Philippines Gaming Chief Optimistic: Believes Country Can Surpass Singapore in Gaming Industry

Posted on: March 15, 2024, 03:13h.

Last updated on: March 18, 2024, 01:49h.

The top official at the Philippine Amusement and Gaming Corporation (PAGCOR) thinks the country’s gaming industry can surpass Singapore’s in the coming years.

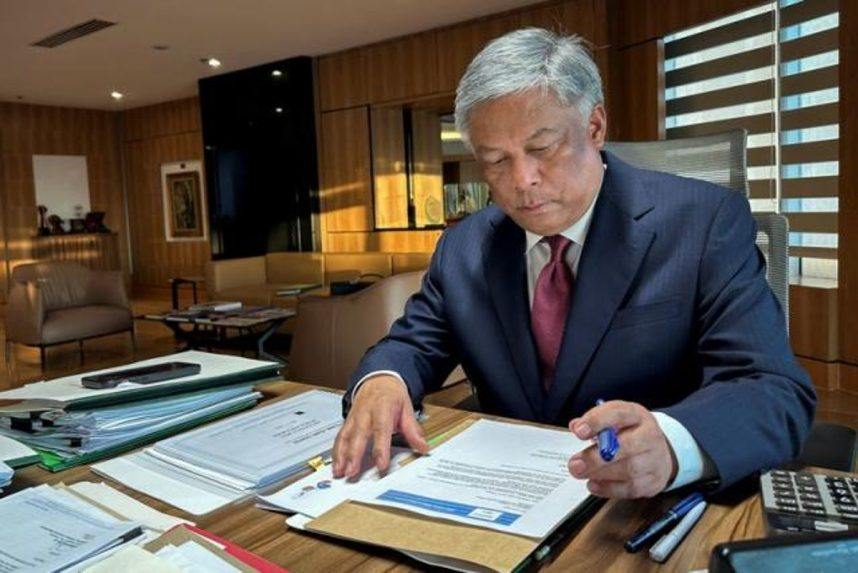

PAGCOR Chair and CEO Alejandro Tengco told reporters this week that he believes the Philippines’ casinos will eventually generate more annual gross gaming revenue (GGR) than Singapore’s duopoly.

Singapore is home to Marina Bay Sands and Resorts World Sentosa, two integrated resorts respectively owned and operated by Las Vegas Sands and Malaysia-based Genting. Tengco’s forecast is something he sees coming in the not-so-distant future.

If Singapore doesn’t expand, they will plateau. Don’t be surprised if next year we surpass them,” said the chief PAGCOR official.

PAGCOR regulates commercial casinos across the country, and in special economic areas like the Clark Freeport Zone in Central Luzon. PAGCOR also operates casinos on the state’s behalf under the Casino Filipino brand.

Already Neck-and-Neck

PAGCOR expects gross gaming revenue to reach a new high of 336 billion pesos (US$6.1 billion) this year, up from last year’s record of approximately $5.1 billion.

Marina Bay Sands generated gross gaming revenue last year of $2.7 billion. Resorts World won about $2.4 billion for a combined haul of around $5.1 billion. However, Singapore remained under COVID-19 restrictions until Feb. 13, 2023, with foreign entries before that date allowed only for work and emergency reasons.

Sands and Genting are investing billions of dollars into enlarging, updating, and improving their resorts. Those are capital investments each resort operator pledged in 2019 to the Singaporean government in exchange for their gaming licenses being extended through 2030.

The Philippines gaming industry will benefit from the introduction of several new casinos in the coming years.

The growth is highlighted by Solaire North, a more than $1 billion development in Quezon City. Solaire North, the sister property to Solaire in Manila’s Entertainment City, will come with 550 hotel rooms and a casino floor with 3,000 slots and 200 table games. Bloomberry Resorts is behind the Solaire casinos.

Along with Solaire North, new casinos are being built or considered in Manila, the Clark Freeport, and tourist hotspots like Boracay and Cebu.

Gaming stakeholders in the Philippines are placing big financial bets that the country will gain some of the VIP market share lost by Macau. That’s after the Chinese enclave forced out junket groups. Junkets cater to high-end gamblers and work with casinos to bring the high rollers to their private gaming rooms.

PAGCOR Overhaul

After over a decade of consideration, PAGCOR is finally moving to a regulator-only capacity in the coming years.

Tengco plans to divest the state-owned Casino Filipino business by early 2026. PAGCOR currently manages nine casinos and 33 smaller “satellite” casinos.

The Casino Filipino selloff will only happen if PAGCOR’s lofty asking prices are met. The state agency initially said it would seek to raise more than $1.4 billion from selling the properties and gaming licenses.

After little interest emerged from casino companies, Tengco said last summer that the agency would seek $1 billion for the 41 casino properties.

PAGCOR is currently the only gaming regulator in the world that also operates casinos. The conflict of interest has been scrutinized for many years. Tengco says selling the Casino Filipino venues will satisfy ethics concerns.

Related News Articles

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet