Atlantic City Casino Property Tax Lawsuit Boils Down to Defining ‘Gross Gaming’

Posted on: February 8, 2022, 04:16h.

Last updated on: February 8, 2022, 05:07h.

The Atlantic City property tax reduction is being challenged by officials in Atlantic County. A state judge said today that he will soon decide the matter’s legal outcome. The reduction was passed by the New Jersey Legislature during its December lame-duck session and subsequently signed into law by Gov. Phil Murphy (D).

In 2016, New Jersey agreed to allow Atlantic City casinos to collectively pay an annual lump sum in exchange for standard property taxes levied on their resorts. Known as the payment-in-lieu-of-tax — or PILOT — the tax is calculated based on the total gross gaming revenue (GGR) generated by the casinos in the prior year.

The 2021 PILOT amendment removes iGaming and mobile sports betting revenue from the computation. The adjustment will lessen the casinos’ property tax sum for 2022 from $165 million to $110 million.

In its lawsuit filed against the state, attorneys representing Atlantic County argue the alteration in the casinos’ favor will come at the expense of residential taxpayers.

New Jersey Superior Court Judge Joseph Marczyk plans to issue a written decision on the PILOT lawsuit in the coming weeks.

Judicial Verdict

Atlantic County receives 13.5 percent of the annual Atlantic City casino property tax. The New Jersey Office of Legislative Services estimates the county will lose between $5 million and $7 million annually under the new PILOT tax structure. The PILOT arrangement is to run through 2026.

Marczyk initially recommended that New Jersey and Atlantic County enter into mediation to settle their differences with an impartial third-party mediator. But the state declined to do so, which moved the legal complaint back to the Superior Court.

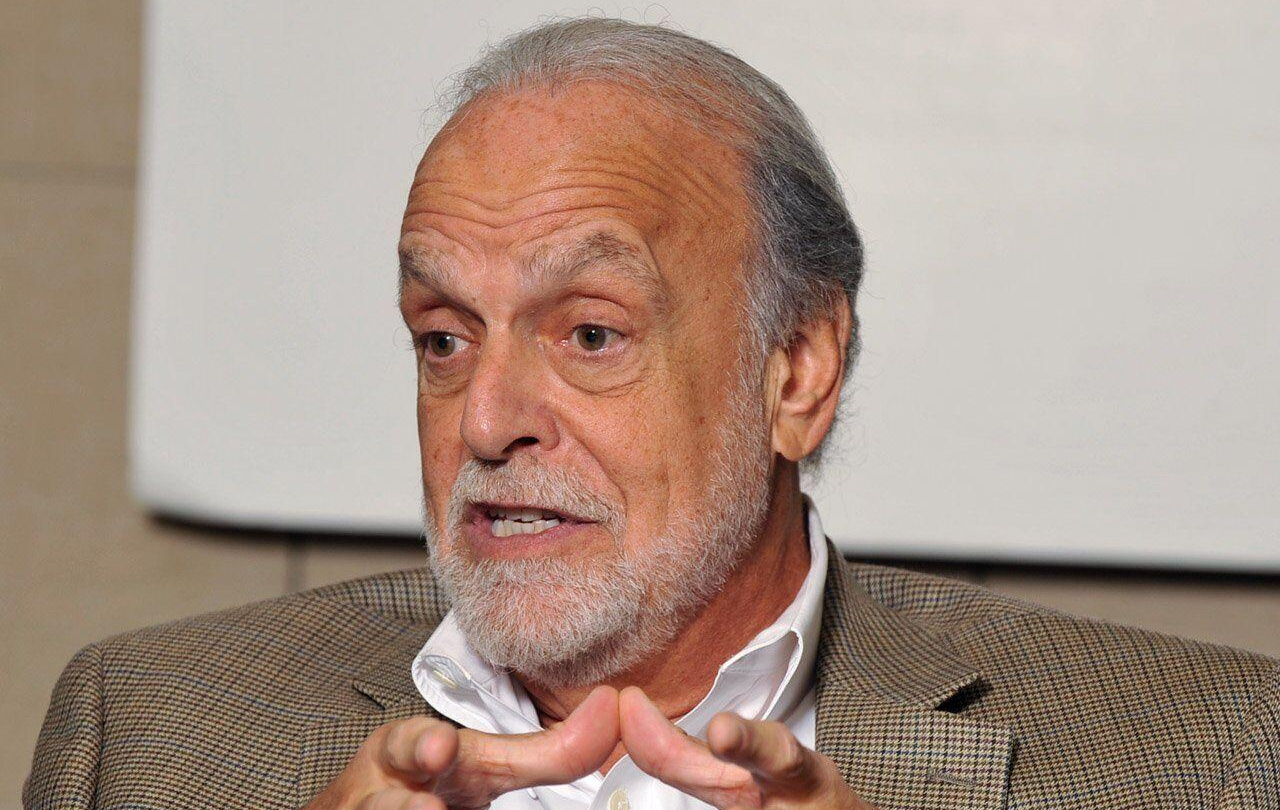

The state’s unwillingness to seek a resolution before a neutral mediator is arrogant and incomprehensible,” said Atlantic County Executive Dennis Levinson. “We should be working to find a fair and equitable solution that will keep our taxpayers whole. That is what we previously negotiated to do.”

Marczyk heard oral arguments from both sides this week, including a preliminary injunction request from the county.

Defining ‘Gross Gaming’

During oral arguments before Marczyk, state attorneys said New Jersey lawmakers possess the right to define “gross gaming revenue.” When the original PILOT was passed, New Jersey’s iGaming market was still getting started, and sports betting was still years away.

GGR from iGaming in 2016 totaled $196.7 million. Last year, that number was $1.36 billion. Online sportsbooks added another $740 million to the total 2021 internet GGR number.

Atlantic City casinos say such online revenue shouldn’t be included in the PILOT tax. They claim a substantial portion of the income is shared with third-party operators that have little or no physical presence in the casino town. County officials, however, contend that online gambling revenue is still “gross gaming revenue.”

Marczyk presented his own concerns regarding the state’s contention that it gets to decide what does and doesn’t constitute gross gaming revenue.

“Under your argument, [the state] could have determined gross gaming revenue should be calculated to include only penny slots or not include slot machines,” the judge told John Lloyd, an attorney representing the state. “Or [the state could] exclude a new slot machine that is going through the roof, analogous to internet and sports gaming. Is that your argument?”

“I think it could [be], your honor,” Lloyd responded.

Related News Articles

Most Popular

Tropicana Las Vegas to be Imploded, Tentative Date Set

VEGAS MYTHS BUSTED: Golden Gate is the Oldest Casino in Vegas

Most Commented

-

End of the Line for Las Vegas Monorail

— April 5, 2024 — 90 Comments

No comments yet