Sports Betting Apps: When — and with How Much Force — Will They Hit the US Mobile Market?

Posted on: May 20, 2018, 10:00h.

Last updated on: May 18, 2018, 09:09h.

With last Monday’s US Supreme Court (SCOTUS) decision to strike down PASPA — the law that banned all but four American states from regulating sports betting — many new questions are bubbling up about how the landmark decision could play out in the mobile app market.

According to a story in AppleInsider.com, it’s “possible, though not certain, that the SCOTUS ruling could eventually lead to the floodgates opening on new, sports gambling-related apps in the App Store.”

“Eventually” is the operative word here. The SCOTUS decision does not create a free market for online sports gambling and it certainly does not invite any budding bedroom entrepreneur to build a DIY gambling app and start raking in the big bucks.

Only in Nevada: For Now

The App Store does not restrict apps that provide gambling (as it does those offering pornography or firearm sales), but its terms and conditions are clear that they “must have necessary licensing and permissions in the locations where the App is used” and “must be geo-restricted to those locations.”

Google Play recently changed its policy to allow gambling apps and has similar terms.

Currently, only three states offer legal and licensed online gambling: Nevada, New Jersey and Delaware, although Pennsylvania will soon join the fray, possibly before the end of the year. The only sports betting apps in the App Store currently available to US citizens are restricted to users in Nevada, who are free to download them, but must sign-up in person in an affiliated land-based casino.

New Jersey, Delaware, and Pennsylvania will soon follow suit — as will other states as they enter the legalization process — but that will all take time.

Taking It to the Wire

In 2011, the DOJ offered a legal opinion that the 1961 Wire Act did not prohibit online casino and poker, only sports betting, paving the way for Nevada, New Jersey, and Delaware to regulate those games. But the predicted tsunami of state-by-state regulation in the wake of the decision never materialized.

The legalization of sports betting, however, will offer more incentive to other American states to regulate online gambling, for the simple reality that online sports betting is a bigger earner all around.

But wait. Didn’t we just say the Wire Act prohibits online sports betting? Well, it does, but only interstate sports betting. Betting within state borders is now fine, provided the state in question has licensed the operator.

But also that means that each operator, to comply with the Wire Act, will have to have servers located within the state where it wants to do business, which will be costly for a company with ambitions dominating the US market in as many states as possible.

US to Outstrip UK in Five Years

Meanwhile, digital sports betting providers will be required to partner with existing land-based gambling licensees, which will restrict entrants to the market. Unless the existing Wire Act opinion of 2011 gets sports betting added on, the complex entanglements of legalities will pose some serious challenges to operators who want a national presence.

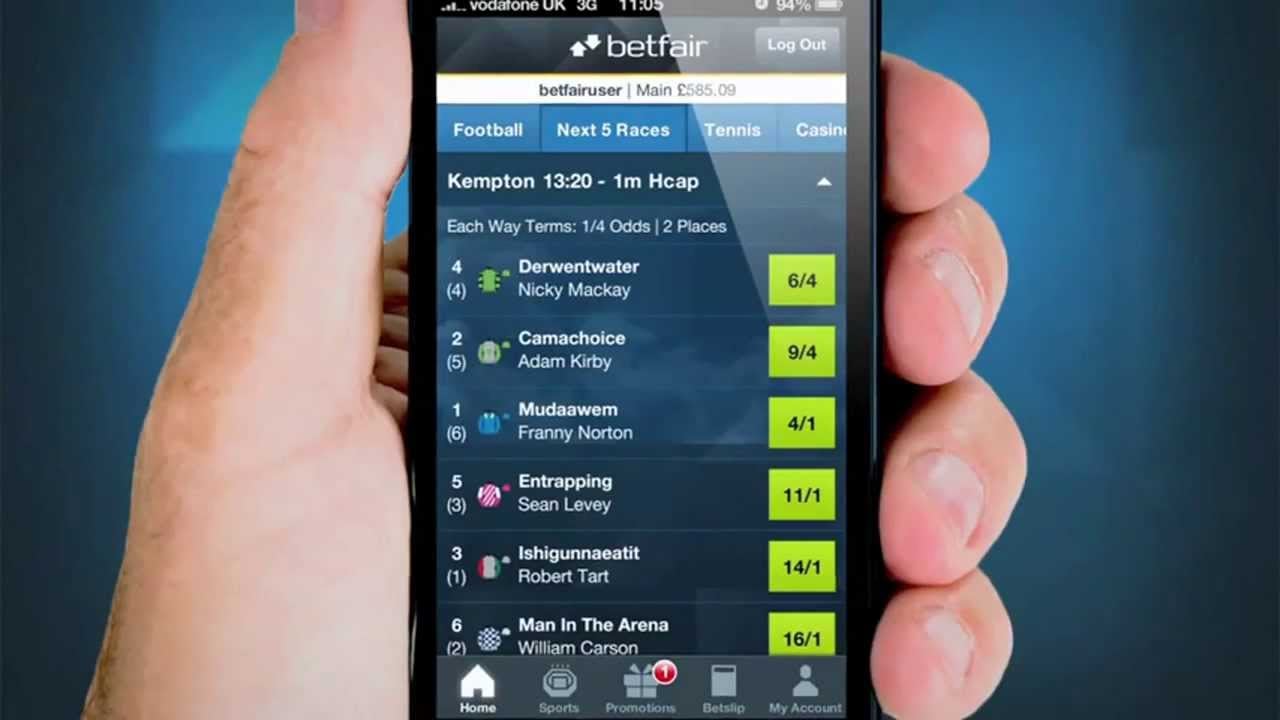

Over time, many states will regulate, of course. Industry data gatherer H2 Gambling Capital predicts 19 states within the next five years, with US sports betting revenues outstripping those of the UK. Currently, Britain is the world’s largest regulated online betting market, with mobile stores loaded with gambling apps. It’s also expected that the majority of future US sports betting transactions will be made online, via apps, rather than in land-based sports books.

But while the UK is a free market to any company that has the means to apply and comply with licensing requirements, the US market will be restricted by a finite number of licenses and political borders.

The floodgates have opened, but they will start with a trickle, rather than a deluge.

Related News Articles

Resorts Atlantic City to Launch Sports Book Wednesday

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

Last Comment ( 1 )

Yes