Minnesota Charitable Gambling Delivers More Money to Government Than Nonprofits

Posted on: August 15, 2017, 03:00h.

Last updated on: August 15, 2017, 02:31h.

Revenue from charitable gambling in Minnesota is growing for a seventh consecutive year, but associated taxes and fees might cost more than what’s ultimately left for the nonprofit beneficiaries.

Revenues from charitable gambling in Minnesota are on pace to eclipse the $1.7 billion risked in the state on bingo, pull tabs, raffles, tip boards, and paddlewheels in 2017. But a sliding tax scale that rises as gross revenue increases, not accounting for payouts first, might end up taking more of the net earnings than what the goes to charities.

According to the Star Tribune, about $1.45 billion of last year’s total take was paid out in prizes. That left $277 million. But of that, only $64.3 million went to charities. The rest covered operating costs, taxes, and fees.

“We are now tax collectors for the state instead of workers for our communities,” Allied Charities of Minnesota Executive Director Al Lund said.

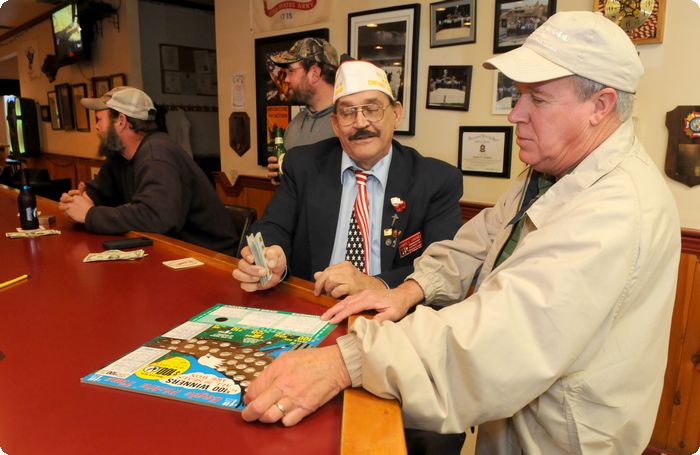

Registered fraternal, religious, veteran, and “other nonprofit groups” are eligible to conduct charitable gaming in Minnesota. The state bans commercial gambling, but does have compacts allowing for tribal casinos.

Charity Tax

Minnesota authorized charitable gambling in 1945, to raise money for churches and community needs. But in 1984, the state legislature took regulatory control from local governments, forming the Charitable Gambling Control Board.

The agency assured that all organizations conducting gambling were properly permitted, and also were required to give 10 percent of net revenue (after prizes were paid) with the state.

That changed in 2012 when legislators decided to dip their hand further into charity gambling cookie jar. Seeking a way to help cover the state’s $348 million commitment to build a new NFL stadium for the Minnesota Vikings, the board changed the tax rate to a progressive variety that now reaches as high as 36 percent.

Fundraising organizations report the problem is that charity gambling sales were up 12 percent in the last fiscal year, but taxes went up 16 percent. Operators say that as wagering activity increases, the taxes are cutting too heavily into their charitable contributions. Efforts to reduce the revised gaming tax in St. Paul, the capital, have failed.

‘Charitable Gaming in Minnesota Dead at 72’

The Irving Community Club, which serves young organizations and kids in need, facilitates charitable gambling operations at 19 bars in the Duluth area. Of the group’s $1 million net revenue in 2017, $733,000 went to the state or was used for overhead, with just $306,000 utilized for charitable programs.

“It’s really sad. The government is that greedy that they take away from the children,” Irving Community Club Gaming Manager Genny Hinnenkamp told the Duluth News Tribune last month.

Now Lund’s Allied Charities group is challenging the legislature, saying the organizations under his umbrella might just suspend gambling operations if the state can’t stop poaching from the charities in need.

In July, his group published a mock obituary on the organization’s website, titled “Charitable Gaming in Minnesota Dead at 72.”

“Details are not yet fully in, but indications are that on June 30, 2017, charitable gaming in Minnesota crossed the Rubicon,” the satirical article says. “Charitable gaming will now be known as The State of Minnesota Charity … In lieu of flowers, relatives ask that you not send any money to the state.”

Related News Articles

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet