Penn National Pops to New High as Goldman Starts Coverage, Bank Backs Barstool Partnership

Posted on: August 13, 2020, 09:22h.

Last updated on: August 13, 2020, 12:00h.

Shares of Penn National Gaming (NASDAQ:PENN) are higher by more than seven percent Thursday. The stock raced to a new 52-week high after Goldman Sachs initiated coverage of the gaming company with a “buy” rating.

The bank points to multiple layers of a bullish thesis on the operator, including rebounding regional casinos and the company’s positioning in the online gaming and sports wagering industries.

PENN sits at the cross-section of a rapidly rebounding regional casino space and inflecting growth in sports betting,” said Goldman in a note to clients today.

“Moreover, we believe Barstool Sports’ embedded customer base and content creation engine will drive one of the lowest customer acquisition costs in the sports betting industry, allowing PENN to quickly take share within our proprietary iGaming and Sports Betting models,” he continued.

With help from the Goldman call, Penn stock is higher by almost 71 percent over the past month, and is up a jaw-dropping 1,326 percent off its March lows.

Lauding Relationship

In January, Penn paid $163 million in cash and equity to take a 36 percent stake in David Portnoy’s Barstool Sports. At the time, the deal was mostly praised, though some analysts expressed reservations about the price, citing the operator’s high debt burden.

The casino company can eventually acquire the sports media property outright for $450 million. Wall Street is increasingly enthusiastic about that relationship, because it gives Penn access to millions of new potential customers in younger demographics that are rapidly embracing internet casinos and sports betting.

“We believe Barstool Sports’ embedded customer base and content creation engine will drive one of the lowest customer acquisition costs in the sports betting industry, allowing PENN to quickly take share within our proprietary iGaming and Sports Betting models,” said Goldman analyst Stephen Grambling.

Penn is also likely to leverage Barstool’s dominant social media presence. The sports and pop culture blog has 38.5 million Instagram and 18.2 million Twitter followers, respectively, while rivals DraftKings and FanDuel have just 200,000 and 600,000 followers on those platforms combined.

Spending Shifts to Penn’s Benefit

Driven by younger consumers, Goldman forecasts the US sports betting business will eventually be worth $28 billion, one of the highest forecasts, and that iGaming vaults to $9.5 billion.

The bank also says changes in consumer spending habits forced by the coronavirus pandemic will drive that growth, a trend Penn is well-positioned to capitalize on.

“We believe the strength of the new customer has been driven by share of wallet shifts within leisure spending, as many forms of travel and entertainment are restricted,” said Grambling. “In fact, we estimate that more than $230 billion is up for grabs on an annual basis from these restrictions and changes in behavior.”

Penn stock trades around $54 at this writing, well above the consensus price target of $43.46, meaning some other analysts may join the party with higher forecasts over the near-term.

Related News Articles

Gaming, Leisure Industry Epicenter of COVID-19 Credit Downgrades

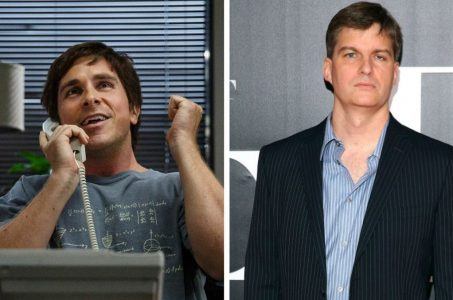

Burry, Inspiration for ‘Big Short’, Adds to Wynn Resorts Investment

Most Popular

VEGAS MYTHS BUSTED: Golden Gate is the Oldest Casino in Vegas

Las Vegas Overstated F1 Race’s Vegas Impact — Report

Most Commented

-

End of the Line for Las Vegas Monorail

— April 5, 2024 — 90 Comments -

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

— April 16, 2024 — 6 Comments -

Long Island Casino Opponents Love New York Licensing Delays

— March 27, 2024 — 5 Comments

No comments yet