Macau Casino Revenues Rose for Third Straight Month

Posted on: November 1, 2016, 06:00h.

Last updated on: September 23, 2020, 07:24h.

Casino revenues in Macau rose in October for the third consecutive month, prompting hopes that the gambling hub is turning the corner after 25 months of nosediving financial reports.

Macau recorded total revenue of 21.8 billion patacas ($2.73 billion), exceeding analysts’ expectations.

Growth may have been aided by the unveiling of three new casino resorts in the last 12 months, most recently Sheldon Adelson’s lavish $2.7 billion Parisian Macao on the Cotai Strip, which opened in September.

Meanwhile, Lawrence Ho and James Packer’s Studio City, Steve Wynn’s Wynn Palace, and Galaxy Entertainment’s recently completed phase 2 on Galaxy Macau, have all added to the Macau landscape, with a big focus on non-gaming attractions and amenities.

The hope was that these attractions would draw back to Macau, the Chinese middle classes, whose visitor rates had dropped thanks to a slowdown in the Chinese economy, and the plan appears to be working.

Visitor numbers were also boosted in October by the Chinese national holiday at the beginning of the month.

Crown Arrests

But while the mass market gamblers do seem to returning, unease remains among foreign operators over the arrest in China of 18 casino operatives working for James Packer’s Crown Resorts, including three Australian nationals.

The employees are believed to have been working in the VIP sector, soliciting potential business from Chinese high rollers for operations in Macau.

The enclave once drew 60 percent of its gambling revenues from the VIP sector, fueled by the once-thriving junket industry, but a crackdown from Beijing, initiated in 2014, was the main driver of Macau’s economic slump.

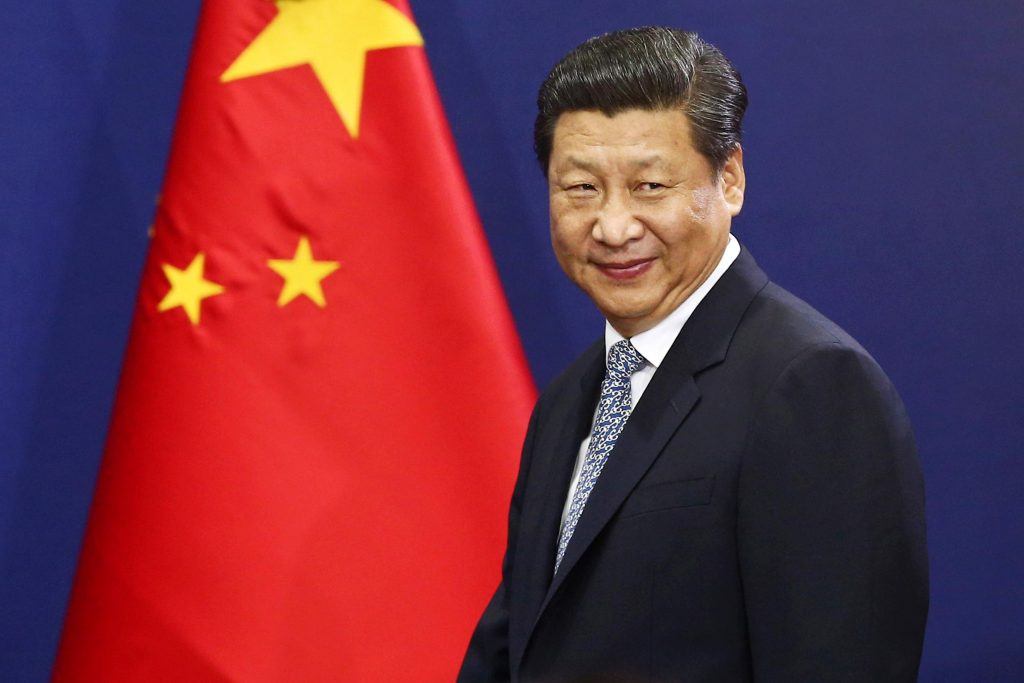

Concerned about capital flight and the amount of corrupt Communist Party officials laundering their ill-gotten gains through Macau and its junket operators, President Xi Jinping sought to break up the junket industry and severely limit the cash flow into the gambling hub.

Caution Urged

The perception that Macau is at last beginning to weather that storm has caused the shares of casino companies to surge, but this has been met with caution by analysts.

“On the whole, we have somewhat mixed feelings on the October GGR print, and encourage investors to temper their enthusiasm accordingly,” said Stifel analyst Steven Wieczynski.

“Though better-than-expected GGR performance during the first full month comprising both of the market’s recent new openings is clearly a positive sign, our market sources suggest the majority of the strength was VIP-driven.

“That said, we view the comp cautiously, as we acknowledge the volatility inherent in the VIP business and suspect operators may have ratcheted up promotional efforts to help stimulate demand in order to support the recent new openings,” he said.

Trends are likely “to remain choppy in the near term, particularly on the mass side of the business, as the market works to fully absorb recent and forthcoming supply additions,” he added.

No comments yet