Gold Rush Keeps License As Illinois Gaming Board Finds No Proof of Inducement

Posted on: April 21, 2021, 10:44h.

Last updated on: April 22, 2021, 10:38h.

One of the largest video gaming operators in Illinois will not lose its license. That’s after regulators in that state determined Wednesday its owner did not offer a bribe to a then-owner of a gaming café chain.

The decision by the Illinois Gaming Board ends a year-and-a-half investigation into Gold Rush Amusements. It approved a settlement that includes the company agreeing to pay $45,000 to cover the board’s costs tied to the investigation.

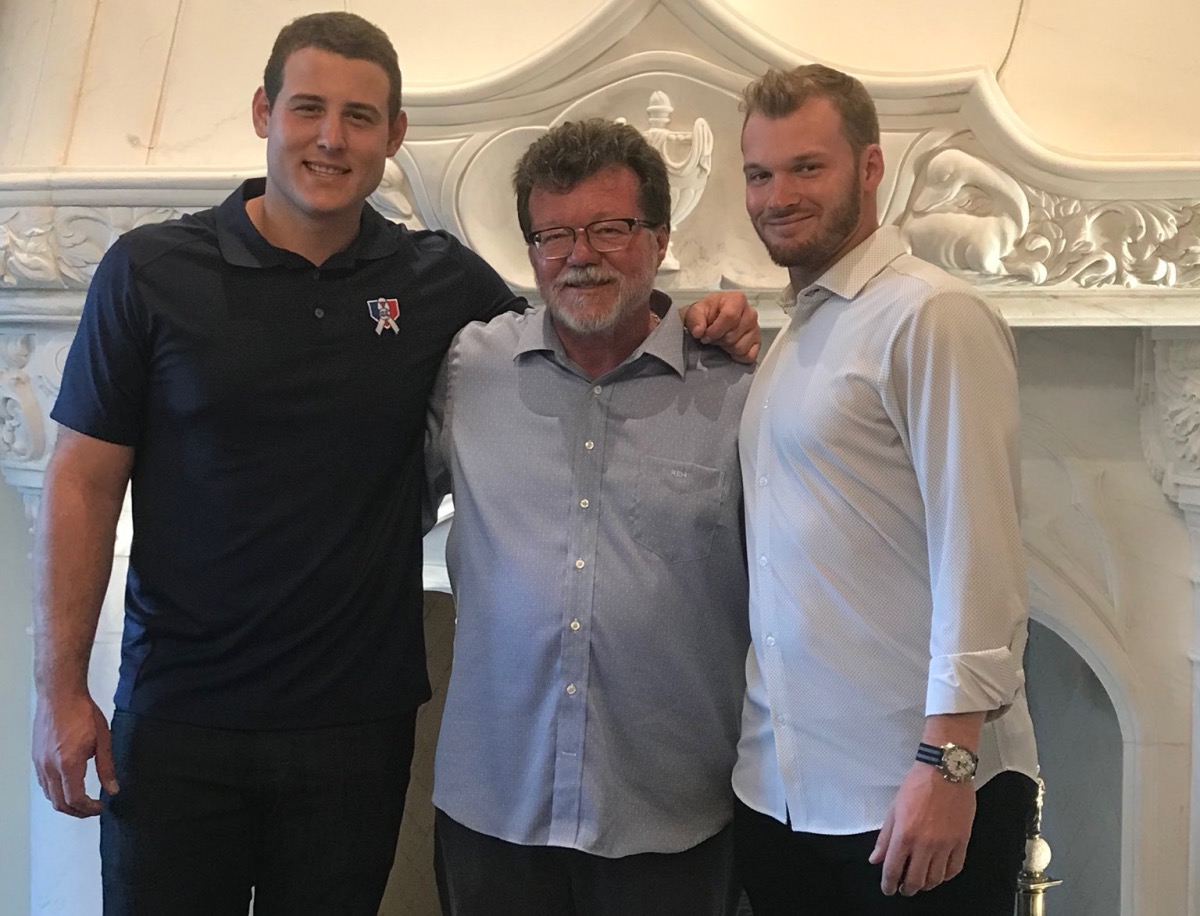

In a statement, Gold Rush founder and Secretary Rick Heidner expressed relief the investigation was over.

