Ohio Sportsbooks Generating Millions Before They Even Open

Posted on: August 30, 2022, 07:32h.

Last updated on: August 31, 2022, 02:45h.

Sports betting doesn’t begin in Ohio until Jan. 1, but the money is already pouring in … to the state. Nonrefundable application fees of $9.6M have already been collected, according to the news site PlayOhio, and fees are likely to generate more than $30M this year.

Once applications are approved, vendors must pay a license fee to begin accepting bets and an annual fee to continue the license. (Fees vary by license type.) Licenses are good for five years. According to PlayOhio, annual license fees could total $5M, with tax revenues as high as $50M.

A wide margin approved sports betting in both houses of the Ohio legislature in December 2021. The Ohio Casino Control Commission (OCCC) announced in June that the betting market would open on Jan. 1.

Casino gambling in Ohio has been legal since 2009. Currently, 11 casinos and racinos are operated in the state, generating revenues of $2.3 billion in 2021, according to published reports.

Online License Costs are Oh-High-Oh

The state law that legalized sports betting in Ohio set up steep prices for proprietors seeking a second skin, and for the operators who want those licenses.

Initial license fees for Class A (online wagering) gaming licenses range from $500K to $2.5M, depending on the business type. Under the law, a professional sports team seeking to host one online operator would pay $1M for a five-year license. A team seeking two skins, or mobile management service providers (MMSPs), would pay $3.3M for the license. Casinos and other businesses looking to partner with one would pay $1.5M for their license. But they’d pay $5M for two.

The first MMSP partner for a sports team pays $2M for a five-year license, while the first MMSP for a casino or other business would pay $1.5M for their license. For a second MMSP, the provider would pay $6.67M for a license if they’re partnering with a sports team, or $5M if the partner is any other business.

The state law allows for 25 proprietors that can each partner with one or two online sports betting operators. According to the OCCC, 22 entities have applied for proprietor licenses, and 25 providers have applied for licenses. However, an application does not guarantee approval.

The state may also choose to expand the number of online licenses if an economic analysis determines it would benefit the state.

The law does give preference to casinos, racinos, and professional sports teams. However, other entities have applied to host online operators. Those applicants are the Hall of Fame Village in Canton and SPIRE Institute in Geneva.

Retail Sportsbook and Kiosk Licenses

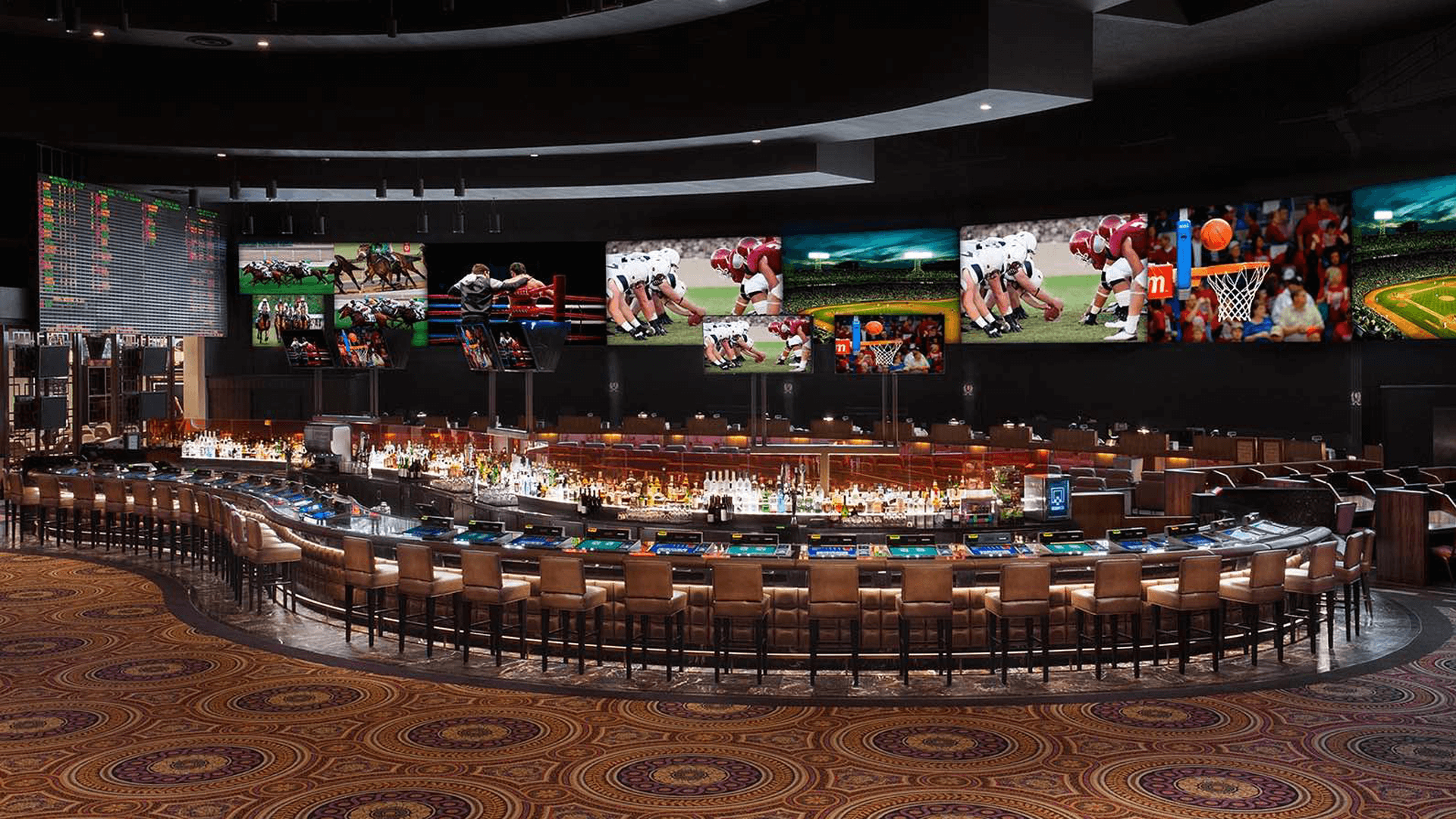

Ohio’s law also allows for 40 retail sportsbooks in the state’s largest counties by population. The initial Class B license fee is either $50K or $100K, depending on whether the vendor also holds a Class A license. Annual fees are $10K. The five-year renewal fees are the same as the initial fees.

It also allows certain lottery retailers to host kiosks in their establishments. For the most part, Class C applicants are bars or restaurants. However, other applicants include bowling alleys, golf courses, and even grocery stores. So far, more than 1,300 vendors have paid the $1K application fee for a Class C license. The license fee is $25K, renewable after five years, with no annual fees.

Kiosks will have certain operations limits compared to online apps and brick-and-mortar sportsbooks. The kiosks will only be able to offer point spread, moneyline, and totals to bettors. Bettors can make parlays, but those will be capped at four legs. In addition, no bettor can wager more than $700 in a calendar week through kiosks.

Related News Articles

JACK Entertainment Unveils Retail Sportsbooks in Advance of Ohio Launch

Sports Betting Survey Reveals Bettor Insights Ahead of Ohio’s Jan. 1 Launch

Sports Betting Operators Plan to Ring in Ohio’s Launch on New Year’s Day

Ohio to Ban Former Alabama Baseball Coach From Sportsbooks

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet