Penn National to Pull theScore Sports Betting App from US Markets on July 1

Posted on: June 1, 2022, 11:25h.

Last updated on: June 1, 2022, 11:28h.

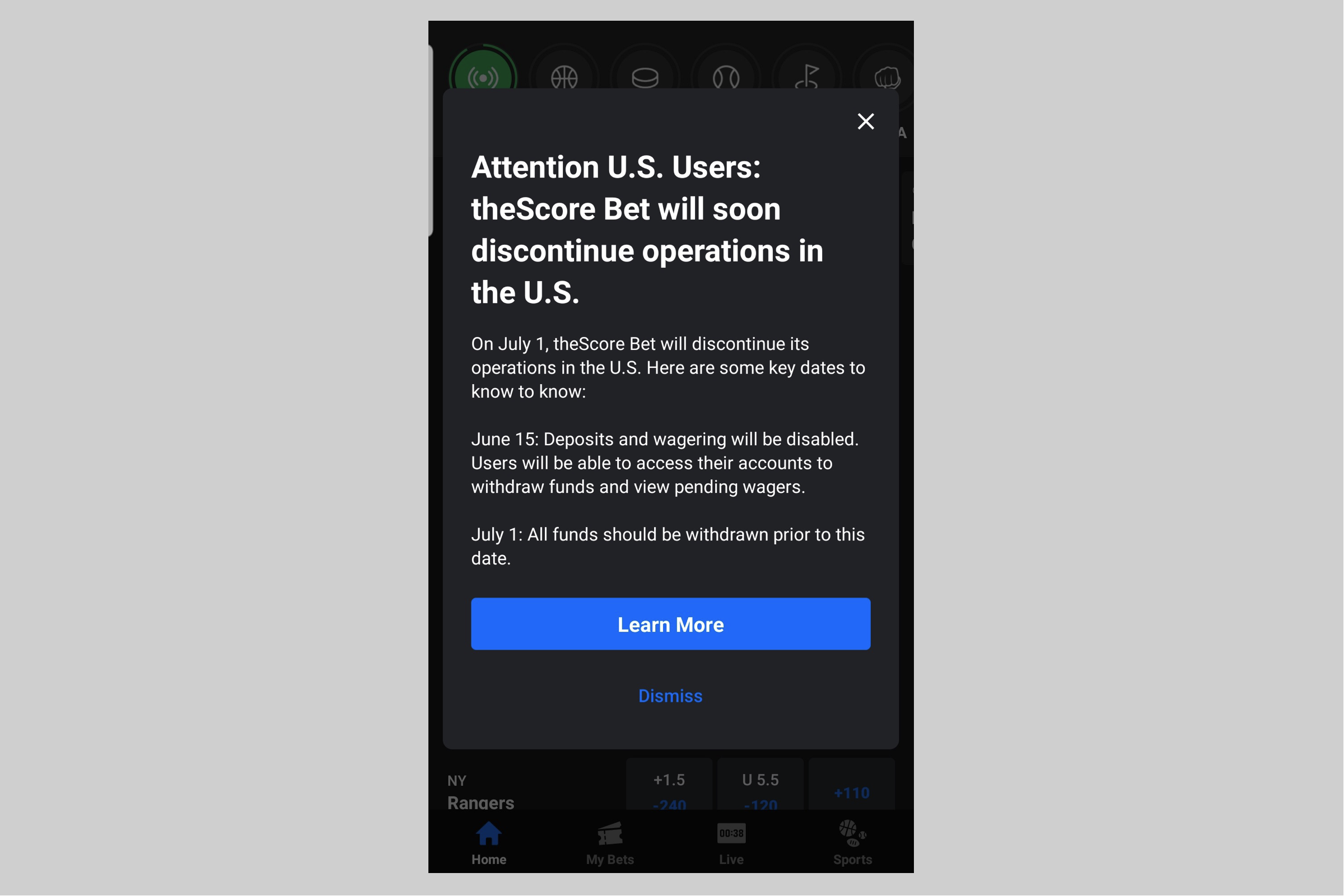

Another sports betting operator has decided to leave the US market. On Wednesday, theScore Bet announced it will stop taking bets in the four states where it’s licensed on June 15.

