Sports Parlays Should Be Among Next Frontiers for Prediction Markets, Says Venture Investor

Posted on: August 14, 2025, 02:05h.

Last updated on: January 6, 2026, 09:06h.

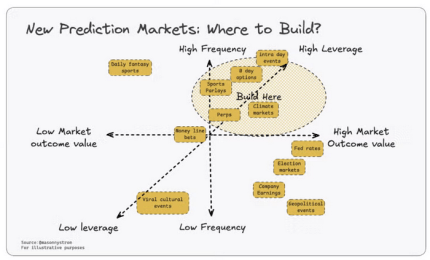

- Sports parlays are described as high-frequency, high-leverage events for prediction markets

- Those companies aren’t yet offering such wagers

- Moneyline bets are seen as low leverage with smaller market outcome value

If there’s one thing that could intensify the growing competition between prediction markets and traditional sportsbooks, it would be the former adding sports parlays.

Companies such as Kalshi and Polymarket currently feature yes/no contracts on sporting events, which are akin to moneyline bets, but they aren’t yet offering parlays. They may have good reason to get into the business of legged sports wagers, however.

In a new report, cryptocurrency venture investment firm Pantera Capital mentioned sports parlays as one of several areas prediction markets should expand into, describing those wagers as “high leverage” affairs that offer “high market outcome value” while enticing traders to keep coming back.

Conversely, Pantera put sports bets in the low leverage/low market outcome value camp. Daily fantasy sports (DFS), which haven’t frequently been discussed as a possible market for prediction exchanges, rank higher in Pantera’s assessment than moneyline bets, but DFS is unlikely to be as lucrative for prediction markets firms as parlays would be.

Parlays Could Be Pivotal to Prediction Markets Success

Parlays already have a documented record of boosting profit and revenue for old guard sportsbook operators, so it’s not a stretch to assume that trend would carry over to prediction markets.

Users want to have high leverage or stack odds to increase payouts. Parlays, perps, intraday event markets –– all of these prediction market products have the potential to increase demand for prediction market events,” notes Mason Nystrom, junior partner at Pantera.

By offering parlays, including those of the sports variety, prediction markets can tap into the gamification of betting and trading that younger market participants have grown to love while potentially realizing better economics by creating a stickier customer base.

“Having more recurring markets will also create better economics for the platforms, enabling them to list more markets, pay for customer acquisition, or otherwise be more competitive,” adds Nystrom. “This already occurs in sports betting, where platforms like DraftKings utilize DFS (daily fantasy sports) as a valuable acquisition and retention tool to foster habitual user behavior.”

High-Outcome Value Matters

US election betting is arguably the primary reason prediction markets gained traction in this country, and some of the operators, such as Polymarket, have a knack for capitalizing on viral events. However, elections aren’t frequent and controversial or viral happenings are fleeting, meaning prediction market operators are likely compelled to focus on expanding offerings that deliver high outcome value.

Along with intraday events and climate markets, among others, sports parlays check the high outcome value box. Should Kalshi, Polymarket and friends tread into parlays, that could usher in a new wave of prediction market adoption, draw more regulatory scrutiny, and ignite more competition from the gaming industry.

“The rebirth of prediction markets will leverage efficient markets to generate valuable prediction insights and offer a form of leveraged entertainment to the same customers who trade individual stocks or bet on sports,” concludes Nystrom. “We’re about to see an explosion in the types of markets and things that people will bet on. Markets for everything are coming.”

No comments yet