Massachusetts Commercial Casino Industry Likely Set Following Mashpee Tribal Ruling

Posted on: December 24, 2021, 09:57h.

Last updated on: December 24, 2021, 10:10h.

Massachusetts legalized commercial casino gambling in November of 2011, when then-Gov. Deval Patrick (D) signed the state’s Expanded Gaming Act.

The package authorized a slots parlor and as many as three large integrated resort casinos across the commonwealth. Today, Massachusetts is home to two full-scale Category 1 resort casinos — MGM Springfield and Encore Boston Harbor. Plainridge Park represents the slots-only Category 2 facility.

The Massachusetts Gaming Commission (MGC) still possesses a third and final Category 1 license. The unissued permit is only available for the state’s Region C, consisting of the counties of Bristol, Plymouth, Nantucket, Dukes, and Barnstable.

More than a decade since the Region C casino concession was authorized, the state has yet to award the permit because of lingering concerns that a Native American tribe might build a $1 billion resort in Bristol’s Taunton. That possibility increased this week, after the US Department of the Interior (DOI) finalized a years-long drawn-out legal battle. That ruling concluded the Mashpee Wampanoag Tribe indeed possesses the federal rights to claim sovereignty on 321 acres of land in Taunton and Mashpee.

Market Unattractive

The DOI ruling that the Mashpee Wampanoag Tribe land will stay in the federal trust means the Native American group can operate Class II bingo-based gaming on the sovereign land. The tribe can also pursue slot machines and table game authorization by way of reaching a Class III gaming compact with the state.

The Mashpee Tribe has long been associated with Genting Group. The multibillion-dollar conglomerate in Malaysia controls several US casinos, including Resorts World properties in New York City and Las Vegas.

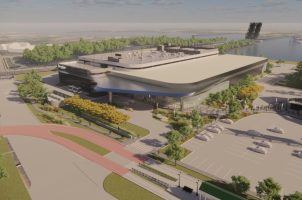

If the Mashpees and state can come to Class III terms, which would be a first in the state, the tribe and Genting’s proposed $1 billion First Light Resort & Casino would be cleared for development. That would likely render the Region C commercial casino license unattractive.

Massachusetts’ gaming lax requires that each Category 1 licensee invest a minimum of $500 million, plus pay a one-time $85 million licensing fee.

In addition to First Light, Region C is adjacent to Rhode Island’s two commercial casinos — Bally’s Twin River Lincoln and Bally’s Tiverton. Those casinos offer slot machines and table games, as well as sports betting. Massachusetts lawmakers again adjourned their 2021 legislative session without passing a sports betting bill.

There is speculation that a casino in this C region is not viable due to oversaturation of the market because the region is located in close proximity to Rhode Island, which has its own casinos,” opined state Rep. Carol Doherty (D-Bristol). “The uncertainty around the status of the tribal casino in Taunton adds to the complexity of a Region C license.”

Compact Considerations

The Mashpee Wampanoag Tribe is one of only two federally recognized tribes in Massachusetts. Since the state doesn’t currently have a tribal casino, the Mashpees and state would be embarking on fertile discussions regarding Class III gaming negotiations.

Most states that enter into Class III gaming compacts with their federally recognized tribes demand some sort of revenue share from the expanded gaming privileges. That money is often used to offset state regulatory costs.

In neighboring Connecticut, which was one of the first states to reach gaming compacts with its tribes, the Foxwoods and Mohegan Sun casinos direct 25 percent of their gross revenue from slots to the state. They do not share any income from table operations.

Related News Articles

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments -

Chicago Pension Mess Highlights Need for Bally’s Casino

— July 2, 2024 — 5 Comments

No comments yet