After 18 months of denying false accusations from adversaries and fighting to protect my business, my family, and my reputation, I’m grateful that the IGB closely reviewed and considered the facts and evidence demonstrating that I did not offer an illegal inducement, as the disciplinary complaint alleged,” he said.

In addition, the company will pay a $30,000 fine for what the IGB said was Heidner’s “unprofessional conduct” in text messages sent in July 2019.

The statement said the texts were not tied to the initial complaint.

IGB: ‘No Evidence’ Against Heidner

The case dates back to nearly three years ago when Laredo Hospitality Services was bought out by Illinois Café and Service Company (ICSC). At the time, Gold Rush provided terminals to 44 of Laredo’s more than 60 cafes. However, with the sale, it was being forced out so another terminal operator could handle those locations.

The allegation of the illegal inducement stemmed from a conversation Heidner had with ICSC’s Dan Fischer. During that talk, according to IGB records, Heidner said he could try to put a group together to buy the Laredo cafes for $5 million more than ICSC did, but Fischer declined.

“There is no evidence that Mr. Heidner took any action to attempt to put together a group of investors,” the IGB agreement stated. “Rather, Mr. Heidner contends that he engaged Mr. Fischer on Nov. 28 for the primary purpose of attempting to elicit financial details regarding the November 2018 transaction.”

As part of the settlement, both Heidner and Gold Rush agreed to dismiss their lawsuits against the IGB related to the investigation, and the Board renewed Gold Rush’s operator’s license retroactively to February 2021. Heidner sued last year, claiming an IGB employee leaked his personal and financial information to federal investigators.

Other Related Lawsuits Ongoing

While the lawsuit between Gold Rush and the state board is over, suits between Gold Rush and ICSC and Midwest SRO continue.

In January 2019, the Laredo cafes that ICSC bought filed suit against Gold Rush, claiming Gold Rush failed to adhere to the termination notice.

Gold Rush later countersued and claims that Midwest SRO, another terminal operator, paid Laredo $44.5 million, while ICSC paid Laredo just $2 million for the 63 cafes. The intent was for Laredo to replace Gold Rush machines with Midwest SRO’s.

Illinois gaming laws prohibit machine operators, like Gold Rush and Midwest SRO, from owning cafes.

The Gold Rush statement said the IGB continues to review the ICSC-Laredo transaction.

“(W)e encourage the IGB to continue to invest the resources necessary to conclude its ongoing investigation and provide the industry with direction on issues that will influence future transactions and relationships,” said Paul T. Jenson, an attorney representing Gold Rush and Heidner, in the Gold Rush statement.

Order Against Gold Rush Executive Repealed

In addition, the IGB also canceled a separate order from February 2020 that called for Ronald Bolger, Gold Rush’s director of operations, to divest from the company. That’s after it was alleged he had a “close personal relationship” with Dennis Greco and “socialized” with Michael Lupo.

The board said those associations posed a threat to public gaming interests. However, Bolger said he did not have any relationship, financial or otherwise, with either individual, aside from occasional meals with Greco.

As part of that settlement, Bolger agreed to refrain from any future financial or any other relationship with either Greco or Lupo.

Related News Articles

Nebraska Lottery Won’t Pay Out on 405 Misprinted Scratch-Off Tickets

Ameristar Casino Banned Gambler Cannot Collect Jackpot in Iowa

Nevada Law Professors Grade New Rules to Prevent Harassment at Casinos

Most Popular

LOST VEGAS: ‘Tony The Ant’ Spilotro’s Circus Circus Gift Shop

Las Vegas Overstated F1 Race’s Vegas Impact — Report

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

Las Vegas Strip Stabbing Near The Strat Leaves One Man Dead

Most Commented

-

End of the Line for Las Vegas Monorail

— April 5, 2024 — 90 Comments -

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

— April 16, 2024 — 8 Comments -

Long Island Casino Opponents Love New York Licensing Delays

— March 27, 2024 — 5 Comments -

Smart Video Poker Players Hamper Casino Profits, Says Study

— March 21, 2024 — 4 Comments

No comments yet