Alabama Casino, Lottery Package Clears State House

Posted on: February 15, 2024, 10:12h.

Last updated on: February 15, 2024, 01:22h.

Update: The Alabama House of Representatives this afternoon passed the casino/lottery referendum bill with the needed three-fifths supermajority support. The gaming package now moves to the state Senate.

Legislation in Alabama to legalize commercial casinos and a state-run lottery cleared the House Economic Development and Tourism Committee on Wednesday. The committee vote moves the gaming expansion package to the full House of Representatives floor for a vote.

House Bill 151 and 152 have been paired together.

HB 151 proposes asking Alabamians this November about amending the state constitution to allow lottery games and Las Vegas-style casino games like slot machines, table games, and sports betting. State residents haven’t been asked to weigh in on expanded gaming since they last rejected the formation of a lottery in 1999.

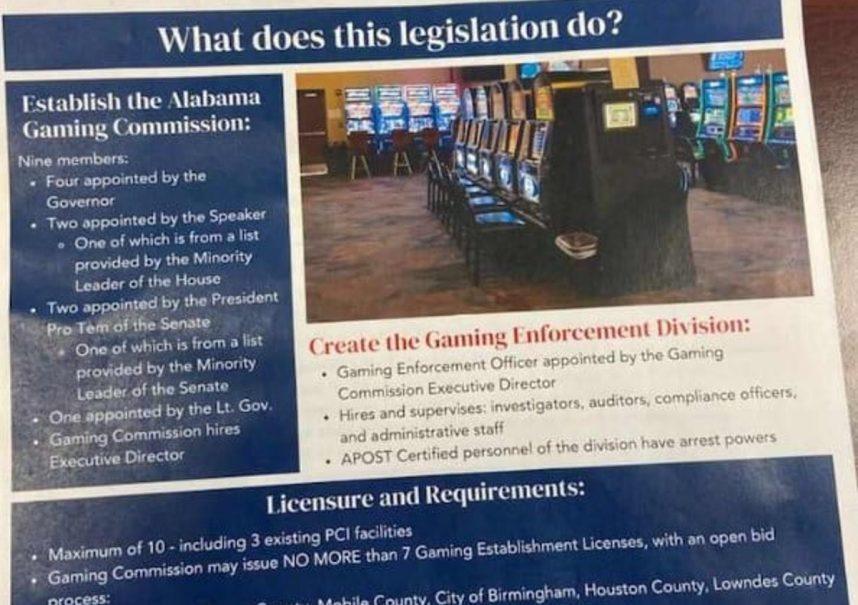

HB 152 would establish the Alabama Gaming Commission and give the nine-member agency regulatory authority over commercial gaming. The bill also defines casino licensing minimums and proposes tax rates on gross gaming revenues to be paid by licensees.

Since HB 151 seeks to initiate a statewide ballot referendum, the bill requires supermajority support in each chamber of the legislature. In the House, 63 votes in the 105-person House are needed, while 21 votes are required in the 34-person Senate.

Tide Turning?

Alabama lawmakers have historically opposed efforts to expand gaming in the Bible Belt state. But with recent polling suggesting that residents are ready to be asked again on a lottery and casino gaming, more lawmakers in Montgomery are getting behind the push.

In my opinion, this is the best piece of legislation put forward in a very long time to give the people the right to vote on if this is something they want in Alabama,” said Rep. Chris Blackshear (R-Phenix City), one of the gaming bills’ primary sponsors.

If it passes both chambers and fields a simple majority vote outcome in November, HB 151 would authorize up to seven commercial brick-and-mortar casinos. Permissible locations would include Greene, Houston, Lowndes, Macon, and Mobile counties, plus the City of Birmingham. The seventh commercial license would be reserved for the Poarch Band of Creek Indians in the northern part of the state.

The state would conduct a competitive bid for the six opportunities, and preference would be given to companies and stakeholders that have worked with the state’s former greyhound racetracks or done business elsewhere in the Cotton State.

Each commercial casino license would cost $5 million. License holders must invest at least $35 million into their facility before the gaming license becomes active. The statute proposes a 24% state tax on slot and table win and 17% on sports hold.

The amendment would encourage the governor to negotiate a Class III gaming compact with the Poarch Indians to transform their three bingo-based casinos into Las Vegas-style casinos. The Wind Creek properties in Atmore, Montgomery, and Wetumpka currently offer electronic bingo-based machines.

Tax Allocations

HB 152 provides a tax framework for where the casino and sports betting money would go.

The statute suggests sending 95% of the slot and table revenue to a newly established Gaming Trust Fund. Three percent would stay with the casino’s host county, with at least 15% of that money required to go to nonprofit organizations. The remaining 2% would be allocated to the casino’s host municipality.

Of the sports tax, 90% would go to the Gaming Trust Fund, with the remaining 10% distributed to host counties for law enforcement purposes.

“Once operational, receipts in the Gaming Trust Fund shall be appropriated by the Legislature in an independent supplemental bill for non-recurring, non-education purposes,” HB 152’s Fiscal Note explained.

Related News Articles

Alabama House Speaker Supportive of Gaming Bill to Protect Consumers

Alabama Governor Urges Lawmakers to Legalize Casinos, State Lottery

Alabama Tribal Casino Bill to Include Sports Betting, State-Run Lottery

Alabama Casino and Lottery Bill to be Introduced Next Week

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet