Nevada Sues Online Travel Booking Companies for Dodging Hotel Room Taxes

Posted on: December 2, 2020, 07:55h.

Last updated on: December 2, 2020, 08:41h.

The state of Nevada is suing some of the online travel booking sector’s biggest names for consumer fraud, alleging that for years they have avoided paying full tax on hotel rooms in the state.

The lawsuit was filed on behalf of Nevada by Las Vegas communications consultants Sig Rogich and Mark Fierro in April. But it remained under seal until Tuesday when it was reviewed by the Nevada AG’s Office. It seeks damages of possibly hundreds of millions under the Deceptive Trade Practices Act from the likes of Travelocity, Expedia, Priceline, and Hotels.com.

The suit claims booking companies have for years block-bought rooms from Nevada’s hotels and casino resorts at discounted prices before selling them online to customers at higher rates. But according to the lawsuit, they’ve been charging customers room taxes based on the higher rates while paying the cheaper room taxes to the state.

Rogich told the Las Vegas Review-Journal late Tuesday that the money “rightfully should be returned to the people of Nevada, especially during these challenging times that we are experiencing as a community,” said.

“There is no way the online travel companies did this mistakenly,” he added. “They intentionally withheld this money that rightfully belongs to taxpayers in Nevada.”

How Does Nevada Room Tax Work?

The state room tax has been an efficient, reliable source of revenue for Nevada for more than 50 years. As well as supporting state and local general funds and other public agencies, much of it goes to fund the Las Vegas Convention and Visitors Authority (LVCVA) and its development projects, thereby promoting more tourism to the state – a self-propelling tax generation system.

The tax rate varies, depending on the type of room and its location. For example, a motel guest might pay 10 percent, while a guest at a resort could pay as much as 13 percent.

Las Vegas room rates vary depending on the time of year, the day of the week, and the general health of the economy. So do the taxes they generate.

With occupancy rates plummeting because of the coronavirus pandemic, operators are dropping room rates — some by 40 percent or more, which is hitting state room tax hard.

LVCVA has said it expects revenues from room taxes to drop from $300 million to $100 million this year and has slashed its budget accordingly.

Punitive Damages

It’s difficult to say how much Nevada might be awarded if the case is ruled in its favor, although the lawsuit is seeking punitive damages of more than three times the amount of the potential loss in public funding.

Fierro told LVRJ that translates to big money.

“The bad news is this money should have been going to Nevada’s schools, law enforcement organizations, infrastructure, and a broad array of other needs of Nevada citizens,” Fierro said. “The good news is that when we win this case, and we are confident that we will prevail, it will rank among the biggest windfalls that Nevadans have experienced since the landmark 1998 settlement with the tobacco industry.”

Related News Articles

David Baazov Forms New Global Investment Company

Wynn Boston Harbor Paying Top Dollar to Demolish Nearby Homes

Sports Bettor Billy Walters Gets Five Years for Securities Fraud

North Korea Decriminalizes Horse Racetrack Gambling, Minimum Age Set at 12

Most Popular

LOST VEGAS: The Foster Brooks Robot at MGM Grand

Bally’s Sets Date for Tropicana Las Vegas Implosion & Party

Most Commented

-

VEGAS MYTHS RE-BUSTED: You Don’t Have to Pay Resort Fees

— August 2, 2024 — 16 Comments -

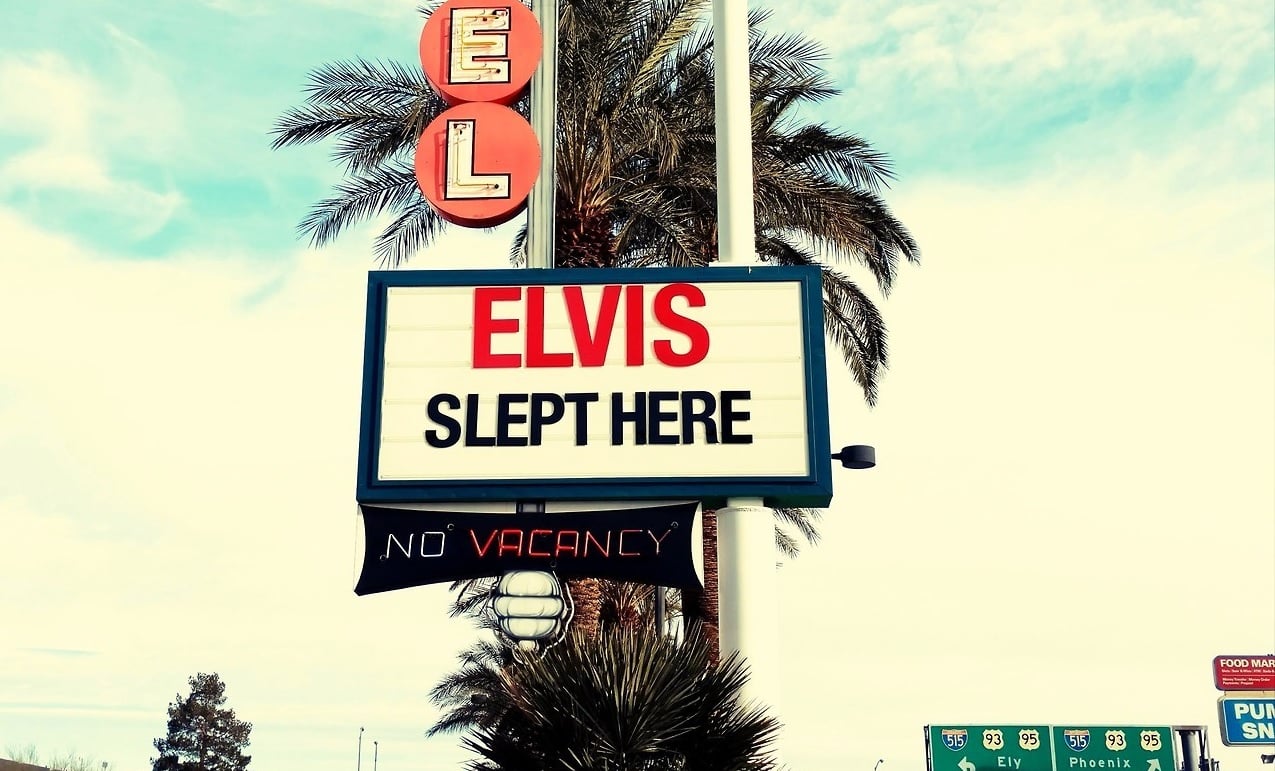

VEGAS MYTHS RE-BUSTED: Elvis Was a Straight-Up Racist

— August 9, 2024 — 11 Comments -

ANTI-SOCIAL BEHAVIOR: Vegas Casino Buffet Stunt in Poor Taste Goes Viral

— August 16, 2024 — 7 Comments -

VEGAS MYTHS RE-BUSTED: The Strip Tried Appealing to Families and Failed

— August 23, 2024 — 7 Comments

No comments yet