China Testing State-Backed Cryptocurrency with Digital Cash Lotteries

Posted on: January 6, 2021, 07:50h.

Last updated on: January 6, 2021, 11:04h.

China is using lotteries to test its new digital currency, DCEP (Digital Currency Electronic Payment). According to a notice from the government of Shenzhen, the city is preparing this week to conduct its second lottery to pay out prizes exclusively in the new currency, following a successful debut draw last October.

The People’s Bank of China (PBoC) announced the creation of DCEP in November last year. DCEP is the world’s first state-backed cryptocurrency. It has prompted concern in the West that Beijing is exploring the creation of a completely cashless society, upon which it can exert greater control.

Mu Changchun, head of the PoBC’s digital currency research institute, has said DCEP is not about control. But he added that it will help authorities to monitor money movements related to organized crime, tax evasion, and online gambling. The government is waging a longstanding war against gaming sites that target its citizens.

Red Letter Days

China’s state-run lotteries provide the only opportunities to gamble legally on the mainland. They comprise the Welfare Lottery, a traditional lottery draw, as well as sports lotteries. In sports lotteries, participants are invited to predict the outcomes of a series of games, usually domestic and international soccer matches.

According to Coin Geek, the latest lottery is set to double the prize pool to $3 million, which will be distributed to citizens in 100,000 “red packets” of $30 each. Winners will be able to spend the DCEP at more than 10,000 participating stores.

The news coincides with the launch of the first trials of the currency in Beijing. Beginning December 29, the PoB has partnered with hundreds of local businesses, enabling them to accept the digital currency. Customers are now able to scan a payment QR code to pay for their goods.

Junket Fear

The concept of a cashless China has been met with anxiety in Macau. The world’s biggest casino market relies on the inflow of money from mainland China, which Beijing has long sought to minimize in its battle against capital flight.

A traceable, central government-linked currency could severely disrupt the gambling hub’s economy. It could make it much tougher for visitors to swerve strict government caps on the amount of cash that can be legally brought from the mainland.

It would destroy the junket industry, which casinos rely on to bring in high rollers and lend them huge sums so they can gamble during their trips.

As one junket operator told Bloomberg last month: “If the water is too clean, there’ll be no fish. The big gamblers will go away if casinos need to be that transparent.”

Related News Articles

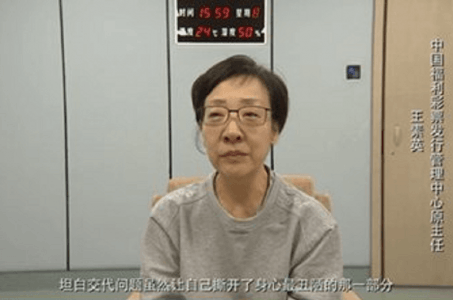

Top Chinese Lottery Officials Paraded After Possible $20 Billion Embezzlement

Nebraska Lottery Won’t Pay Out on 405 Misprinted Scratch-Off Tickets

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments -

Chicago Pension Mess Highlights Need for Bally’s Casino

— July 2, 2024 — 5 Comments

No comments yet