Universal Accused of ‘Suspicious Activity’ in Legal Rift with Ader SPAC

Posted on: July 31, 2023, 03:54h.

Last updated on: July 31, 2023, 04:37h.

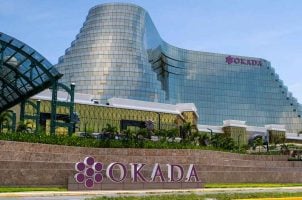

Universal Entertainment, the parent company of the Okada Manila casino resort, may have engaged in dubious activity potentially bordering on bribery in an effort to gain favor among authorities in the Philippines.

That’s according to a pretrial brief filed as part of the ongoing legal spat between the Japanese company and 26 Capital (NASDAQ: ADER), the special purpose acquisition company (SPAC) controlled by Jason Ader that’s attempting to execute a reverse merger with Okada Manila.

Defendants also appear to have engaged in suspicious activity to obtain government assistance to regain control of the casino: a senior Parent executive brought ‘heavy luggage’ to meet with the Speaker of the House of the Philippines— Martin Romualdez (all in breach of the ordinary course covenants),” according to the legal document.

The alleged actions apparently stem from a May 2022 “coup” in which Japanese gaming tycoon Kazuo Okada and some associates took physical control of Okada Manila, in effect breaching parts of the merger agreement with 26 Capital. Last year, the Philippines Supreme Court ordered Universal affiliate Tiger Resort, Leisure & Entertainment, Inc. (TRLEI) to reconfigure its board of directors to its 2017 composition, including a seat for Okada.

Potentially Damning Emails

The pretrial brief contains emails obtained by the SPAC that indicate Universal executives may have attempted to commit graft in the Philippines.

A July 2022 email from Universal CFO Asano Kenshi to board member Hajime Tokuda indicated Mr. Sato was on his way to the Philippines the next day “with heavy luggage.” Presumably, Mr. Sato is Sato Nobuki. Tokuda responded by saying that after the item “arrives safely,” he’d set up a meeting with Martin Romualdez.

26 Capital also alleged that Hans Van Der Sande, the chief financial officer of the operating company, received real-time updates on the goings on through a secret Hotmail account.

“As soon as this ‘Philippine lobbying’ — to use Defendants’ phrase — succeeded, in August 2022, Van Der Sande’s mission became quashing this deal which would bring management reform, potential investigations, and U.S. regulatory scrutiny,” according to the brief.

Earlier this month, Universal and its affiliates attempted to terminate the SPAC merger, alleging “material breaches of the merger agreement and fraudulent conduct by 26 Capital,” and that Ader publicly made misleading statements about the integrated resort.

Universal Attempted More Direct Approach, Claims 26 Capital

Following Okada’s coup attempt at his namesake casino hotel, Universal supposedly employed a more direct approach with Philippine authorities that included the “item” described as “heavy luggage.”

These barely-disguised buzz words were used in top-secret internal emails and discussed only at the very top of UEC,” as noted in the legal document. “Within three days of the ‘item’ being delivered, Parent and Operating Company Director Tokuda (who was also Mr. Van Der Sande’s closest ally at Parent) met directly with Speaker of the House Martin Romualdez.”

During this time, 26 Capital worked to bring the merger across the finish line. By last September, the Philippines Department of Justice and the Philippine Gaming Corporation issued opinions against Okada. Later that month, armed military personnel and police retook control of Okada Manila.

After that, Van Der Sande and Okada Manila President Byron Yip resumed efforts to derail the merger. The duo attempted to leverage the coup and broader weakness in the SPAC arena to convince Universal board members to vote against the combination.

26 Capital and Okada Manila announced merger plans in October 2021, with the agreement valuing the gaming entity at $2.6 billion.

Related News Articles

Okada Manila Attempts to Scrap SPAC Deal as 26 Capital Balks

Chippy Start to 26 Capital, Okada Manila Trial

Okada Manila Notches Legal Win, Court Rules SPAC Deal Can Be Terminated

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet