Related News Articles

Star Entertainment Shares Plunge on Money Laundering Allegations

Landing International Chairman Suspended Amid Securities Regulator Probe

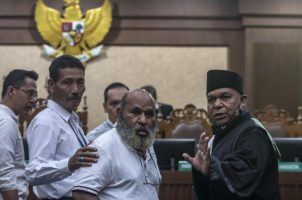

Former Indonesian Governor With Gambling Habit Goes to Prison

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet