Young Bettors Likely to Be Crypto, Stock Speculators, Too, Says TransUnion

Posted on: September 24, 2025, 01:40h.

Last updated on: September 24, 2025, 02:05h.

- Gen Z and millennial bettors are more likely to have crypto trading apps

- Many bettors are looking for “big payoffs” in the stock market, too

- Younger bettors increasingly embrace online sports wagering, are tepid on casino visits

Gen Z and millennials are driving growth in online sports betting as the two demographics display a flair for risk in pursuit of boosting their personal financial circumstances.

TransUnion’s latest US Betting Report says that devoted millennial and Gen Z sports bettors, or those spending at least $50 per month on wagering, are usually urban dwellers. In the case of the older demographic, they own homes and have at least one child, while the Gen Z cohort is mostly childless renters. The survey also confirms that younger sports bettors are likely to embrace other forms of speculation, including investing in cryptocurrency.

Analysis revealed these segments also had higher proportions of consumers who use cryptocurrency apps compared to the rest of the population,” observes TransUnion. “It’s likely in addition to mobile betting, these consumers also participate in trading or other forms of entertainment via cryptocurrency apps.”

The research suggests that other traits held by younger sports bettors include a willingness to speculate in stocks, proclivities for making impulse purchases, and taking vacations that involve some level of physical adventure.

Operators Too Dependent on Young Bettors?

Since the Supreme Court ruling on the Professional and Amateur Sports Protection Act (PASPA) was handed down in 2018, the core customer for sportsbook operators has skewed younger and male, but when it comes to age, gaming companies may want to reduce reliance on youthful customers.

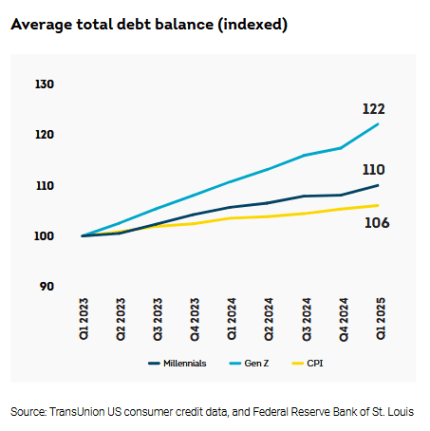

While some studies suggest online sports betting isn’t a direct contributor to financial duress, it’s clear millennials and Gen Z are dealing with rising debt burdens. TransUnion points out that since the start of 2023, millennial and Gen Z debt has increased by 10% and 22%, respectively, while Gen X has seen its liabilities rise by just 1%. A potential headwind for gaming companies is the amount younger bettors are doling out every month to service debt.

“The total monthly debt payment for consumers was up 27% and 20% among Gen Z and Millennial consumers, respectively,” according to TransUnion.

The research firm speculates that as younger folks rein in discretionary spending in an effort to reduce debt, there could be adverse effects to “betting participation rates over time as these consumers reduce their discretionary spending to meet growing debt obligations.”

Macro Environment Could Pinch Young Bettors

As it relates to Gen Z and millennial bettors, operators ought to be cognizant of some other economic developments that could highlight risks in depending on these demographics to drive earnings and revenue growth.

TransUnion points out that the federal government has reinstated student loan payments, and borrowers who don’t comply will be reported to credit bureaus, meaning their scores will decline, making it difficult for them to access credit.

A TransUnion analysis of student loan borrowers in February 2025 found 40% had no record of payment in 90+ days. As those payment delinquencies are reported to credit bureaus, credit scores will go down, making it more difficult for those consumers to access additional credit to weather sudden financial shocks,” according to the study.

The survey also says volatile US trade policy could weigh on consumer sentiment, potentially compelling some bettors to rein in related spending. Likewise, reduced promotional spending could be an issue to monitor because some younger bettors, including college kids, are dependent on “free” cash to support their wagering habits, as they have no income or have only recently entered the workforce.

No comments yet