Caesars Reaches Deal with Creditors to End Bankruptcy Lawsuit

Posted on: September 29, 2016, 03:00h.

Last updated on: September 29, 2016, 10:25h.

Caesars’ junior creditors have accepted an improved debt restructuring deal, a breakthrough that looks to mark the beginning of the end of the tortuous bankruptcy of Caesars main operating unit, CEOC.

According to Forbes, just one creditor, Trilogy Capital Management, is now holding out.

CEOC filed for bankruptcy in January 2015 with industry-high debts of $18 billion, and has been locked in a legal battle with its junior creditors ever since.

Several lawsuits against parent Caesars Entertainment Corp accused the parent company of deliberately stripping CEOC of its prized assets, such as the Linq and Planet Hollywood, for the benefit of its controlling shareholders.

The controlling shareholders are led by Apollo and TPG, leaving CEOC with just distressed assets and unpayable debts for junior shareholders.

The junior creditors were initially offered just 9 cents on the dollar, an offer that was later increased to 39 cents. The new offer, presented just last week, represents 66 cents on the dollar, which will be made up of cash, equity and convertible bonds.

Apollo and TPG to Relinquish Equity

Apollo and TPG, meanwhile, will relinquish their controlling stake in the Caesars Group in exchange for release from further litigation. Junior creditors will own greater equity in a new reorganized group to be formed by the merger of parent Caesars Entertainment Corp with its affiliate Caesars Acquisition Co. Apollo and TPG will retain just 16 percent of the new group, to be known as “New CEC,” while creditors in general will own 70 percent.

“The Second Lien Committee is pleased with the progress that has been made and looks forward to the completion of the restructuring,” said Bruce Bennett, attorney for the group

“It’s important to recognize that a lot of work needs to be done in the next few weeks. Will there be bumps along the road? Yes. Is this a durable deal? Yes,” he added.

“Pony up the Paper”

The stalemate between the two groups was shattered last month by US bankruptcy court judge Benjamin Goldgar’s refusal to extend an injunction preventing the continuation of the creditors’ lawsuits against the Caesars, which comprised claims of over $10 billion.

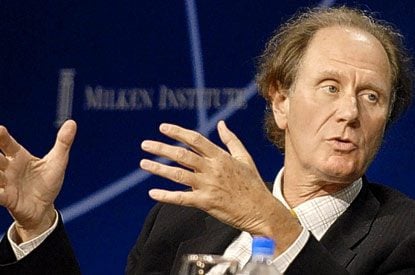

Then, earlier this month, Goldgar ruled that top Caesars directors would have to “pony up the paper,” and reveal details of their financial wealth to the court, as their creditors pushed to hold them personally responsible for CEOC’s debts.

These directors included billionaires Marc Rowan and David Bonderman, co-founders of Apollo and TPG, respectively. This week, after millions of dollars spent in legal fees and almost two years of negotiations in one of the most complex bankruptcies in recent history, Apollo and TPG have finally crumbled.

Related News Articles

Sands Bethlehem Sale to MGM Resorts Reportedly Falls Through

Most Popular

LOST VEGAS: ‘Tony The Ant’ Spilotro’s Circus Circus Gift Shop

Las Vegas Overstated F1 Race’s Vegas Impact — Report

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

Las Vegas Strip Stabbing Near The Strat Leaves One Man Dead

Most Commented

-

End of the Line for Las Vegas Monorail

— April 5, 2024 — 90 Comments -

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

— April 16, 2024 — 8 Comments -

Long Island Casino Opponents Love New York Licensing Delays

— March 27, 2024 — 5 Comments -

Sinclair Broadcast Group Selling 7.91 Million Bally’s Shares

— April 12, 2024 — 4 Comments

No comments yet