US Casino Operators Could Face Bankruptcy, Available Cash Tight, Experts Say

Posted on: March 24, 2020, 09:30h.

Last updated on: March 25, 2020, 10:47h.

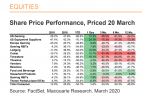

Gaming operators could eventually seek bankruptcy protection if they continue to burn through their limited money after shuttering operations because of the coronavirus pandemic, according to sector experts. A recent Macquarie Research report reveals US casino companies now have as little as 5.2 months to as much as 14.3 months before running out of cash.

On the low end, Penn National Gaming is burning through $6.4 million daily, having just 5.2 months before running out of cash, the report said.

MGM Resorts International is burning about $14.4 million daily, with nine months of cash available. Boyd Gaming Corp. is burning through about $3.2 million daily, with 9.4 months of cash available.

Century Casinos, Monarch Casino & Resort, and Full House Resorts have either $300,000 or $200,000 of cash burned through daily. They have between 5.8 and 14.3 months of cash available.

Golden Entertainment goes through $1 million daily, with 10.4 months of cash. Red Rock Resorts is burning through $1.7 million daily and has cash to last the company for 13.8 months.

The Rev. Richard McGowan, a finance professor at Boston College who closely follows the gaming sector, confirmed these projections are a serious concern.

“The casino industry was way over-leveraged, so the virus is attacking like a person who was compromised even before contracting the virus,” McGowan told Casino.org.

“They [the projections] are probably quite accurate,” McGowan added. “The debt to equity is public knowledge, and so, given that they will have no cash flow, it is easy to predict when they will run out of cash.”

Casinos May Move to Bankruptcy Protection

Given these numbers, some casino companies could seek bankruptcy protection, McGowan confirmed.

“Right now, the only ones that won’t are Sands and Wynn,” McGowan predicted. “The rest of the industry will go under if there is no federal aid.”

Stephen Miller, an economist and director of UNLV’s Center for Business and Economic Research, further told Casino.org, “At some point, if the shutdown is long enough, eventually companies will run out of cash. Then they will have to look for some sort of protection in bankruptcy.”

Looking at the big picture, David G. Schwartz, a gaming industry historian and academic administrator at UNLV, says he “believes” this is the most serious threat to Las Vegas’ economy in its history.

Nothing has forced the mass closures of casinos and hotels in the past,” Schwartz told Casino.org. “While it will take two quarters of negative growth to officially enter recession, clearly southern Nevada is in economic peril.”

It is unknown how long casinos will remain shuttered after the current Nevada mandated 30-day shutdown ends. Even after casinos reopen, it may take far more time for the economy to rebound in some place like Las Vegas, given current conditions.

For example, it is going to “take some time for airlines to get back up to speed…. Planes are crucial for a lot of our visitors,” Miller warned.

Casinos, hotels, restaurants, and public venues will also need to get sanitized. Supplies and food must get restocked.

Also, businesses which supply the casinos are “much more vulnerable than the casinos themselves,’ Miller cautioned.

Overall, the Las Vegas metropolitan area probably will be one of the hardest hit nationally, as far as livelihoods, from the economic downturn, Miller predicted. He recalls how the region was one of the hardest hit during the 2008-09 recession.

“We survived the last downturn,” Miller recalled. “It took us a while to get back.”

Making it harder, casino companies have significant labor costs, given the large number of employees. Some operators, such as Wynn Resorts, pledged to keep on paying workers after the shutdown. But if the closure continues beyond several weeks, Wynn and others may have to rethink their commitment, Miller said.

Casinos Need to Trim Expenses

Somehow, casinos will need to find ways to cut costs. “They have to economize wherever they can,” Miller said.

Casino companies could also look beyond brick and mortar casinos for revenue elsewhere. “Some jurisdictions have legalized online gaming, which may provide a revenue flow,” Schwartz suggested.

Overall, Las Vegas’s economy is dependent on the leisure and hospitality sector. In Las Vegas, over 29 percent of the economy relates to the industry.

It’s a huge part of our local economy… If you don’t get visitors here, you’re dead,” Miller said.

Casino management is also awaiting word on the proposed $2 trillion coronavirus relief plan now before Congress. It sets aside 25 percent of the money for businesses, such as the airlines or cruise lines, initial news reports said.

But will casinos get their share of federal aid?

“It’s hard to say,” Miller said. “Casinos are a special type of business. Some people would say, we shouldn’t help them.”

McGowan notes, however, that many state governments rely on in-state casinos for funding key programs. “Ironically, state governments are now dependent on casino revenues, so they will push the Feds to have the casinos open again, quickly,” McGowan said.

Gaming Regulations Need Updating

As the economic challenges continue, there could also be some regulatory updates, says Anthony Cabot, Distinguished Fellow of Gaming Law at UNLV Boyd School of Law.

This crisis will bring about a new financial reality,” Cabot told Casino.org. “Old regulatory standards for financial reserves and measures for financial viability need to be relaxed.”

“Gaming taxes based on gross gaming revenues that are paid before casino expenses and debt payments place an extraordinary burden on the industry and need to be reconsidered on a temporary basis,” Cabot added.

Moreover, he says that some procedures need to be changed, including those for expediting approvals of new corporate restructuring.

“Gaming regulators need to understand that the fundamental economic aspects of the gaming industry have radically changed in the last month,” Cabot cautioned.

But despite the challenges, there is still hope for Las Vegas’ future.

“There will always be a place for Las Vegas,” Stephen Miller said.

Related News Articles

Most Popular

Las Vegas Overstated F1 Race’s Vegas Impact — Report

Vegas Strip Clubs Wrestle in Court Over Animal Names

Most Commented

-

End of the Line for Las Vegas Monorail

— April 5, 2024 — 90 Comments -

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

— April 16, 2024 — 6 Comments -

Long Island Casino Opponents Love New York Licensing Delays

— March 27, 2024 — 5 Comments

Last Comments ( 2 )

legalize online poker or you will destroy it.Your over reacting, lower rents, make 30 hr work week to bring every one back to work, Test everyone coming into casino stop the bs example 4 at poker table just test.Legalize all drugs and prostitution reality is reality just test and license. It could be the greatest city in the world. Freedom for all.

Finally, the only other time a casino went bankrupt was under trump's watch, hmmm guess it happened again.