Bally’s Sports Networks Unlikely to Gain Financial Support from Pro Leagues

Posted on: December 19, 2022, 04:26h.

Last updated on: December 19, 2022, 05:49h.

The financially ailing regional sports networks (RSNs) bearing the Bally’s name are unlikely to garner support from professional leagues. That could increase the probability of bankruptcy for owner Diamond Sports Group.

The New York Post reports that Diamond has shopped itself to Major League Baseball (MLB), the NBA, and the NHL for $3 billion, including debt. That’s a massive haircut compared to the $10.6 billion Diamond parent Sinclair Broadcast Group (NASDAQ: SBGI) paid to Walt Disney (NYSE: DIS) in 2019 to acquire the RSNs.

In September, it was reported that the three aforementioned leagues were preparing a joint bid for Diamond. But that’s likely off the table after the RSN operator said last month its 2022 profitability will be hindered by customers dropping traditional cable for streaming services, according to the Post.

It was previously reported that Sinclair was willing to deliver equity in the sports networks to creditors in an effort to expedite a sale. But that plan appears to be dead, prompting bondholders to prepare for a bankruptcy filing.

Bally’s Insolated from Diamond’s Woes

In November 2020, Bally’s announced it would pay $85 million over 10 years to put its name on the RSNs, marking one of the splashiest media/sports wagering accords at the time. Fortunately for the gaming company’s investors, that’s the extent of the operator’s exposure to Diamond’s problems.

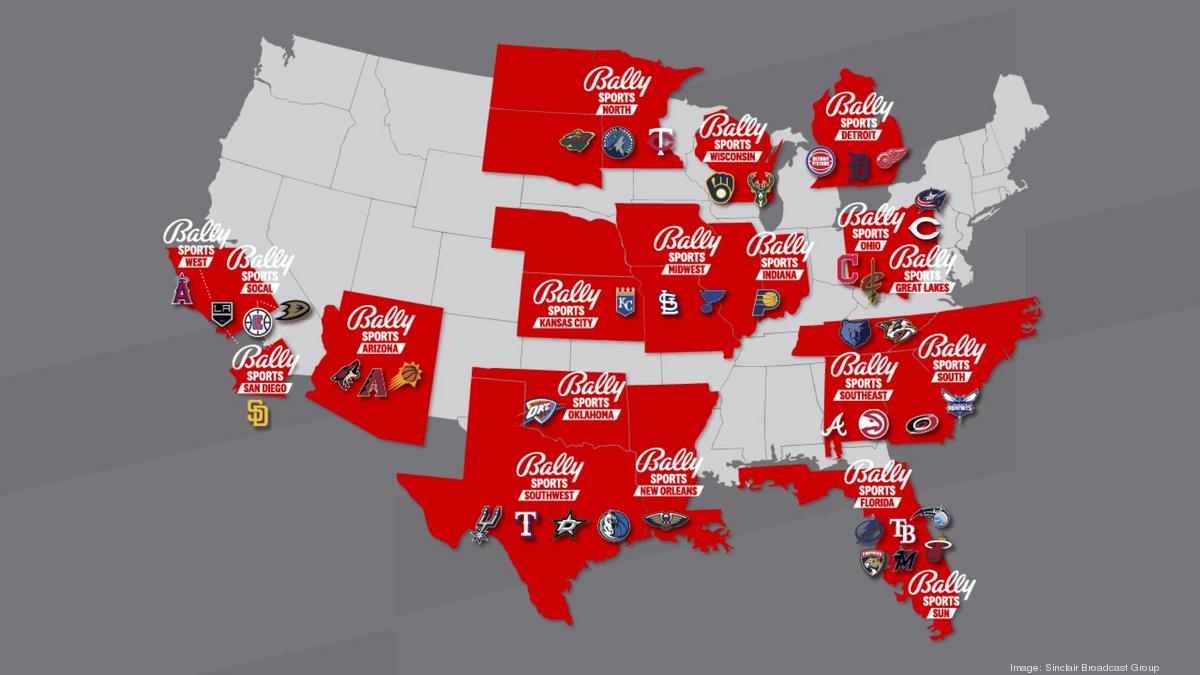

The RSNs have broadcasting rights for 12 NHL, 16 MLB, and 17 NBA franchises, creating allure for the leagues to buy the networks. But that luster was significantly diminished in late November when Sinclair reported a $1.2 billion loss due to a sizable write-down tied to the declining value of the RSNs.

It’s possible that MLB could eventually step up as a streaming partner for the Bally’s networks. But as the Post reports, big tech companies such as Amazon, Apple, and Meta are pursuing sports streaming deals.

Amazon is in its first year of broadcasting Thursday Night Football on its streaming platform, and there’s speculation Google’s YouTube could make a run at NFL Sunday Ticket next year. The NBA is also expected to negotiate new broadcast rights in 2023, potentially putting financially strapped media companies in a bind.

Diamond Sports Faces Other Issues

Some industry observers claim Diamond overpaid some teams in smaller markets for broadcast rights. As an example, the Post highlights Bally’s Sports San Diego paying MLB’s Padres $60 million annually for a 10-year deal.

Additionally, Diamond is hindered by debt coming due in 2026 and 2027, and those bonds recently traded at levels implying default.

As for the gaming side of the equation, that’s been difficult to leverage because many of the 21 RSNs bearing the Bally’s name broadcast in states where sports betting currently isn’t permitted, including California, Texas, and Florida, among others.

Related News Articles

Kenny Alexander Led Group Takes Stake in 888 Holdings

DraftKings And Fanatics Nearly Sealed Massive Merger, Now Rivals

Most Popular

LOST VEGAS: ‘Tony The Ant’ Spilotro’s Circus Circus Gift Shop

Las Vegas Overstated F1 Race’s Vegas Impact — Report

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

Las Vegas Strip Stabbing Near The Strat Leaves One Man Dead

Most Commented

-

End of the Line for Las Vegas Monorail

— April 5, 2024 — 90 Comments -

Mega Millions Reportedly Mulling Substantial Ticket Price Increase

— April 16, 2024 — 8 Comments -

Long Island Casino Opponents Love New York Licensing Delays

— March 27, 2024 — 5 Comments -

VEGAS MYTHS RE-BUSTED: You Can Buy Legal Weed On the Strip

— March 22, 2024 — 4 Comments

Last Comment ( 1 )

This news story about Bally's will not be posted on the Ballys.com website. What could they say about it?