Wynn Resorts Shareholders Suing Casino Company Optimistic Following Nevada Settlement

Posted on: February 5, 2019, 11:09h.

Last updated on: February 5, 2019, 11:09h.

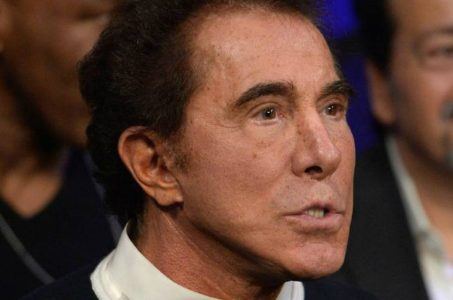

Wynn Resorts and the Nevada Gaming Control Board (NGCB) reached a settlement late last month stemming from the numerous sexual misconduct allegations made against the company’s shamed founder and former CEO.

Attorneys representing shareholders suing the casino operator say that only helps their cases moving forward. Speaking with the Las Vegas Review-Journal, lawyer William Kemp, whose firm is representing a consolidated investor case, says Wynn Resorts essentially admitted guilt in the settlement.

Our lawsuit has four basic elements, and this (NGCB) complaint admits all four of them,” Kemp stated. “It was a total surrender by the company. I don’t know how they think they are going to try our case after they admitted everything.”

The NGCB initiated an investigation soon after The Wall Street Journal published a bombshell expose in January 2018 on Steve Wynn that detailed decades of sexual harassment allegations. The billionaire has never admitted guilt, but resigned a month later and sold off his entire stake in the company.

Wynn Response

The NGCB complaint detailed seven instances where investigators believe Wynn Resorts executives were made aware of sexual misconduct allegations. They involve paying $7.5 million in hush money to a woman who claimed she was raped and became pregnant by the billionaire, and another female worker who was paid $1 million after claiming she was forced into unwanted sex.

Though Wynn Resorts agreed to settle the complaint – with the Nevada Gaming Commission to determine a financial penalty at a later date – determining if the casino company actually admitted guilt depends on who one asks.

“The completion of the NGCB’s investigation of the response of certain employees to allegations against our founder and previous CEO Steve Wynn is an important remedial step,” Wynn Resorts said in a statement.

“We have undergone an extensive self-examination over the last 12 months, intended to reinvigorate and implement meaningful change across all levels of the organization, cultivate a safe, healthy and supportive workplace culture, and build on our core values of respecting our employees, corporate responsibility and citizenship, and service to the community,” the company concluded.

CEO Matt Maddox only briefly referenced the NGCB settlement during the company’s 2018 earnings call.

Wynn Resorts remains under investigation by the Massachusetts Gaming Commission, which is determining whether the company remains suitable to operate the under-construction Encore Boston Harbor.

Shareholders Lose Value

The shareholder lawsuits contend that there was systemic failure at Wynn Resorts to properly address Steve Wynn’s alleged actions.

The day before the WSJ article was published in late January 2018, Wynn Resorts shares on NASDAQ were trading at $180. By the end of last year, the stock had tumbled more than 44 percent to $100.

It wasn’t simply the sexual misconduct scandal that hurt the company, as the stock market as a whole endured a difficult second half of 2018. One man who saved money on the stock market selloff was Wynn himself.

The billionaire sold his Wynn Resorts shares in March at around $175 each for a total exchange of $2.1 billion. That means should he essentially saved around $900 million by selling the position.

Forbes has Steve Wynn’s real time net worth at $3 billion.

Related News Articles

Most Popular

Las Vegas Overstated F1 Race’s Vegas Impact — Report

Vegas Strip Clubs Wrestle in Court Over Animal Names

Most Commented

-

End of the Line for Las Vegas Monorail

— April 5, 2024 — 90 Comments -

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

— April 16, 2024 — 6 Comments -

Long Island Casino Opponents Love New York Licensing Delays

— March 27, 2024 — 5 Comments -

Nearly Abandoned Mall Outside Vegas Soon to Have Only One Tenant

— March 12, 2024 — 5 Comments

No comments yet