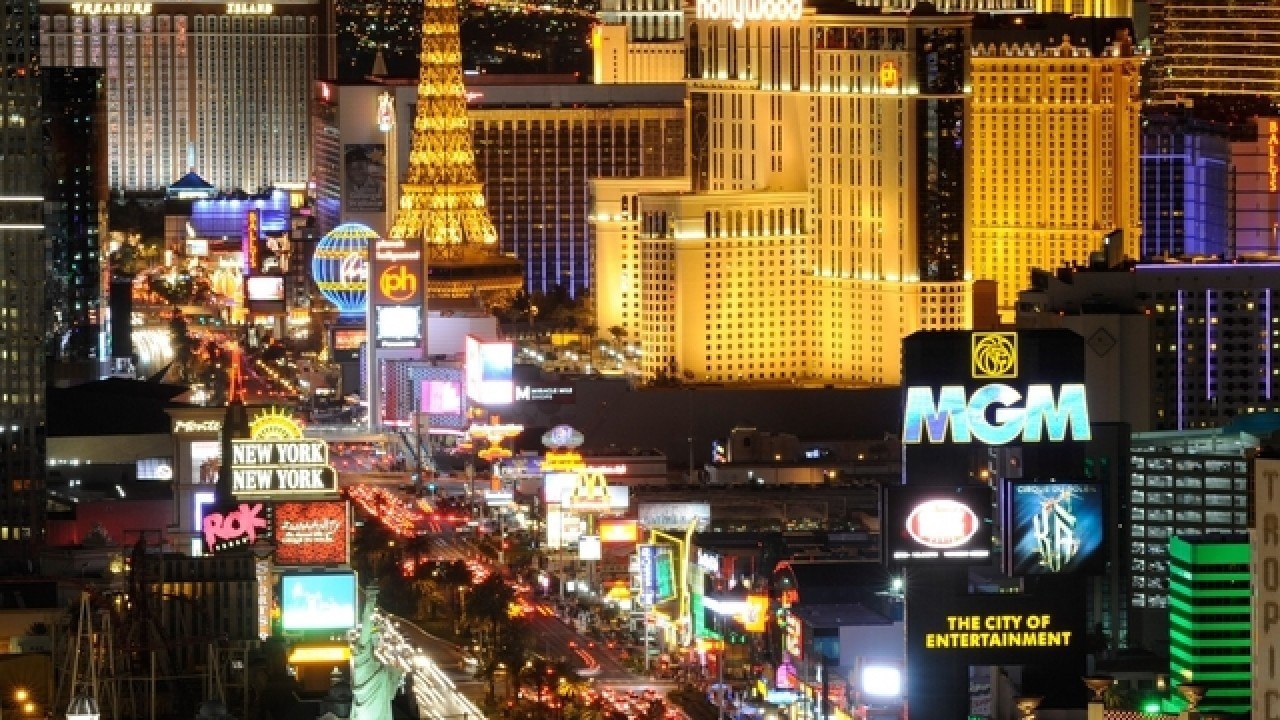

Nevada Resort Association Takes Aim at Casino Tax-Hike Ballot Measure

Posted on: February 5, 2020, 11:13h.

Last updated on: February 5, 2020, 12:08h.

Nevada’s casinos are looking to sabotage a ballot initiative that calls for a major hike on gaming tax.

The Nevada Resort Association (NRA), which represents all the state’s major casinos, filed a lawsuit in Carson City District Court Tuesday that picks holes in the language of the initiative in a bid to delay or derail it.

The ballot petition — spearheaded by the Clark Country Education Association (CCEA), a teachers’ union — proposes raising taxes for casinos by 3 percent, which would result in a projected increase to state revenue of $350 million a year.

The union has filed a separate ballot initiative that would increase statewide Local School Support Tax (LSST) by 1.5 percent. It hopes the two motions will together create around $1.4 billion to boost Nevada’s underfunded K-12 education system and other state programs.

Nevada’s casino taxes are the lowest in the land outside of Indian country — a 6.75 percent tax on gross gaming revenues, which is a 7.75 percent effective tax with the addition of fees. The casino sector is the state’s economic engine, and has historically been protected by the legislature. But will the public think differently if the initiative hits the ballot?

The NRA is hoping we don’t get to find out.

Legal Uncertainty

The industry body argues in its complaint that the petition contains inaccuracies in its “Description of Effect,” the blurb that describes what the measure aims to achieve and tells voters what they’re voting for.

The complaint notes that the CCEA gives the wrong date on which the proposed law would take effect and doesn’t explain that the money from the new taxes would go into the state’s general fund and not directly to schools. Lawmakers would have “no duty to use any of this money for education,” it claims.

Whether by design or oversight, these errors could “mislead voters” and “create legal uncertainty related to implementation” further down the line, reads the complaint.

Supporters of the initiative have until November to gather roughly 98,000 signatures. If successful, the question would first be sent to the legislature. If lawmakers fail to pass the measure the vote would go to the public.

Bottom of the Pile

Nevada has consistently been at the bottom or near the bottom of public education rankings. In 2019, it was 50th out of 50 states and the District of Columbia, outranking only New Mexico.

In a statement, the NRA said it was not against raising taxes across the board to support education, but draws the line at targeting a single industry.

“To be very clear, the gaming industry has consistently supported a broad-based business tax to support public education, and has a long history of investing in Nevada’s classrooms,” reads the statement.

“Broad-based taxes are a sound and stable approach, rather than the volatility that comes with taxing a single industry,” it continues. “We look forward to working with the governor, legislative leaders and other stakeholders to improve education.”

Related News Articles

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet