Brexit “Leave” Vote Passes: What Did UK Bookies Know That the Rest of Us Didn’t?

Posted on: June 24, 2016, 04:14h.

Last updated on: June 24, 2016, 04:39h.

With the Brexit shock decision for the UK to leave the European Union, many are wondering about repercussions for the global economy. And on High Street, bookies may be wringing their hands today, wondering why they got it so wrong.

But wait, are they?

The betting markets have proved to have an unerring ability to predict the outcome of political events with far greater accuracy than the often notoriously unreliable opinion polls. And the Brexit referendum was the biggest political betting market in the UK ever, which meant that they had a larger sample size to work with than ever before.

In theory, that reality should have produced even greater accuracy. And yet, when the ballot boxes were sealed at 10 pm BST in the UK on Thursday night, odds on the “Vote Leave” campaign were 4:1 against, which equated to an 80 percent likelihood that Britain would remain a part of the EU.

Did Betting Industry Know All Along?

“The truth is that bookies do not offer markets on political events to help people forecast the results,” said Ladbrokes’ head of political betting, Matthew Shaddick, in an official statement this morning. “We do it to turn a profit (or at least not lose too much) and in that respect, this vote worked out very well for us.

“Nobody at Ladbrokes’ HQ will be criticizing the predictive powers of our odds, they’ll be looking at the money we made,” he said.

And therein lies the answer. There were signs, largely overlooked by the press, which suggest bookmakers may have been expecting a “Leave” vote all along. Which begs the question: why didn’t the betting odds reflect that?

Last week, William Hill spokesman Graham Sharpe described the markets as “volatile” due to the fact that while 66 percent of all the money his company had taken had been for “Remain,” 69 percent of individual wagers had been for “Leave.”

“Remain” Bettors More Affluent

It was a huge clue. Since voters only get to vote once, it’s only the individual bets that count, but because bookmakers calculate their odds in relation to the volume of money they handle, the odds had to be shortened based on the total amounts staked.

The “Vote Leave” campaign was at its strongest in poorer areas of England, such as the Northeast, Yorkshire, and the East Midlands, and at its weakest in affluent London. Those who bet on and supported “Remain”simply had more money to gamble with.

Should we now distrust betting markets as predictors of political outcomes? Well, no. Brexit produced an unusual set of circumstances, unlikely ever to be replicated. And as every gambler knows, sometimes the outsider just wins, especially in a volatile market.

“Whilst I see no evidence that the betting was deliberately ‘manipulated’ by big money, I think there’s something to be considered in the fact that the most affluent sections of society were generally behind remain,” said Shaddick. “Maybe there just aren’t enough dispassionate investors out there to correct that possible bias, even in a multi-million pound market like the referendum.”

Related News Articles

Pair Found Guilty in New Zealand Roulette Scam

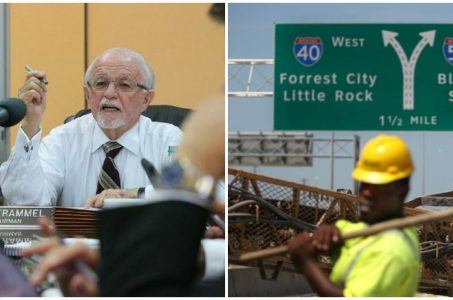

Arkansas Highway Commission Cautions Voters on Casino Ballot Question

Most Popular

Tropicana Las Vegas to be Imploded, Tentative Date Set

VEGAS MYTHS BUSTED: Golden Gate is the Oldest Casino in Vegas

Most Commented

-

End of the Line for Las Vegas Monorail

— April 5, 2024 — 90 Comments -

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

— April 16, 2024 — 6 Comments

No comments yet