After that date, theScore’s customers will only be able to make withdrawals. All US wagering operations will cease by July 1 in Colorado, Indiana, Iowa, and New Jersey.

In an announcement to its US players, theScore said it will continue its wagering operations in Canada, where the sports media company is based. Last August, Penn National Gaming acquired theScore, giving it a second sports betting operator. It also operates Barstool Sportsbook, another sports media branded operator licensed in 12 states – including Colorado, Indiana, Iowa, and New Jersey.

According to information shared with theScore Bet users, events that take place on or before July 1, such as the NBA and NHL playoffs, will be graded and settled accordingly. The operator said it recommends players withdraw the funds from their accounts before July 1. After that, theScore Bet will mail checks or issue ACH transfers to account holders.

“Patrons whose address on file with theScore Bet is outdated should contact theScore Bet’s Customer Support team to update their address prior to July 1, 2022 to ensure checks are sent to the correct address,” the FAQ stated.

‘Timing is Right’

In a statement, theScore President and COO Benjie Levy said Penn’s plans since the acquisition have been to let Barstool front the US market and theScore lead up north.

With theScore Bet launched and thriving in Ontario, and as we approach a major undertaking this summer with the launch of our proprietary risk and trading service, the timing is right to focus our US efforts on marketing Barstool Sportsbook and our Canadian efforts on marketing theScore Bet,” he said.

The departure by theScore from the US market comes a few months after Churchill Downs Incorporated announced it would pull its TwinSpires brand out of the online sports betting business for now in the US. Churchill Downs CEO Bill Carstanjen said in February the company raised concerns about whether sports betting would ever be a profitable venture.

Penn National, though, shows no signs of pulling up. Rather, the move makes business sense, as there’s no need for two sports betting brands under the same umbrella to compete in the same markets.

Platform Integration a Focus

As Levy noted in his statement, besides focusing on growing the Canadian market, theScore will also wrap up work on its risk and trading platform. According to information from Penn National’s first-quarter earnings presentation last month, theScore expects to transition to its proprietary platform by the third quarter of this year.

As that work goes on, Penn National will look to integrate Barstool Sportsbook onto theScore’s platform.

Sometime later this year, US users of theScore’s sports media app will be able to use that app to make bets through Barstool. That would be identical to the integration theScore Bet had with theScore media app. Then in 2023, Penn National faces a deadline of acquiring the remainder of Barstool Sports. It bought a 36% stake in the media company founded by Dave Portnoy in January 2020.

If all goes to plan, Barstool Sportsbook is expected to switch over to theScore’s account management and trading platforms in the third quarter of 2023.

“Bringing together theScore’s powerful sports media platform with Barstool Sportsbook, supported by our in-house technology, will strengthen the overall US product offering and broaden its reach,” Levy added.

Related News Articles

FanDuel to Be New York Yankees Official Sports Betting Partner

Caesars Plans Sportsbook Truck Tour as Digital Marketing Efforts Shift Gears

Disney CEO Bob Iger Lukewarm on Sports Betting

Most Popular

LOST VEGAS: The Foster Brooks Robot at MGM Grand

Bally’s Sets Date for Tropicana Las Vegas Implosion & Party

Most Commented

-

VEGAS MYTHS RE-BUSTED: You Don’t Have to Pay Resort Fees

— August 2, 2024 — 16 Comments -

VEGAS MYTHS RE-BUSTED: Elvis Was a Straight-Up Racist

— August 9, 2024 — 11 Comments -

ANTI-SOCIAL BEHAVIOR: Vegas Casino Buffet Stunt in Poor Taste Goes Viral

— August 16, 2024 — 7 Comments -

VEGAS MYTHS RE-BUSTED: The Strip Tried Appealing to Families and Failed

— August 23, 2024 — 7 Comments

No comments yet