Bill to Amend Atlantic City Casino Property Taxes Work in Progress

Posted on: May 18, 2021, 09:14h.

Last updated on: July 7, 2021, 01:05h.

NOTE: This article has been updated to reflect that Assemblyman Armato said prior to Atlantic County Executive Dennis Levinson’s strong response to his casino property tax bill that the legislation was not final.

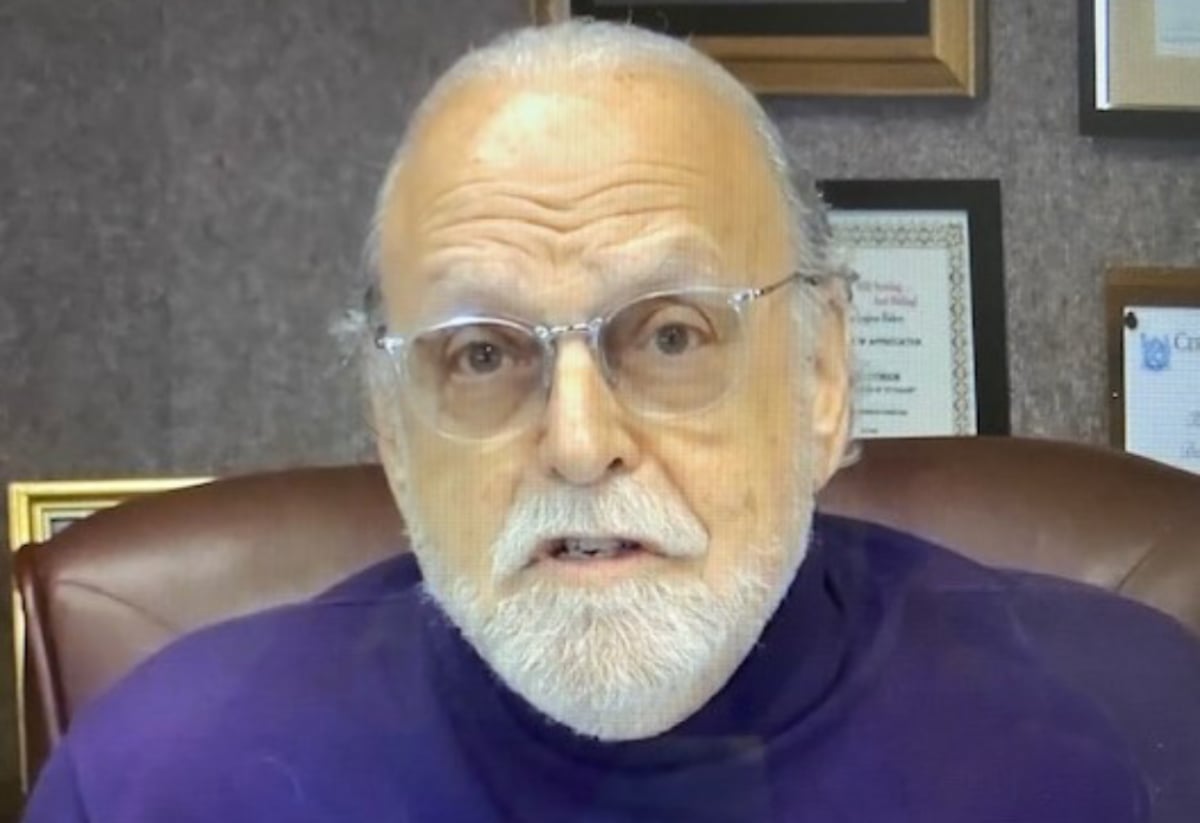

Assemblyman John Armato (D-Atlantic), the lead sponsor of legislation to alter how property taxes for Atlantic City casinos are calculated, says the bill is a work in progress.

Assembly Bill 5587 is designed to assist Atlantic City’s nine casinos in the wake of COVID-19. The legislation would exclude gross gaming revenue (GGR) derived from online gaming and mobile sports betting from the PILOT program.

PILOT is the payment-in-lieu-of-taxes bill that was passed in 2016 and set to run 10 years. It affords casinos the right to pay property taxes based on their annual GGR. The program was initiated in response to casinos challenging their assessed resort values in the wake of the Great Recession and five casinos closing between 2014 and 2016.

PILOT mandates that the casinos pay $120 million annually in state and local property taxes. That number increases as casino revenue climbs. Atlantic County Executive Dennis Levinson opposes Armato’s bill on grounds that it will allow casinos to pay fewer property taxes, and subsequently limit property tax relief for residents.

Casinos Benefit at Taxpayers’ Expense?

Levinson, Atlantic County’s longtime executive, says Armato’s bill would hurt local residents, and they, too, endured a most difficult 2020.

It will benefit the casinos at the expense of the non-casino taxpayers by removing a huge and steadily increasing portion of the revenues,” Levinson said. “The loss in property tax relief could be millions of dollars.”

Armato says the bill’s details are fluid. He noted that nothing is set in stone.

“As anyone who understands the legislative process knows, you introduce a piece of legislation, debate and discuss it, then you take the result of those conversations into consideration when deciding how to move forward,” Armato explained this week. “This is called governing responsibly.”

Levinson questioned that statement.

“Why would you introduce a bill that’s nowhere near what they want? They got caught. Nobody was supposed to see this. They were going to push it through and get a quick vote,” Levinson contended.

iGaming Revenues

Brick-and-mortar casino revenues were devastated by the coronavirus. Slot machines and table games at the Atlantic City casinos won $1.5 billion last year — down 44 percent from 2019.

iGaming, meanwhile, flourished. GGR from interactive slots and tables more than doubled to $931.5 million. Fees from poker games climbed 85 percent to $38.8 million. Sportsbooks won $398.5 million from bettors. And the vast majority — over 90 percent — was generated online.

Profits for the nine casinos plunged more than 80 percent last year. It would have been far worse if not for their online operations.

Casinos, however, point to the fact that they don’t keep nearly as much of the online GGR as they do from brick-and-mortar play. Casinos share profits from internet gambling and sports betting with their third-party operators.

Hard Rock Atlantic City President Joe Lupo opined recently that New Jersey should change the way casinos report their GGR.

“We need to see the city revitalized, and it’s not going to happen when the media is reporting [GGR] increases when they add in online revenue that is going to third-party companies that don’t have a stake in the [Atlantic City] game,” Lupo stated.

Related News Articles

Maryland Casinos Tell Lawmakers to Back Sports Betting

Northern Ireland’s First Casino a Possibility in Belfast, Public Opinion Sought

Most Popular

Mirage Las Vegas Demolition to Start Next Week, Atrium a Goner

Where All the Mirage Relics Will Go

Most Commented

-

Bally’s Facing Five Months of Daily Demolition for Chicago Casino

— June 18, 2024 — 12 Comments

No comments yet