Japan Considers Banning VIP Junket Operators from Its Fledgling Casino Industry

Posted on: June 15, 2017, 03:00h.

Last updated on: June 15, 2017, 02:55h.

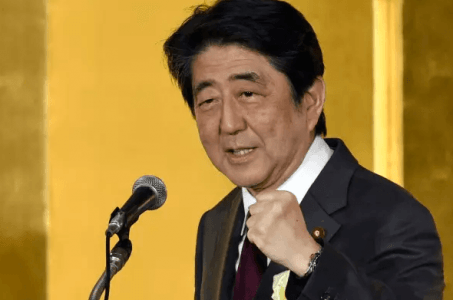

As Japan moves forward in the early stages of building its own casino gaming industry, the country is considering disallowing the use of VIP junket operators to help future casinos bring in high rollers to their properties.

That’s the opinion of an advisory board charged with presenting ideas to the National Diet, Japan’s legislative body, for inclusion in a developing bill to establish a framework for opening integrated casino resorts in the Land of the Rising Sun.

VIP operators elsewhere in the world, most notably Macau, often work in collaboration with casinos to transport high rollers to casinos. They have been controversial, however, with several supposed VIP hosts offering not just lavish arrangements for the rich, but also an avenue for laundering money from criminal enterprises.

Those are just some concerns about the seamy side of gambling finance that junket operators traffic in, according to a panel of citizens responsible for informing the Diet with public concerns about the legalization of commercial gambling.

GGRAsia reports that the Office of Integrated Resort Regime Promotion in Japan has suggested the government make sure that the junket sector not be included in the industry, and that these sometimes controversial VIP touring companies should be banned.

Taking Advantage

Japan has passed laws in recent years to allow two integrated casino resorts to be built (exactly where still to be determined) and seems to be following Singapore most closely in forming its regulatory blueprint for gambling. integrated resorts bill. The island country in Southeast Asia bars junket enterprises.

Much of Japan is opposed to the idea of bringing commercial casinos to the country. An opinion poll last year found that just 12 percent of the Japanese electorate supported an initial bill to legalize integrated casino resorts. Thus lawmakers have been focusing heavily on preventing harmful social impacts the casinos might generate.

Though the Diet hasn’t yet publicly revealed details of changes to the bill, charging residents prohibitively costly entry fees has been considered as one way to keep out problem gamblers among the poor. Similarly, banning junket operators would, in theory, prevent casinos from taking advantage of vulnerable wealthy citizens.

Supposedly, with a population of more than 126 million, Japan should have little problem filling its casinos and operating them profitably without junket operators, who make their money on keeping these players gambling as much as possible.

Location, Location, Location?

The Japanese government has so far approved the issuance of licenses for two integrated resort properties, one of which is expected to be built in Tokyo, the other in either Osaka or Yokohama, two population-dense cities.

But leaders in the Wakayama region say one goal of the bill should be to generate economic growth in more rural expanses. Thus the provincial government there is working on a proposal, to be revealed in November, Wakayama officials say, that would convince the Diet of the benefits of choosing it as a future resort destination.

Japan’s developing integrated resorts bill won’t be revealed until August, if not later, at which point locations should be known, at which point companies wanting one of the two licenses will be able to make their bid. The bill will also presumably address a slew of regulatory concerns such as licensing fees, tax rates, and problem gambling safeguards.

In addition to cities jockeying for the right to open a casino, the global gaming industry’s major corporate players are also trying to position themselves accordingly.

Las Vegas Sands, MGM, Wynn, SJM Holdings, Galaxy Entertainment, and Melco are all eyeing a coveted Japanese license. As for now, only two will be winners. And though revenue projections vary wildly until more is decided about what casino gambling in Japan should look like, it’s almost certain that billions of dollars in annual gross gaming revenue are at stake.

Related News Articles

Most Popular

LOST VEGAS: The Foster Brooks Robot at MGM Grand

Bally’s Sets Date for Tropicana Las Vegas Implosion & Party

Most Commented

-

VEGAS MYTHS RE-BUSTED: You Don’t Have to Pay Resort Fees

— August 2, 2024 — 16 Comments -

VEGAS MYTHS RE-BUSTED: Elvis Was a Straight-Up Racist

— August 9, 2024 — 11 Comments -

ANTI-SOCIAL BEHAVIOR: Vegas Casino Buffet Stunt in Poor Taste Goes Viral

— August 16, 2024 — 7 Comments -

VEGAS MYTHS RE-BUSTED: The Strip Tried Appealing to Families and Failed

— August 23, 2024 — 7 Comments

No comments yet