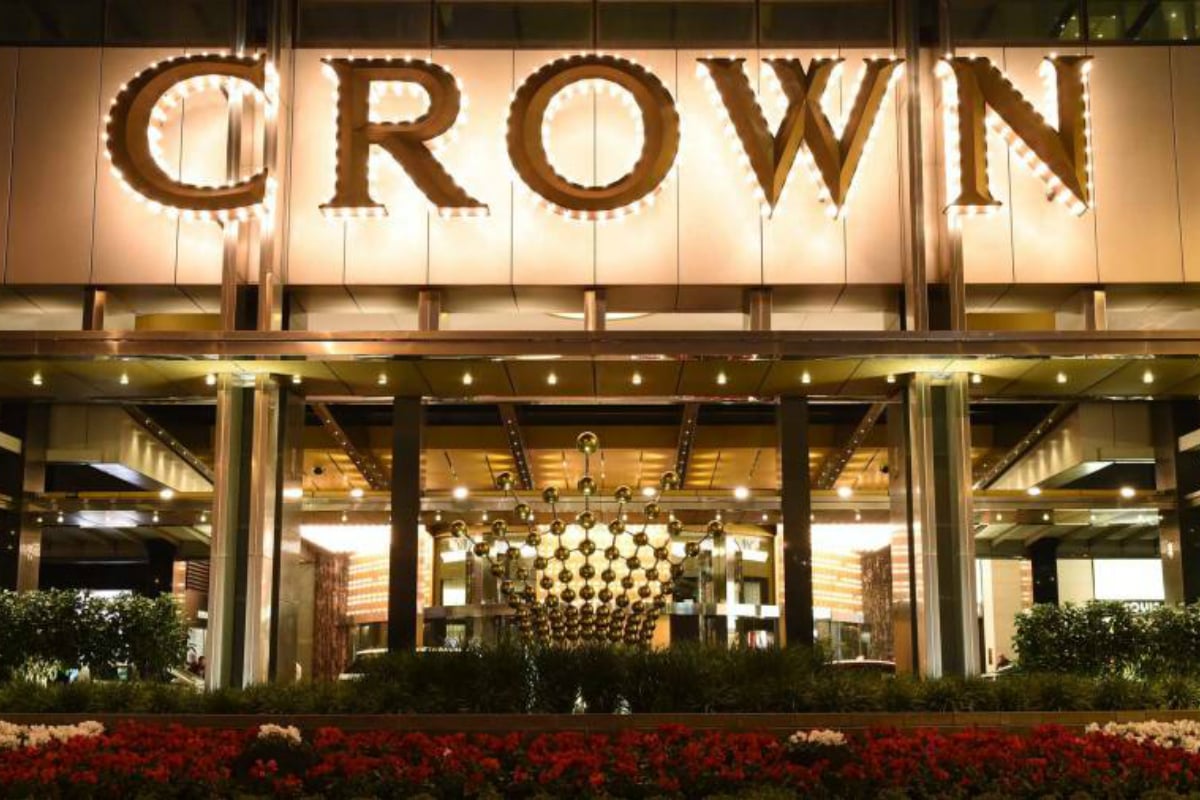

Crown Resorts Appoints Financial Crimes Officer, as Company Tries to Win Over Sydney Regulators

Posted on: December 2, 2020, 12:05h.

Last updated on: December 2, 2020, 02:38h.

Crown Resorts announced today the appointment of the Australian casino operator’s first chief compliance and financial crimes officer.

Steven Blackburn has agreed to join the casino group. He is currently the chief financial crime risk officer and group money laundering reporting officer at National Australia Bank (NAB).

Crown is amid a period of intense uncertainty, as the fate of its $1.6 billion integrated resort casino in Sydney is in the hands of state officials in New South Wales (NSW). Crown CEO Ken Barton said the appointment will further address anti-money laundering policies in the company.

Helen Coonan, chair of the Crown Resorts Board of Directors, added that Blackburn’s hiring is yet another commitment to overseeing improvements across all areas of compliance.

Crown’s Radical Overhaul

Crown Resorts planned to open Crown Sydney this year. The VIP casino, hotel, entertainment, and residential complex is highlighted by its 75-story tower, the tallest structure in all of Sydney. Crown Sydney is fully completed and ready to open its doors, but officials in New South Wales have put it on hold.

The Independent Liquor and Gaming Authority (ILGA) launched a casino inquiry into Crown’s suitability to hold a gaming license in August of 2019. After numerous hearings, the inquiry concluded its hearings in October, and former NSW Supreme Court Judge Patricia Bergin, who heads the investigation panel, is set to issue a verdict sometime in February 2021.

NSW is determining whether the Crown’s self-admitted shortcomings in preventing its casinos in Australia from being used by criminals to launder money and other regulatory deficiencies warrant revocation of its Sydney operating permit. There are numerous allegations, among them failing to prevent money laundering and that Crown casinos have ties to triad-linked junket groups throughout Asia.

In an effort to ease such concerns among NSW officials, Crown has overhauled its corporate leadership. Coonan replaced former Crown Executive Chair John Alexander, and Deputy Chairman John Horvath is set to resign.

Blackburn is arriving at Crown to head the company’s newly formed Compliance and Financial Crimes Department. He will report directly to Barton and the Crown board.

Billions at Stake

Bergin’s decision whether to allow Crown Resorts to retain its Sydney gaming rights comes with great consequences, perhaps unlike anything the global gaming industry has ever seen.

If Crown is deemed unsuitable, chaos would result in Crown’s finances, as it invested $1.6 billion in a project that it cannot operate. An unsuitability verdict would likely result in legal challenges, and that would extend to contractual language between Crown and NSW that requires the Australian state to compensate the company “by up to 10.5 times the negative financial impact” caused by any revision to its gaming rights.

An unsuitable ruling could fuel more rumors regarding a potential acquisition of Crown.

Blackstone owns a 10 percent stake in Crown, as well as the physical assets of Las Vegas’ MGM Grand, Bellagio, Mandalay Bay, and Cosmopolitan. It is one of the largest private equity firms in the world. It is said to be mulling a full takeover of the Australian casino group.

Related News Articles

SJM Resorts Relocating VIP Baccarat Tables to Grand Lisboa Palace

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet