Reality Bets: More Gen X Bettors Get Into Sports Wagering

Posted on: February 11, 2025, 03:45h.

Last updated on: February 11, 2025, 03:57h.

- Gen X is getting more involved in sports betting.

- Data indicate millennials’ share of the market decreased in the fourth quarter.

Sportsbook operators often gear marketing and promotional efforts to younger demographics. Namely millennials and Gen Z, but data indicate it’s older bettors that drove a recent increase in wagering.

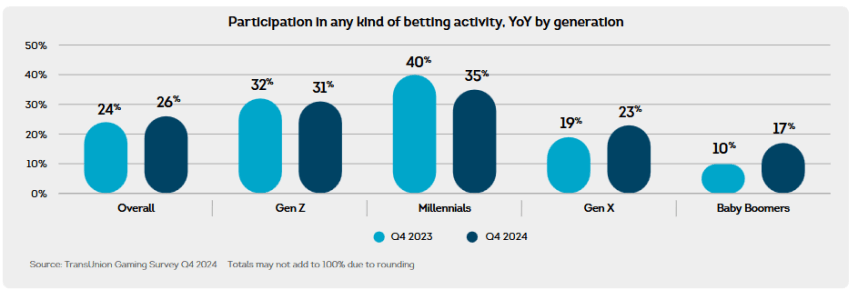

In the fourth quarter, betting activity among US consumers increased to 26% from 24% a year earlier with the jump led by baby boomers and Gen X, according to a new survey by TransUnion.

While Millennials have dominated all forms of betting in recent years, this generation’s engagement dropped 5% year-over-year (YoY) in Q4 2024. Conversely, Baby Boomers and Gen Xers got more involved, with 7% and 4% respective YoY increases. Gen Z bettors’ participation remained about the same,” notes TransUnion.

Millennials, or those people born between 1981 and 1996, account for the largest percentage of US sports bettors, but their share of the market declined to 35% from 40% in the last three months of 2024 while participation among Gen X and boomers surged.

Macroeconomic Factors Weigh on Betting Habits

Broader betting trends increased in the October through December period, but spending was off both at online casinos and sportsbooks and at brick-and-mortar casinos due to macroeconomic challenges.

In 2022, inflation spiked to its highest levels in four decades, prompting the Federal Reserve to raise interest rates. The central bank eventually boosted borrowing costs to 20-year highs, but the combination of eroded purchasing power and higher interest rates on credit cards prompted a decrease in the number of $500+ bettors — both internet and land-based — in the fourth quarter.

“Another factor may be that new bettors are simply dipping their toes into betting activities and playing with small amounts, while those willing to deposit higher amounts are disproportionately represented in longer-term players,” adds TransUnion.

The credit rating agency also noted a cooling labor market and consumers reigning in discretionary spending are among the reasons for those declines. That jibes with recent research from Jeffries, which indicates that bettors are reducing the frequency of visits to gaming venues.

Some Encouraging Trends

Today, 38 states and Washington, DC permit some form of sports wagering with Missouri poised to join that group this year. There have been negative effects due to that proliferation, including bettors taking on more consumer debt and selling traditional investments, such as stocks, to fund their wagering habits.

Those are ominous trends, but it’s not all doom and gloom. TransUnion points out that about half of online bettors in the high income category have excellent or good credit scores and the same is true of 14% of their middle income counterparts. Add to that, many land-based and online bettors said they made more money in the fourth quarter than they did in prior months.

“Of online bettors who deposit over $500 per month, 54% had a combination of good or excellent credit with high or middle income, up from 50% in the prior year. What’s more, those with the riskiest financial profiles (having lower income and fair or poor credit) fell from 7% in 2023 to just 4% this year,” concludes TransUnion.

No comments yet