Macau Gaming Stocks Tripped Thursday by Trump Trade Tweets

Posted on: August 1, 2019, 12:25h.

Last updated on: August 1, 2019, 04:17h.

Shares of gaming companies with Macau exposure slid late Thursday after President Trump said the US is planning to levy a 10 percent tariff on $300 billion worth of Chinese products after trade talks between the world’s two largest economies stalled.

US stocks, including casino operators, opened higher today, a day after the Federal Reserve lowered interest rates, but with about two hours left in the trading session, Trump took to Twitter to voice his displeasure with the trade discussions. The tariffs being pitched are in addition to the 25 percent penalty currently being applied to $250 billion of Chinese goods.

Immediately, traders departed companies with Macau footprints. With about 45 minutes left in the trading day, Wynn Resorts, Ltd. (NASDAQ: WYNN), a company that generated three-quarters of its 2018 operating in the Chinese gambling center, was down 5.8 percent.

Our representatives have just returned from China where they had constructive talks having to do with a future Trade Deal,” said Trump in the first of several tweets on the matter. “We thought we had a deal with China three months ago, but sadly, China decided to re-negotiate the deal prior to signing.”

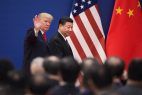

In early July, shares of Wynn, Las Vegas Sands Corp. (NYSE:LVS), and MGM Resorts International (NYSE:MGM) rallied after Trump and his Chinese counterpart, President Xi Jinping, met at the G-20 summit in Japan and agreed to reconvene trade negotiations.

Not Holding Up Their End Of The Deal

Trump has consistently said the US-China trade relationship is mostly one-sided and that he believes the world’s second-largest economy rarely sticks to its promises. Data confirm that China does get the more favorable end of trade with the US. Last year, the US imported $539 billion worth of Chinese goods, but exports to China totaled just $120.3 billion.

Trump is also upset for other reasons. Following the G-20 summit, the president announced that China was planning to up its purchases of US agricultural products, something that hasn’t happened. Additionally, Trump repudiated China for not ceasing exports of fentanyl to the US.

Fentanyl is a deadly opioid that caused an estimated 32,000 overdose deaths in America last year, up from 6,000 such fatalities in 2014.

“Additionally, my friend President Xi said that he would stop the sale of Fentanyl to the United States – this never happened, and many Americans continue to die!,” said Trump in another tweet.

Macau Weakness

In a case of coincidence, bad timing or both, Trump’s tweet storm arrived less a day after Macau’s Gaming Inspection and Coordination Bureau (DICJ) said that June gross gaming revenue (GGR) on the peninsula slipped 3.5 percent on a year-over-year basis to $3.03 billion as VIP play cratered by 20 percent.

That glum report and Trump’s tweets come nine days after Las Vegas Sands reported weaker-than-expected second-quarter earnings, due in part to slack Macau results.

The owner of five casinos on the peninsula said its Sands China unit had second-quarter earnings before interest, taxes, depreciation, and amortization (EBITDA) of $765 million on revenue of $2.14 billion, but analysts were expecting EBITDA of $788 million on revenue of $2.15 billion. Rival Wynn Resorts reports earnings for the June quarter on Aug. 7.

In late trading Thursday, shares of LVS were lower by nearly four percent. Both Sands and Wynn slid below their 50-day moving averages, a technical indicator used by some traders to assess near-term strength or weakness in a stock.

Related News Articles

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments -

Chicago Pension Mess Highlights Need for Bally’s Casino

— July 2, 2024 — 5 Comments

No comments yet