Bipartisan Federal Legislation Seeking to Assist Gaming and Tourism Industries Introduced

Posted on: October 16, 2020, 10:34h.

Last updated on: October 19, 2020, 10:50h.

The gaming industry has been one of the hardest-hit sectors by COVID-19, prompting two US Senators to introduce legislation this week that seeks to assist in its recovery.

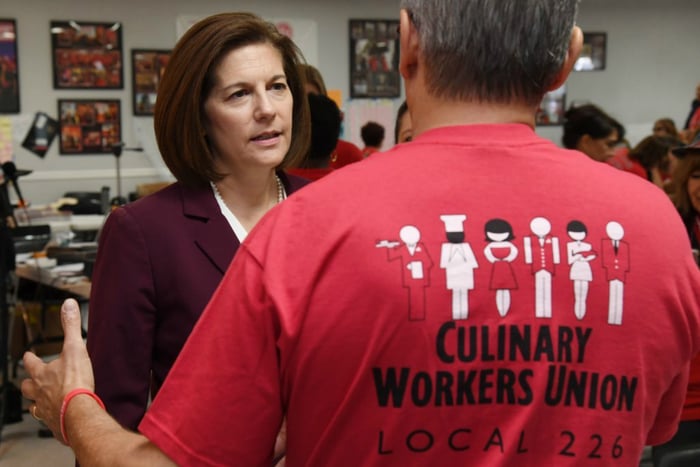

The Bureau of Labor Statistics groups casinos into the “amusement, gambling, and recreation” classification, and according to the agency, the group lost 60 percent of its jobs between February through April. US Senators Catherine Cortez Masto (D-Nev.) and Kevin Cramer (R-N.D.) say additional federal aid is needed to help hospitality, travel, and tourism recover.

“The coronavirus pandemic has devastated economies and industries across the country, and Nevada’s hospitality, travel, and tourism sectors have been especially hard hit. These industries are the economic engine of our state and our communities, and the incredible challenges they are now facing due to COVID-19 demand our attention — and action — in Congress,” said Masto.

The legislation — dubbed the “Hospitality and Commerce Job Recovery Act of 2020 — would create incentives for hospitality and trade shows, enhance the Employee Retention Tax Credit for employers, and provide tax incentives for middle-class families to travel once deemed safe.

Bill Contains Tax Breaks

Masto and Cramer’s legislation, if passed, would provide tax breaks to both business and many Americans.

Taxpayers who attend a convention or trade show in the US between January 1, 2021, through December 31, 2023, would be afforded a tax credit. Businesses that organize and host such large-scale meetings would also be given a tax break.

The Entertainment and Business Expense Deduction, which was repealed during the 2017 Tax Cuts and Jobs Act, would be restored. Masto and Cramer say a “modest tax credit for qualified travel expenses” for middle-class Americans would also be offered.

The recovery package has the support of the American Gaming Association, the gaming industry’s leading lobbying firm in DC. The US Travel Association, American Hotel and Lodging Association, Nevada Resort Association, and the North Dakota Department of Commerce have also issued their backing.

“While gaming’s responsible reopening is well underway, the sustained economic damage has jeopardized our ability to sustain jobs and drive much-needed tax revenue that will be essential to our nation’s economic recovery,” said AGA President Bill Miller.

Las Vegas Stripped of Visitors

Fitch Ratings this week issued a dire report for the Las Vegas Strip. The ratings agency doesn’t expect the Strip to recover to pre-coronavirus levels until 2024.

Around two-thirds of a Strip casino’s overall revenue, today comes from nongaming. “The Las Vegas Strip will experience the slowest recovery relative to other major gaming markets and segments globally,” Fitch opined.

The relief bill brought by Masto and Cramer has welcomed the news. Just this week, AGA Senior VP of Government Relations Chris Cylke opined that additional COVID-19 relief from Congress to the gaming industry was unlikely.

Citing “fractured views across Congress,” Cylke said he didn’t expect the federal government to come to the industry’s rescue until after the November 3 presidential election.

“This bipartisan bill will give these industries the support and incentives they desperately need to recover and thrive as the Silver State continues efforts to safely and responsibly re-open,” Masto concluded.

Related News Articles

Burnett Stepping Down as Chairman of Nevada Gaming Control Board

UK to Discuss Gambling Bonus Regulations as Public Backlash Intensifies

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet