Most Macau Casinos Reopened, But Expect Lengthy Recovery After Coronavirus Shutdown, Says Expert

Posted on: February 24, 2020, 01:10h.

Last updated on: February 24, 2020, 04:36h.

To bring you the most in-depth knowledge possible, we continue our Asia-Pacific Expert Insight series with this article. Gaming industry insiders on the ground in this region will share their professional deconstruction of important trends in the casino sector in Macau, Japan, the Philippines, and throughout the area.

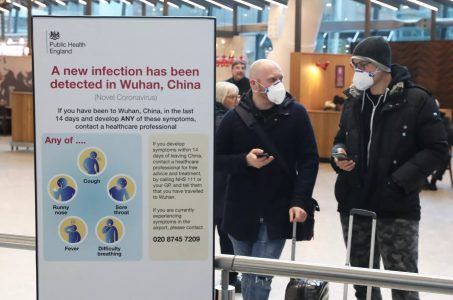

Macau’s gaming industry may be back in business, but it’s business isn’t fully back — and won’t be for quite some time. The devastating toll the coronavirus has taken on the Asian gaming enclave will continue to be felt, even as new health protocols are put in place and wary gamblers slowly return to play.

Cautious Reentry

Only 30 percent of gaming tables were operational once more as of Friday — with some health and safety restrictions — while some casinos chose to stay closed entirely. Those will have a 30-day grace period to reopen.

But there isn’t the customer base yet to fill the table seats of those venues that are once again up and running. That will be some weeks away and contingent on the advice of medical professionals and the policy direction of area governments to reopen air, land and sea routes to Macau.

It was only a few weeks ago — and within a matter of days of the coronavirus impact — that the world’s largest gaming economy experienced a fairly comprehensive shutdown across the hospitality and gaming sector. It had added impact due to when it hit: just as the region’s gaming operators were ramping up their marketing campaigns leading into the normally busy and lucrative Chinese New Year period. All planned celebrations were cancelled, and marketing and event investments were lost.

Macau’s casino industry has shown resilience in the past and it would likely be realistic to predict some time around Easter (which falls on April 12 this year) and a further ramp up towards summer as the period of recovery for the gaming enclave.

That’s assuming no new cases of coronavirus surface in Macau once the immediate crisis has passed, of course.

Expect Slow Casino Recovery

There’s now a pressing urgency to return to normal, but there’s no question that the outbreak of the coronavirus will continue to affect Chinese visitation to Macau. Despite the casino reopenings, customers returning to stay and play in Macau will take a little longer.

Most reports compare coronavirus to SARS. In fact, people reference back to SARS in 2003, further reinforcing fear and anxiety over the present-day virus. But back then, neither social media nor the Cotai Strip existed, and Chinese visitor and casino revenue volumes were a fraction of what they are today.

Even the steady six million annual Hong Kong visitations were significantly curtailed with the temporary closure of the Hong Kong ferry terminal by the authorities, which remains closed. Hong Kong visitors do travel to Macau, but must take the Hong Kong-Zhuhai-Macau bridge.

Look Beyond Gaming, Widen Markets for Recovery

Some 90 percent of all revenue from Macau’s integrated resorts is generated from gaming, a percentage that’s increased each year since casino liberalization. There’s been a constant narrative since early 2000 surrounding the need to diversify into non-gaming areas. But a substantial portion of non-gaming — such as accommodations and food — are comped to the casino’s premium mass or junket VIP players.

While Macau has impressive visitation figures, it has a relatively low penetration rate within China’s first, second and third-tier cities (especially when reflecting on the increasing numbers of outbound Chinese globally).

Diversification to a widening customer base within China’s mega-cities can help. While Shanghai has a reported population of nearly 35 million, within Macau’s neighboring Guangdong Province, cities such as Guangzhou, Shenzhen, Donggin and Foshin have populations of 14.9, 13.0, 8.4 and 7.9 million respectively that could be targeted as potential gaming customers.

In 2018, mainland Chinese visitation was 71 percent (25.3 million, with 13.3 million staying overnight) of total tourism to the city. And many of those were multiple repeat customers. Compare that to almost 20 years prior, in 1999 — the year of Macau’s handover — when of the seven million visitations to Macau, only 1.6 million (23 percent) were from the mainland, which was still a three-fold increase from 1997.

Operational Costs

The economic impact from the coronavirus has been heavily reported in the media, with Macau’s financially depleted casino industry covering daily operational costs — including staff salaries (albeit with cost-cutting measures in place, including the revenue losses from the closure of some hotels, as others slipped below 10 percent occupancy).

Only a minimal operations and facilities workforce remained behind to service the few floors of hotel or restaurant outlets that remained open.

One in 14 people working in the gaming epicenter are dealers (around 26,000), an occupation allowed exclusively for Macau residents. Beyond the economics, there were social issues of well-being to the community, as people were essentially being confined to their homes.

Relationship-Building with Loyal Players

Events and entertainment entice and attract repeat net worth players from China. Immediate casino recovery in 2020 from the economic impact of the coronavirus will likely see a greater reinforcement on loyalty databases and host team connections to casino players, essentially sidelining any spotlight to an actionable diversification policy.

Looking back, there’s been no safety net for Macau’s casino industry should something happen to mainland Chinese visitation. Some visa restriction policies in Chinese outbound in early 2000 had only minor bearing on GGR and quickly passed without too much impact on month-on-month GGR increases.

GGR peaked at US$44.6 billion in 2013–a dramatic climb, considering only 14 years earlier, in 1999, it had been less than $2billion.

The significant 34 percent drop from $43.4 billion GGR in 2014 to $28.5 billion in 2015 (due to the corruption crackdown in China) was a very clear indication that if something happened to Macau’s key source market, the city would feel the impact like a punch.

At the time–in 2014–nobody believed that there could be an ongoing reversal of Macau casinos’ upward trends, with most believing that the setback would turn around within a few months.

It didn’t. In fact, it would take two years and two months before an upward trend was recorded for GGR once more.

Additionally, the mass transit system of high-speed trains, highways and airlines that now networks throughout China and funnels down towards Guangdong and Macau were also only ideas or emerging construction projects in 2003. This perspective is important when putting analysis around the present situation.

With greater collaboration between the city’s tourism marketing authorities, casino concessions and other major tourism agencies for a clear destination message to take to market, particularly in China, an expedited recovery is more likely.

A recent Reuters article on the coronavirus threat to the global economy mentioned that while infectious diseases are inevitable and happening with increasing frequency, risk assessment, mitigation and remedy should be part of government standards and policy making. As Macau now focuses on recovery, there is a need to forward-think scenarios, as well as greater public and private sector collaboration. If not right now, it should certainly become part of the later recovery thought process.

Meanwhile, Macau will slowly continue to get back on its feet. An unnamed industry executive told Reuters last week:

It is wise to open a little bit, even if business is slow. The government wants us to open because it signals a sign of stability for Macau.”

Glenn McCartney MBE has authored numerous articles for academic journals and is often quoted in mainstream media. Professor McCartney has also written two best-selling textbooks on tourism and events management in Asia, published by McGraw-Hill. He can be reached at: glenn.mccartney@casino.org

Related News Articles

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet