Macau Casinos Account for 77% of Government Taxes in 2023

Posted on: March 4, 2024, 12:48h.

Last updated on: March 4, 2024, 01:01h.

Macau casinos last year remained the Chinese Special Administrative Region’s (SAR) primary tax source.

Macau’s Financial Services Bureau disclosed over the weekend that the six commercial casino operators generated taxes in excess of MOP65.25 billion (US$8.1 billion) in 2023. Macau casinos generated gross gaming revenue (GGR) of approximately $22.7 billion last year, a 334% year-over-year rebound.

The benefit exceeded government expectations, which forecasted $6.31 billion in gaming tax receipts.

The casino market continues to be Macau’s economic heartbeat despite vast changes to the gaming industry during the COVID-19 pandemic, most significantly the departure of most junket groups that had attended to VIPs and high rollers.

Macau’s resorts are subsequently refocusing their marketing toward more of the mass market and investing heavily in nongaming attractions.

Tax Rebound

2023 marked Macau’s COVID recovery after China President Xi Jinping ended “zero-COVID” in late 2022. Casinos welcomed back players and battled for the premium mass segment.

Gaming taxes soared 240% from $2.4 billion in 2022. Macau’s casino share in 2021 was $4.2 billion and $3.7 billion in 2020. The enclave’s gaming tax benefit in 2019 was upwards of $13 billion when the resorts won about $36.5 billion.

Macau taxes its six casino concessions at an effective rate of 40%. Only 35%, however, goes to the government for general spending. The $8.1 billion in gaming taxes includes additional fees like concession costs and per table and slot machine annual duties.

A 3% tax on the GGR is used to fund urban development, tourism promotion, and social security, with the other 2% going to the Macau Foundation. The charitable arm of the SAR government uses its funds to support cultural, social, economic, educational, scientific, academic, and philanthropic activities across the region. The foundation also promotes Macau as a leisure and business epicenter.

SJM Resorts, which held a monopoly on casino gambling in Macau until the SAR was handed to China around the turn of the century and new concessions were approved, had previously been afforded a 1% tax break, but that exemption was axed during the 2022 relicensing.

The Macau SAR Government reported that gaming taxes accounted for 77% of its 2023 revenue. The city disclosed total revenue of $10.47 billion.

After casinos, the government’s greatest source of income was personal income taxes of $1.42 billion.

Looking Ahead

Macau officials are projecting a further rebound for its casino industry in 2024. The SAR has budgeted gaming tax revenue of $10.4 billion.

GGR in January 2024 was up 67% year over year to $2.4 billion. February climbed 79% from February 2023 to $2.29 billion.

The Macau government expects GGR to reach MOP216 billion (US$26.8 billion) this year, with the number of visitors forecasted to grow to 33 million people.

Macau’s six gaming permit holders – Sands, Galaxy, MGM, Wynn, Melco, and SJM – are investing $18 billion, as dictated through their 2022 casino tenders, into nongaming projects. The goal is to make Macau appealing to more travelers who might not necessarily fancy gambling for hours on end.

The casinos are allocating the nongaming money into an array of developments, including family-friendly lures like waterparks, entertainment events like movie premiers, cultural engagements, art, live music, and sports.

Related News Articles

Macau to Soon Announce Casino Tender Winners, Current Six Operators Favored

Macau Casinos Begin 2023 Strong, January Gaming Win Highest in Three Years

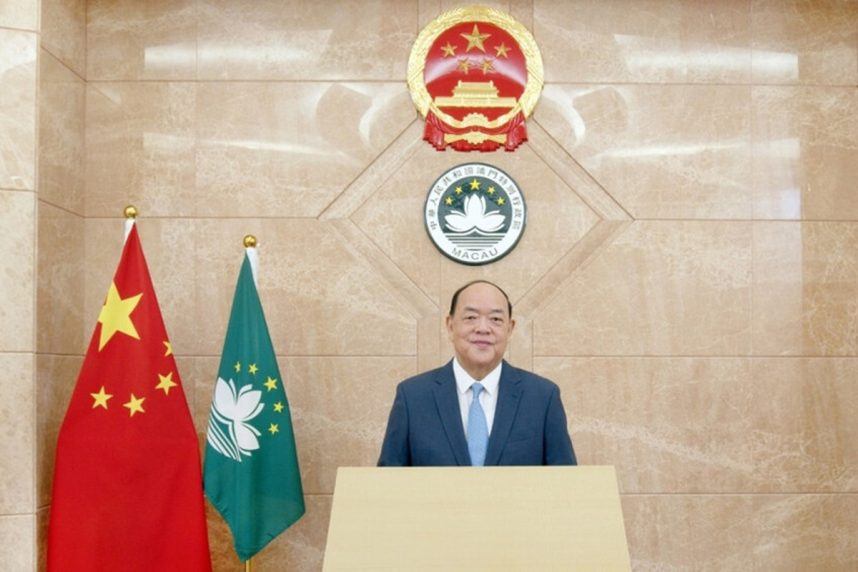

Macau Chief Executive Ho Iat Seng ‘Confident’ Regarding Local Casino Industry

Macau Casinos Win $2.4B, Government Claims Gaming Crimes Down

Most Popular

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

NoMad Hotel to Check Out of Park MGM on Las Vegas Strip

Most Commented

-

End of the Line for Las Vegas Monorail

— April 5, 2024 — 90 Comments -

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

— April 16, 2024 — 9 Comments -

Sinclair Broadcast Group Selling 7.91 Million Bally’s Shares

— April 12, 2024 — 5 Comments

No comments yet