SJM Holdings Puts Its Money on Cotai Casino Reversing Downward Spiral of Gaming Operator That Once Ruled Macau Market

Posted on: June 14, 2018, 12:45h.

Last updated on: June 14, 2018, 12:49h.

SJM Holdings hopes its first casino resort on the Cotai Strip will turnaround the Macau casino giant’s dwindling market share in Macau.

SJM is the casino empire of recently retired billionaire Stanley Ho, who controlled a gambling monopoly on Macau for decades, until 2002 when the territory was returned from Portugal to the People’s Republic of China. When competitive casino operators — including US behemoths Las Vegas Sands and Wynn Resorts — began infiltrating the enclave as early as 2004, SJM’s market share began to decline.

Over the last decade, SJM’s aging casinos have lost their attractiveness to high rollers, who prefer the multibillion-dollar glitz of the newer Cotai properties. SJM finally took action in 2014 when it announced its first integrated casino resort in Cotai, the $4.6 billion Grand Lisboa Palace.

SJM CEO Ambrose So Shu Fai explained at this week’s annual company meeting in Hong Kong that Grand Lisboa Palace will return that lost market share. According to financial reports, SJM’s share in Macau was just 15.2 percent last year.

Grand Lisboa Palace will offer 2,000 five-star guestrooms, and a casino floor featuring as many as 700 gaming tables. SJM hopes to have the Cotai property open by early 2019.

Sands’ Castles

Macau is the world’s richest gambling hub, with gross gaming revenues (GGR) totaling more than $33.2 billion last year, or about three times the size of Nevada’s entire casino industry. Sands China — the Macau operating arm of Las Vegas Sands — is top dog in the enclave.

Sands was the first to build in Cotai, and created the Cotai Strip designation. Macau is where Sands makes nearly 90 percent of its earnings, and the primary reason that 84-year-old founder and CEO Sheldon Adelson is now worth over $43 billion.

According to Bloomberg research, Galaxy Entertainment controls the most GGR in Macau, with 22.8 percent last year. Sands trails closely at 21.1 percent, but additionally owns 35 percent of Macau’s available four and five-star hotel rooms.

Melco Resorts, Stanley Ho’s son Lawrence’s casino company, is third in terms of GGR, at 16.1 percent. Wynn Resorts is next at 15.3 percent.

After Sands opened The Venetian and Plaza casinos in Cotai in 2007 and 2008 — and VIPs began flocking to the massive resorts — three of Macau’s other six gaming licensees followed. The two that didn’t were MGM Resorts and SJM, the two companies that held the least market share in 2017.

MGM’s market share in Macau was the lowest of the six operators, at just 9.5 percent.

Changing Hands

At 96 years old, Stanley Ho is officially retiring. At the company’s annual meeting, he was formally removed from his positions as chairman and executive director of the board.

Ho is replaced by his daughter Daisy Ho Chiu Fung. Stanley’s new title is now SJM Holdings chairman emeritus.

Named the “king of gambling,” SJM said in a statement that “Ho has justifiably been acknowledged as the founding father of Macau’s gaming industry. The board expresses its sincere gratitude to Dr. Ho for his invaluable contributions in building a solid foundation for the company’s continuing growth in the future.”

Related News Articles

Wynn Boston Harbor Paying Top Dollar to Demolish Nearby Homes

Ethics Commission to Seize Maine Casino Backer’s Financial Records

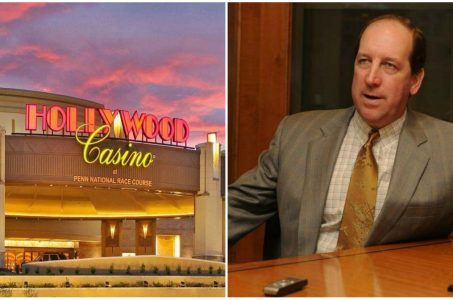

Penn National in No Rush to Build Pennsylvania Satellite Casino

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments -

Chicago Pension Mess Highlights Need for Bally’s Casino

— July 2, 2024 — 5 Comments

No comments yet