Resorts World Wants New York to Reevaluate Casino Tax Scheme

Posted on: November 17, 2025, 09:25h.

Last updated on: November 17, 2025, 10:17h.

- Resorts World New York wants the state to reconsider its offer to pay higher taxes

- Operator may ask the state to lower the tax rate imposed on it

- It could also push for higher levies on rival venues

After offering to pay higher taxes should it be awarded one of three downstate casino licenses, Resorts World New York is reportedly asking state regulators to reconsider that proposal.

Citing unidentified sources with knowledge of the matter, Bloomberg reports that the Genting-operated, slots-only venue in Queens is prepared to request that state regulators either lower the levies that would be charged on that venue or raise the tax rates applied to other winners of the downstate casino permits.

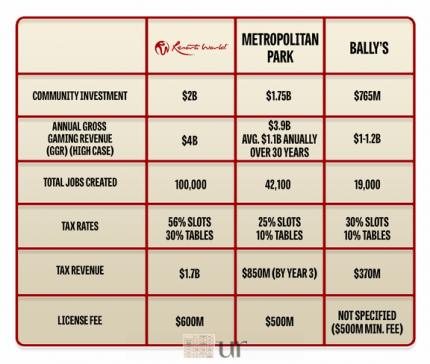

Perhaps in a bid to woo New York regulators, Genting recently pitched what some analysts called “aggressive” terms, volunteering to pay a higher licensing fee and elevated taxes. The company recently pitched a $600 million permitting fee, above the $500 million required by the state, as well as levies of 56% and 30%, respectively, on slots and table games. Those would be some of the highest gaming taxes anywhere in the US.

Resorts World Looking to Up NY Casino Rivals

Last month, MGM Resorts International (NYSE: MGM) stunned the gaming industry with its decision to pull out of the New York City casino competition, leaving just three bidders for three licenses. Like Resorts World, MGM’s Empire City Casino in Yonkers was widely believed to be all but assured of winning a permit.

The current group of contenders is comprised of Bally’s (Bronx), the $8 billion Metropolitan Park proposal in Queens, and Resorts World New York. Genting has made clear that it’s willing to invest more in the community and create more jobs than its competitors, but it’s not clear why the Malaysian company wants the state to reconsider its tax proposal.

The company estimates that, as a Las Vegas-style casino, Resorts World New York would pay $18.8 billion in taxes in its first decade with gross gaming revenue (GGR) potentially approaching $4 billion on an annual basis, perhaps quadrupling the high mark expected of Metropolitan Park, which would feature a casino operated by Hard Rock International.

Resorts World Has Promised Other Perks

In addition to the higher taxes, the fate of which are now unknown, Resorts World New York has made other significant financial pledges, including a promise to invest $5.5 billion in converting the venue. That figure doesn’t include another $2 billion in community benefits.

Earlier this month, a forecast was revealed indicating that the Queens casino could contribute $2.5 billion over four years to New York’s Mass Transit Authority (MTA), well above the $1.8 billion the MTA was expecting from the downstate gaming venues.

The New York Gaming Facility Location Board is currently evaluating the three bids and is expected to announce winners as early as December 1. There’s some speculation that the board won’t award all three licenses, as it’s not obligated to do so.

Last Comment ( 1 )

I would tend to believe everything Genting says. They have a fabulous reputation for honesty.