Minnesota Charitable Games Charitable to State Coffers, Not Actual Nonprofits

Posted on: February 20, 2017, 03:00h.

Last updated on: February 20, 2017, 05:53h.

Minnesota charitable games are used by roughly 1,200 nonprofits across the Gopher State as a way to grow revenue for the missions of their respective organizations.

But the latest fiscal report on the legalized gambling sector shows that state tax coffers are getting rich, while the actual groups themselves are barely pulling in more money than they deliver to St. Paul.

The Star Tribune, the largest circulated newspaper in Minnesota, published a story this week showing that nonprofits paid $60.6 million in state taxes last year, while spending $62 million on their charitable work. And while overall the nonprofits engaged in charitable games still came out on top, that wasn’t the case for some groups.

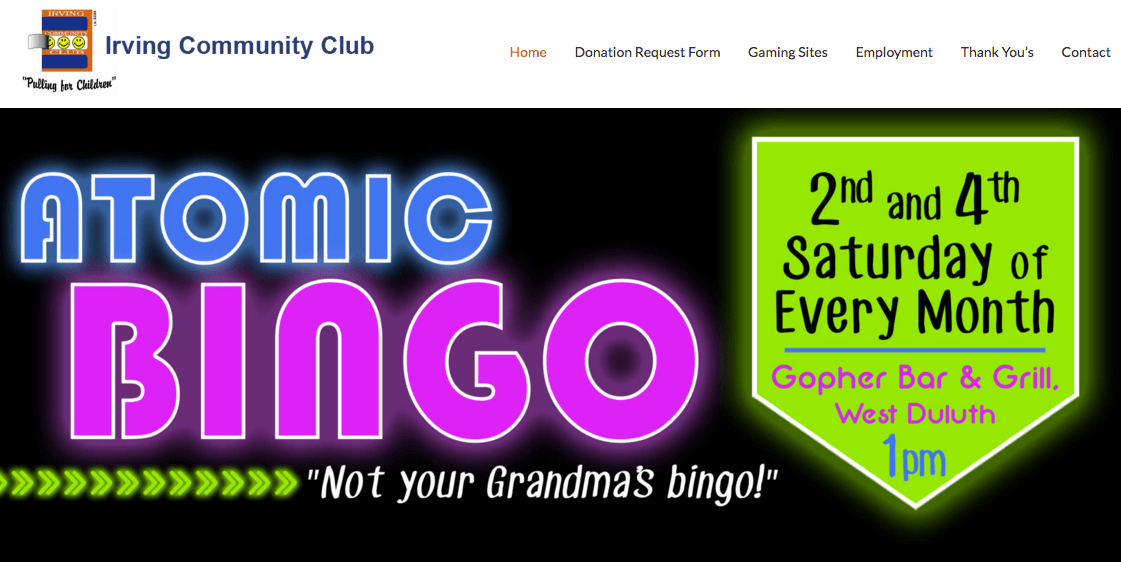

For example, the Irving Community Association was on the hook for $733,000 in state taxes i n2016. But the 501(c)(3) group that supports youth organizations around the Duluth area spent just $306,000 on actual mission programs.

Tax rates vary depending on an organization’s total gambling revenue and which games they offer. Groups pay between 8.5 and 36 percent of their gross receipts on games like pull-tabs and electronic bingo to the state.

Some observers blame the nonprofits for having too much overhead, while others say taxing a charity as much as 36 percent is downright shameful.

Making US Bank

Most nonprofit 501(c)(3) organizations are exempt from paying taxes. The exception is that charities must share their gambling revenues with the state.

The tax structure was last modified in 2012 when lawmakers decided to earmark Minnesota charitable games revenue to help build the $1.1 billion US Bank Stadium. The 66,600-seat NFL football venue is the home of the Minnesota Vikings.

Gaming revenue was targeted in the stadium bill that was eventually passed.

The charitable gambling law was expanded to authorize new types of electronic gambling including bingo and pull-tabs. A new tax was also levied on all tip-boards, which are basically self-contained raffle games that are also known as punchboards.

The first $37 million in gaming taxes collected each year goes to the general fund, which helps cover the state’s nearly $350 million pledge to the stadium financing.

A group of lawmakers in the Minnesota House have introduced legislation that would lessen a charity’s gaming tax burden. Revenues that are directly used for nonprofit work would become duty-free, but gambling money that supports operational expenses would remain taxed.

Cuomo Gets Charitable

New York Governor Andrew Cuomo (D) has now been in office for six years, and during his tenure gambling has expanded greatly in the Empire State. The lottery has grown, daily fantasy sports are legal, land-based casinos are enlarging, and the state is considering online casinos.

That’s all hurt charitable gaming in New York. Last fall, Cuomo vetoed legislation approved by the state legislature that would have allowed nonprofits to sell raffle tickets online.

However, Cuomo is now apparently ready to throw a bone to philanthropic organizations.

In the governor’s latest budget, he calls for the legislature to amend charitable gaming laws to allow groups to offer bigger prize payouts. The statute also would ease restrictions on how charities can advertise their gambling, permit alcohol to be among the prizes up for grabs, and authorize raffles and games of chance tickets to be sold via credit and debit cards.

Related News Articles

David Baazov’s Lawyer Grills AMF, Claims Regulator’s Case Is Full of Holes

MGM Japan to Open in 2025, CEO Jim Murren Hints

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet